PwC survey: banks are preparing for PSD2 but few are ready for new era of open banking

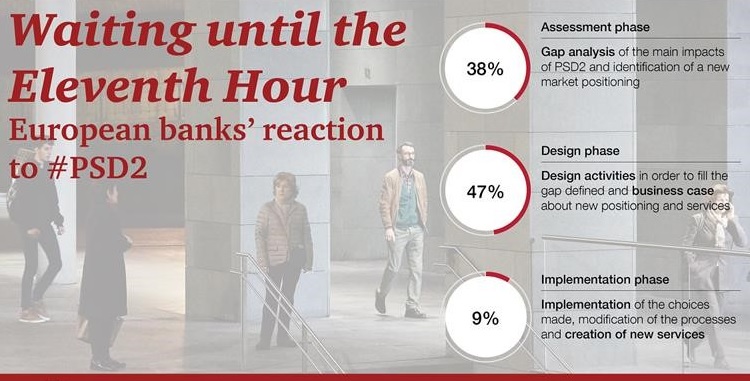

Although the revised EU Payments Services Directive (PSD2) already goes into effect in January 2018, a new PwC survey shows few banks seem to be ready for it. At the start of the summer, 38% were still in the early stages of assessing its impact, while only 9% were in the implementation stage of the new PSD2 requirements.

For its new PSD2 readiness survey dubbed ‘Waiting until the Eleventh Hour’, PwC interviewed 39 senior bank executives in 18 European countries, covering most of the world’s leading banks. The interviews were conducted in the first half of 2017. While two-thirds of the execs anticipate PSD2 will affect all their bank functions, with numerous interdependencies with other regulations, only 9% said their preparations for PSD2 were at the stage of being implemented.

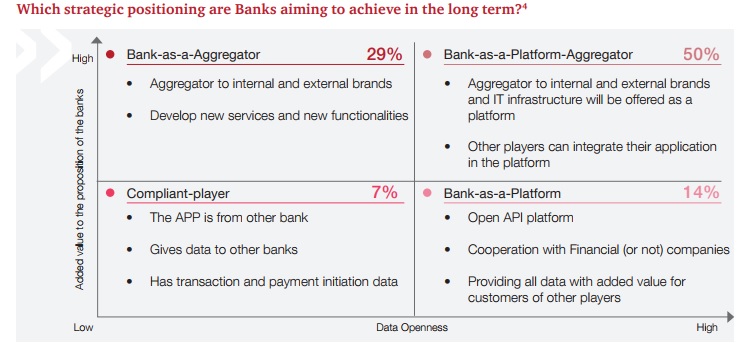

In the survey, PwC also asked banks about their preference among four types of emerging business models. „50% of the respondents aspire their bank to be a platform aggregator, which would mean developing an open platform that allows partners to integrate their products and services into the bank’s offering, while providing an open platform for generating new products and services based on the bank’s API and data.”, according to the press release.

In January 2018, banks’ monopoly over customer account information and payment services will effectively cease. Encouragingly, almost all banks (94%) PwC interviewed are currently working on PSD2 in some way or another and two out of three banks say they want to use PSD2 to change their strategic positioning.

Marco Folcia, PwC Partner and European PSD2 Leader says: “PSD2 promises a complex implementation with multiple stakeholders. So for many banks, compliance will be a challenge by 2018, but mere compliance—though challenging in itself—will not be their only concern. Banks need a proper strategic response to avoid becoming disintermediated by more customer-oriented third-party offerings. They will need to analyse the emerging payments landscape and identify new revenue opportunities for services, something most have yet to do.”

Marco Folcia adds:

“Any bank that could achieve this would be a powerful operator. However, the reality is that only a handful of large banks could reasonably expect to build a truly powerful partner ecosystem. In fact, we doubt that many third parties will be willing to connect to multiple banks as long as there is no common API standard across Europe. It’s clear that banks need to perform a rigorous self-assessment as they transition to the world of open banking, including their market positioning and competitive strengths.”

As part of the report, PwC identified several best practices that banks should follow to ensure they address PSD2 effectively and efficiently. Perhaps the most important finding is that banks should ensure their top management is part of the strategic response to open banking. Currently, strategic considerations are oftentimes a by-product of a PSD2 compliance project managed by IT and operations. Given the far-reaching impact PSD2 will have, banks that take this approach will miss the opportunity to become powerful operators in the new world of open banking.

Download the full PwC survey: Waiting until the eleventh hour – European bank’s reaction to PSD2

About the survey

To capture the industry perspective, senior representatives of 39 leading banks in eighteen countries (Italy, Denmark, UK, France, Slovakia, Czech Republic, Belgium, Finland, Luxembourg, Poland, Ireland, Switzerland, Spain, Portugal, Germany, Netherlands, Austria and Norway) were interviewed. The findings were analysed and evaluated by leading thinkers of the global PwC PSD2 center of excellence, which combines experts with regulatory, technology and strategy backgrounds.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: