Project Stella: the ECB and the Bank of Japan release joint report on distributed ledger technology (Phase 2)

The European Central Bank and the Bank of Japan have today released the outcome of the phase 2 of their joint research on distributed ledger technology in a report titled, „Securities settlement systems: Delivery versus payment in a distributed ledger environment.”

The joint research project “Stella” of the Bank of Japan (BOJ) and the European Central Bank (ECB) studies the possible use of distributed ledger technology (DLT) for financial market infrastructures.

The joint work is being conducted at conceptual level and through practical experimentation with the technology. Legal aspects are not part of the studies. Project Stella aims to contribute to the ongoing broader debate around the potential usability of DLT while not being geared towards replacing existing central bank services with DLT-based solutions.

In September 2017 the first findings of project Stella were published (1). The analysis focused on efficiency and safety aspects of the operation of payment system functionalities in a DLT environment. The experiments provided promising results and valuable insights into the functioning of DLT. Given the relative immaturity of the technology, however, it was noted that DLT was not a solution for large-scale payment services like BOJ-NET and TARGET2 at this stage of development.

Moving from payments to securities settlement, the second phase of the Stella project explored how the delivery of securities against cash (2) could be conceptually designed and operated in a DLT environment. It draws on existing delivery-versus-payment (DvP) approaches as well as innovative solutions that are currently being discussed for DLT (3).

In order to gain practical understanding of DvP functioning on DLT, prototypes were developed using three DLT platforms: Corda, Elements and Hyperledger Fabric.

The findings of the second phase of the Stella project can be summarised as follows:

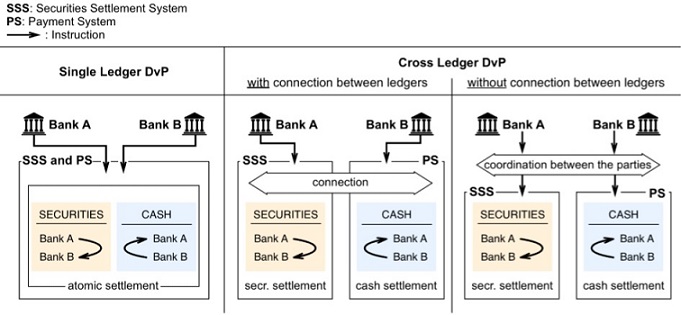

DvP can run in a DLT environment subject to the specificities of the different DLT platforms. DvP could be conceptually and technically designed in a DLT environment with cash and securities either on the same ledger (single-ledger DvP) or on separate ones (cross-ledger DvP). The specific design of DvP, however, depends on the characteristics of the DLT platform (e.g. range of information shared among participants, data structure and locking of delivered assets). In addition, depending on the use case, the design of DvP can be influenced by a number of factors including the interaction of the DvP arrangement with other post-trade infrastructures.

DLT offers a new approach for achieving DvP between ledgers, which does not require any connection between ledgers. Conceptual analysis and experiments have proven that cross-ledger DvP could function even without any connection between individual ledgers – a novelty which does not exist in today’s set-up. Functionalities such as „cross-chain atomic swaps” have the potential to help ensure interoperability between ledgers (of either the same or different DLT platforms) without necessarily requiring connections and institutional arrangements between them (4).

Depending on their specific design, cross-ledger DvP arrangements on DLT may entail a certain complexity and could give rise to additional challenges that would need to be addressed. The conduct of DvP transactions between ledgers that have no connection requires several process steps and interactions between the seller and the buyer. Depending on the specific design, this could impact transaction speed and require the temporary blockage of liquidity.

It should also be borne in mind that ledgers acting independently may inadvertently affect each other from an operational perspective. From a risk perspective, the absence of fully synchronised process steps could also expose participants to principal risk if one of the two counterparties does not complete the necessary process steps. Those additional risk aspects would need to be properly addressed.

In conclusion, the second phase of project “Stella” has proven that – from a conceptual and technical viewpoint – the settlement of securities against cash can follow different designs in a DLT environment, including a novel approach that relies on “cross-chain atomic swaps” and does not require any connection between ledgers. However, given that discussions on applying DLT to DvP arrangements are still at an early stage, further analysis on the safety and efficiency of individual approaches is warranted. Also legal aspects, which have not been part of this study, would need to be further explored.

1) https://www.ecb.europa.eu/pub/pdf/other/ecb.stella_project_report_september_2017.pdf

2) Settlement mechanisms based on DvP link the transfer of two assets in such a way as to ensure that the transfer of one asset occurs if and only if the transfer of the other asset also occurs. The outcome of settlement is that either both parties successfully exchange those assets, or no transfer takes place. Such a condition is also often referred to as „atomicity” in computer science.

3) The analysis is based on a basic, stylised scenario of two counterparties exchanging securities against cash.

4) From a technical point of view, functionalities that enable „cross-chain atomic swaps” could be implemented for non-DLT platforms.

Download the full report: Securities settlement systems: delivery versus payment in a distributed ledger environment

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: