Project mBridge experiments with a multiple-central bank digital currency (multi-CBDC) common platform for wholesale cross-border payments. It seeks to solve some of the key inefficiencies of cross-border payments, such as high costs, low speed and transparency, and operational complexities. At the same time, the project aims to safeguard currency sovereignty and monetary and financial stability for each participating jurisdiction, guided by the principles of „do no harm”, compliance and interoperability

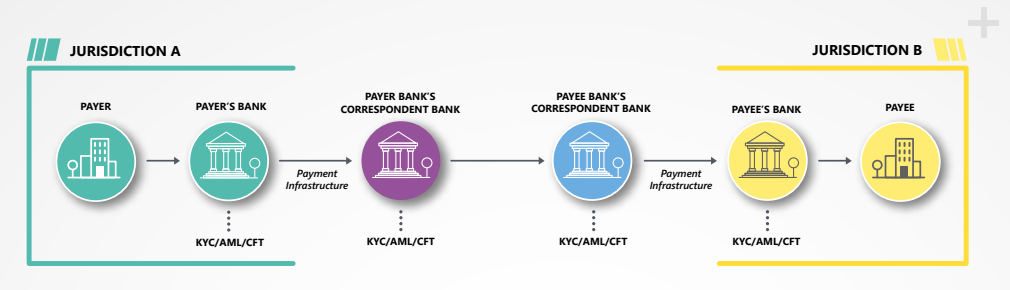

Commercial banks often lack direct relationships with offshore counterparties and must rely on a global network of correspondent banks to make cross-border payments. A typical cross-border payment would involve not only the payer’s and payee’s local banks, but also their correspondent banks (which may or may not be in a third jurisdiction). While critical to the functioning of the international payments system, cross-border payments made in this manner tend to exhibit high costs, settlement risks, low speed and operational complexities due to duplicated processes and steps in the payment chain. There is also evidence to suggest that correspondent banks are cutting back their services worldwide, leaving many without sufficient or affordable access to the global payments network.

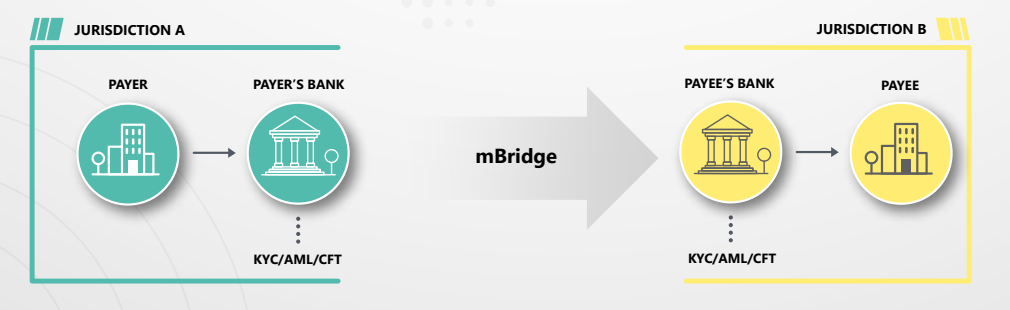

With Project mBridge, the number of steps can be significantly reduced by allowing direct,

bilateral connectivity between the payee’s and payer’s local banks supported by interoperability

with participants’ domestic payment systems. As such, cross-border payments on the platform

developed for Project mBridge can be:

• Faster: instant settlement within seconds.

• Safer: settled in the safest settlement asset – central bank money.

• More accessible: with direct, bilateral connectivity between any two banks on the platform.

• Cheaper: less settlement risk and fewer duplicated processes can lead to a reduction in

overall costs.

• Compliant: with banks ensuring compliance with each jurisdiction’s KYC/AML/CFT

regulations off-bridge.

• Settled with finality: based on legal and/or contractual arrangements and protections.

Project mBridge’s platform is underpinned by custom-built distributed ledger technology (DLT), a set of comprehensive legal rulebook documents and a fit-for-purpose governance structure.

The project is a collaborative effort of the BIS Innovation Hub, four founding central banks and over 25 observing members:

Founding central banks: Hong Kong Monetary Authority, Central Bank of the United Arab Emirates, Digital Currency Institute of the People’s Bank of China and Bank of Thailand.

Observing members: Bangko Sentral ng Pilipinas; Bank Indonesia; Bank of France ; Bank of Israel; Bank of Italy; Bank of Korea; Bank of Namibia; Central Bank of Bahrain; Central Bank of Chile; Central Bank of Egypt; Central Bank of Jordan; Central Bank of Malaysia; Central Bank of Nepal; Central Bank of Norway; Central Bank of the Republic of Türkiye; European Central Bank; International Monetary Fund; Magyar Nemzeti Bank; National Bank of Georgia; National Bank of Kazakhstan; New York Innovation Centre, Federal Reserve Bank of New York; Reserve Bank of Australia; Saudi Central Bank; South African Reserve Bank; The World Bank.

Multi-CBDC arrangements that directly connect the CBDCs of different jurisdictions in a single common technical infrastructure offer significant potential to improve the current system and allow cross-border payments to be immediate, cheap and universally accessible with final settlement.

For Project mBridge, a platform based on a new blockchain – the mBridge Ledger – was built by central banks to support real-time, peer-to-peer, cross-border payments and foreign exchange transactions using CBDCs, focusing on the use case of international trade. It also ensures compliance with jurisdiction-specific policy and legal requirements, regulations and governance needs. In 2022, a pilot involving real corporate transactions was conducted on the platform among participating central banks, selected commercial banks and their corporate customers in four jurisdictions.

A next envisaged stage in this project is to see if the platform tested can evolve to become a minimum viable product, which entails continued work on the technology and legal and governance frameworks; acting as a testbed and evaluating potential synergies with other BIS Innovation Hub projects and innovative private sector solutions; and welcoming new participants and use cases.

Project mBridge Update – Experimenting with a multi-CBDC platform for cross-border payments

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: