Project enables new privacy paradigm of payer anonymity to protect purchasers’ identities. Quantum-safe cryptography was successfully implemented for future security, however speed enhancements await further research.

Project Tourbillon, developed by the Bank for International Settlements (BIS) Innovation Hub Swiss Centre, „demonstrates a new privacy paradigm for retail central bank digital currencies (CBDC)” – according to the press release. „The experiment proposes a concept of payer anonymity, providing cash-like anonymity to the payer” BIS said.

Privacy is a foundational requirement for retail CBDCs, consistently ranking at or near the top of users’ concerns, according to recent surveys conducted by the Bank of England and the European Central Bank.

Payment arrangements used today have different levels of privacy:

Project Tourbillon tested the concept of payer anonymity, which provides cash-like anonymity to payers, although not for payees. For example, a consumer paying a merchant using CBDCs does not disclose personal information to anyone, including the merchant, banks and the central bank. However, the identity of the merchant is disclosed to the merchant’s bank (as part of the payment) and is kept confidential there. This concept also helps to reduce tax evasion or illicit payments. The central bank is able to see the transaction amount but remains unaware of any details regarding the consumer or the merchant.

„Privacy is an important user requirement but it is the most difficult to solve. The difficulty lies in ensuring privacy protection technologically rather than just promising it, and at the same time ensuring that such a high level of protection cannot be abused.” – Thomas Moser, Alternate Member of the Governing Board at the Swiss National Bank

„Privacy is indeed a key requirement for a retail CBDC. But it cannot be the only one: security and scalability are also crucial to how payments are handled. In Tourbillon, we looked at these requirements through the lens of how to protect privacy and how fast can we process payments.” – Morten Bech, Head of the BIS Innovation Hub Swiss Centre.

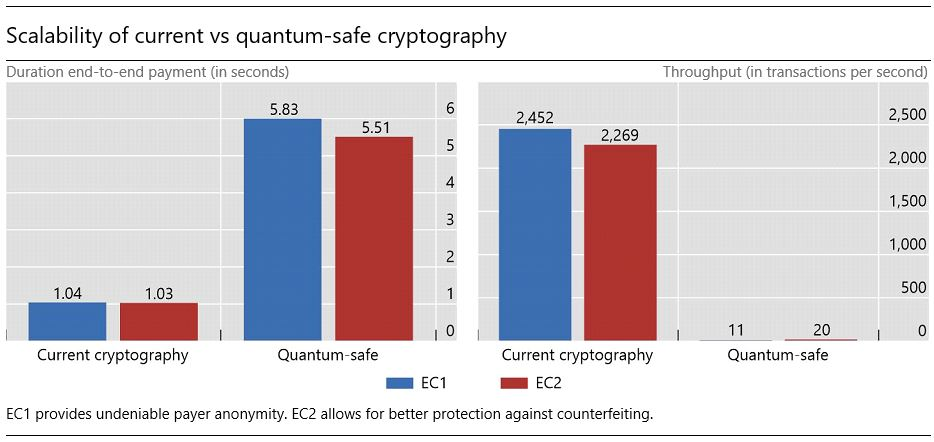

The project developed two different prototypes based on the eCash design, which builds on the existing two-tier banking system. One design, eCash 1.0 (EC1), resembles a cash-like digital payment instrument. The second design, eCash 2.0 (EC2), investigates enhanced security features allowing for strong protection against and detection of counterfeiting.

In the future, quantum computers may be able to break encryption schemes, as explored in Project Leap. Therefore, Project Tourbillon explored not only current, but also quantum-safe blind signatures, an important cryptography used in both designs to guarantee privacy and future security. Tourbillon demonstrates that implementing quantum-safe cryptography is possible, but that it requires specialised expertise, and severely limits transaction processing, as scalability tests show: compared to current cryptography, the duration of payments is increased by a factor of five and throughput is reduced by a factor of 200. This finding shows the need for more research on quantum-safe cryptography.

„Project Tourbillon is a first step in exploring privacy, security and scalability and their trade-offs in a retail CBDC design. Further work is needed, in particular, to improve quantum-safe cryptography, to extend the use cases, and explore viability.” Morten Bech added.

______________

Reflections on project Tourbillion

Report: Project Tourbillon: exploring privacy, security and scalability for CBDCs

The final report describes the experimental work and discusses related technical and operational considerations for central banks.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: