Project Aperta: enabling cross-border data portability through open finance interoperability

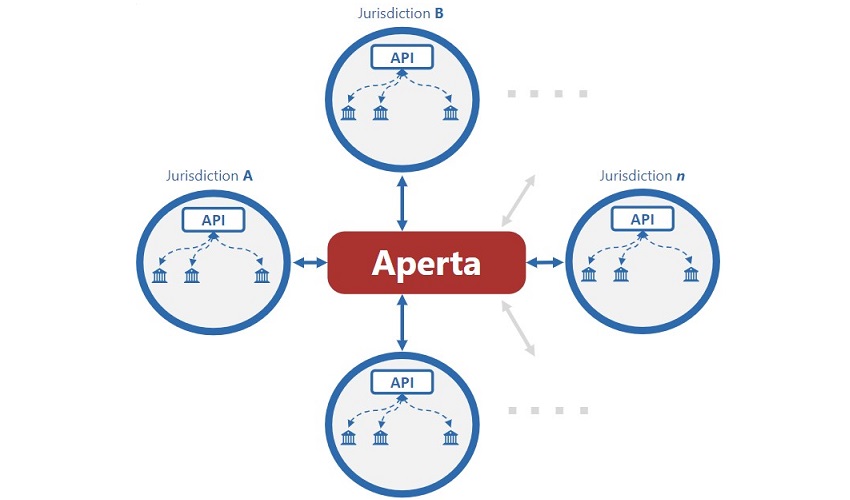

Aperta is a prototype of a multilateral cross-border interoperability network that connects the domestic open finance infrastructures of different jurisdictions, enabling consumer-consented, safe, secure and end-to-end encrypted financial data to be shared via APIs. This allows financial institutions and third-party providers to establish mutual trust across borders and exchange data within an end-to-end trusted environment.

The Bank for International Settlements (BIS) is launching Project Aperta to explore how to reduce frictions and costs in global finance by enabling seamless cross-border data portability. „The project aims to connect the domestic open finance infrastructures of different jurisdictions. The initial use case to be explored is in trade finance for small and medium-sized enterprises (SMEs), with many more applications to follow.” – according to the press release.

Project Aperta (Latin for „open”) is a collaboration between the BIS Innovation Hub Hong Kong Centre, the Central Bank of the United Arab Emirates, the Banco Central do Brasil, the Financial Conduct Authority of the United Kingdom, the Hong Kong Monetary Authority, the Global Legal Entity Identifier Foundation, the International Chamber of Commerce Digital Standards Initiative and the Hong Kong University Standard Chartered Foundation FinTech Academy.

Why Aperta?

Businesses engaged in trade finance face numerous challenges when using financial products that facilitate trade, such as letters of credit, trade credit insurance and supply chain financing. Processes are often inefficient and costly due to excessive manual paperwork and a lack of digital data portability. Digitalising trade finance can promote sustainable economic growth and support financial stability, contributing to the overall resilience of the global financial system.

Around 70 jurisdictions currently regulate open finance through various approaches, with open banking as a subset. These open finance ecosystems often operate with differing domestic standards and protocols, preventing the smooth flow of data across borders. But technologies based on proven application programming interfaces (APIs) have the potential to significantly enhance cross-border data portability via these existing ecosystems, as the true value lies in facilitating international data flows.

Some jurisdictions have begun addressing cross-border data portability through bilateral arrangements, but this risks causing fragmentation in scope, standards and solutions. This fragmentation, in turn, reduces interoperability and scalability while increasing overall complexity. It is essential to focus on avoiding fragmentation and to foster interoperability.

This is where Project Aperta could play a pivotal role in bridging the gap.

How does Aperta work?

Aperta will provide an innovative mechanism for global interoperability, offering harmonised features, functionalities, use cases, security protocols, operating procedures and trust frameworks for open finance across jurisdictions. In its current phase, the participating jurisdictions include the United Arab Emirates, the United Kingdom, Brazil and Hong Kong SAR. The participants have varying approaches to open finance – ranging from regulatory-led to hybrid to market-led.

The multilateral nature of Project Aperta will enable a licensed third-party provider – such as a bank, fintech or other financial institution – in one jurisdiction to seamlessly connect with third-party providers in other jurisdictions. This will facilitate the exchange of information such as payment and account data, letters of credit or electronic bills of lading.

What are use cases for the prototype?

The prototype will enable cross-border portability of:

. a consumer’s account and business data to a bank abroad to open a new account there significantly faster

. trade finance data related to shipping to significantly reduce the cost and increase the speed of international trade.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: