„More than 60 central banks have already entered the central bank digital currency race. CBDCs will be a game-changer, providing access to alternative payment solutions for citizens and corporates, as well as reinventing financial market settlement and interbank monetary transactions.” – Benoît Sureau Partner Financial Services Risk and Blockchain PwC France & Maghreb.

This first edition of PwC Global CBDC Index report, which is aim to be publish annually, allows monitoring of the ongoing transformation triggered by Central Bank Digital Currencies (CBDCs) globally. The PwC Global CBDC Index is designed to measure a central bank’s level of maturity in deploying their own digital currency.

The PwC Global CBDC Index provides a synthetic index, capturing the central banks’ progress, stance on CBDC development and public interest in two distinct use cases:

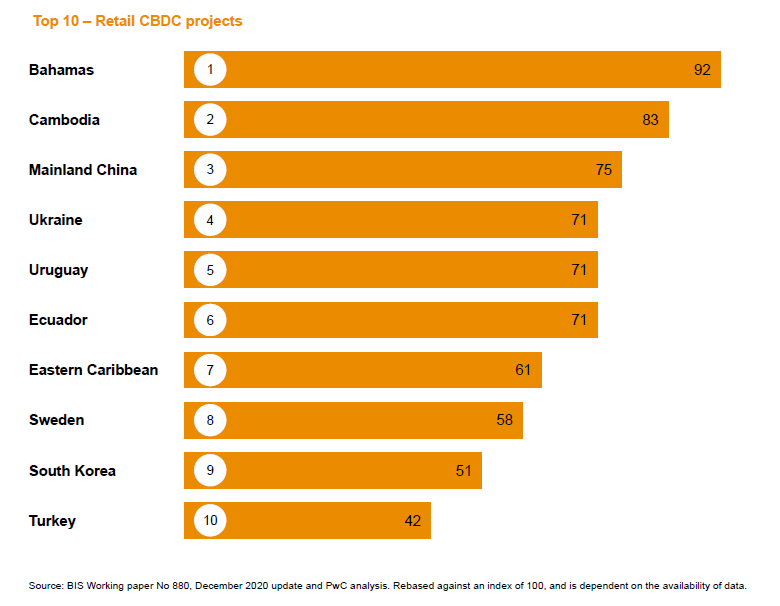

. Retail CBDC which are held directly by citizens and corporates;

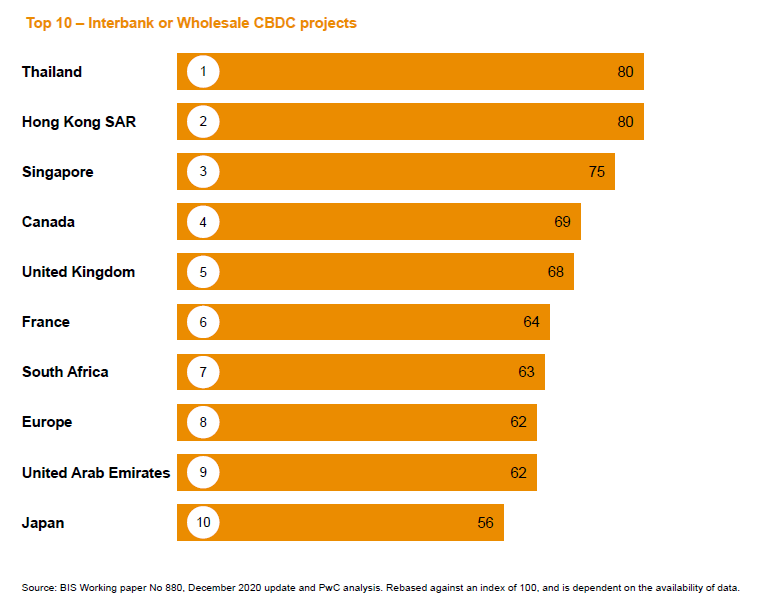

. Interbank, or Wholesale CBDC which are restricted to Financial Institutions, principally for interbank payments and financial settlement processes.

Project Maturity – Retail CBDC development – Key insights

1. Retail CBDC initiatives are particularly strong in emerging economies, where financial inclusion and digitisation appear as key drivers.

2. Two projects are now live; the Bahamas with the Sand Dollar and Cambodia, with project Bakong. It is still too early to capture uptake data

on CBDC usage but 2021 should produce further interesting insights.

3. The Digital Yuan project in Mainland China has already reached an advanced level of trialling, with more than 2 billion yuan (~$300m) in transactions and is reportedly preparing for broader usage at the Beijing 2022 Winter Olympics.

Project Maturity – Interbank CBDC development – Key insights

1. Advanced Interbank/Wholesale CBDC projects have on average shorter research stages than retail programmes but longer pilot stages. There are no live projects as yet but there are very advanced pilot initiatives.

2. Cross-border projects make up the majority of the most advanced initiatives, allowing Central Banks to test cross-border connectivity and project interoperability, examples include Hong Kong SAR-Thailand, Singapore-Canada, Europe-Japan, United Arab Emirates-Saudi Arabia.

3. Most advanced interbank/wholesale projects are expanding their scope to test interconnectivity with other interbank projects or the potential of

linking with retail projects.

The authors of the PwC report:

„We believe CBDCs will contribute significantly to the modernisation of the international monetary landscape, hand-in-hand with reconfiguration in both payment and financial infrastructure. They will generate numerous opportunities for further digitisation in both corporates and financial institutions, as their integration in payment and financial infrastructure progresses.”

„The general public will be one of the biggest beneficiaries of CBDCs as it will give them access for the first time to a digital form of central bank money. And that is a big milestone in the evolution of money.” – Henri Arslanian Partner and Global Crypto Leader PwC.

„Central Bank Digital Currencies are direct alternative solutions to further financial inclusion efforts by public authorities. As sovereign digital cash, they can contribute to modernise the current monetary system but also help to bridge the gap with the unbanked.” – Pauline Adam-Kalfon Partner, Financial Services and Blockchain Leader PwC France & Maghreb.

„A digital currency, backed by an asset held on a central bank balance sheet, allows for money to be fully integrated into the emerging digital ecosystems of the future that will support supply chains, securities settlement and potentially finding its way into social media platforms.” – Haydn Jones Director, UK Blockchain & Crypto Leader PwC UK.

„The potential of a Central Bank Digital Currency to digitize cash, accelerate payments and provide a more efficient way to distribute economic stimulus is gathering pace around the world. In the US, the digital dollar has been described by the Federal Reserve Bank as a ‘high priority project’ with research focused on understanding the potential impact use, benefits, risks and design.” – Paul Chew Principal, Financial Services Technology PwC US.

For more details download the PwC Global CBDC Index report

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: