The Bank for International Settlements (BIS) together with seven central banks today announced plans to join forces with the private sector to explore how tokenisation can enhance the functioning of the monetary system.

Project Agorá (Greek for „marketplace”) brings together seven central banks: Bank of France (representing the Eurosystem), Bank of Japan, Bank of Korea, Bank of Mexico, Swiss National Bank, Bank of England and the Federal Reserve Bank of New York. They will seek to work in partnership with a large group of private financial firms convened by the Institute of International Finance (IIF).

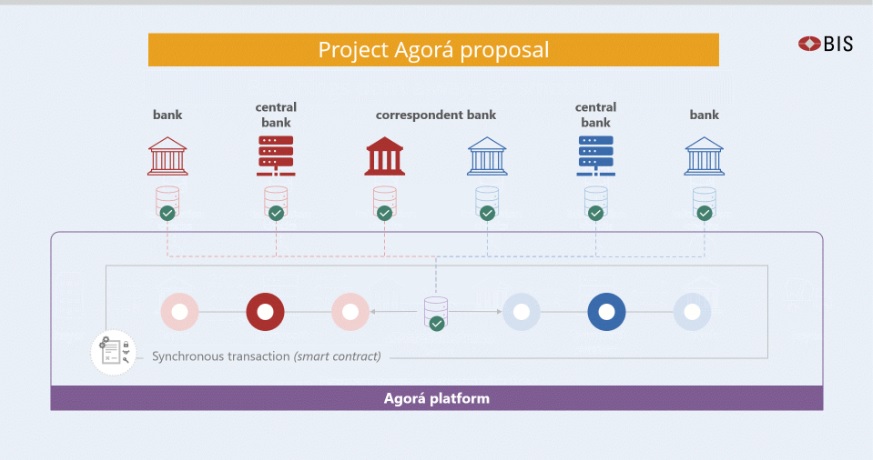

The project builds on the unified ledger concept proposed by the BIS and will investigate how tokenised commercial bank deposits can be seamlessly integrated with tokenised wholesale central bank money in a public-private programmable core financial platform. This could enhance the functioning of the monetary system and provide new solutions using smart contracts and programmability, while maintaining its two-tier structure.

Smart contracts can enable new ways of settlement and unlock types of transactions that are not viable or practical today, in turn offering new opportunities to benefit businesses and people.

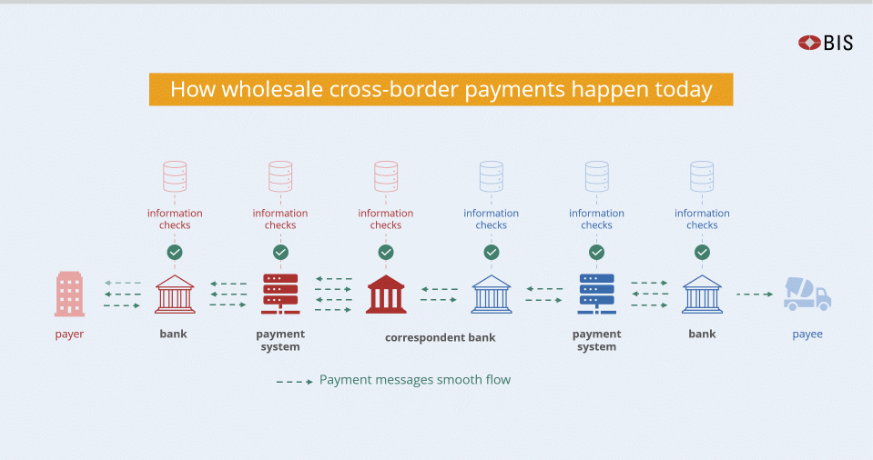

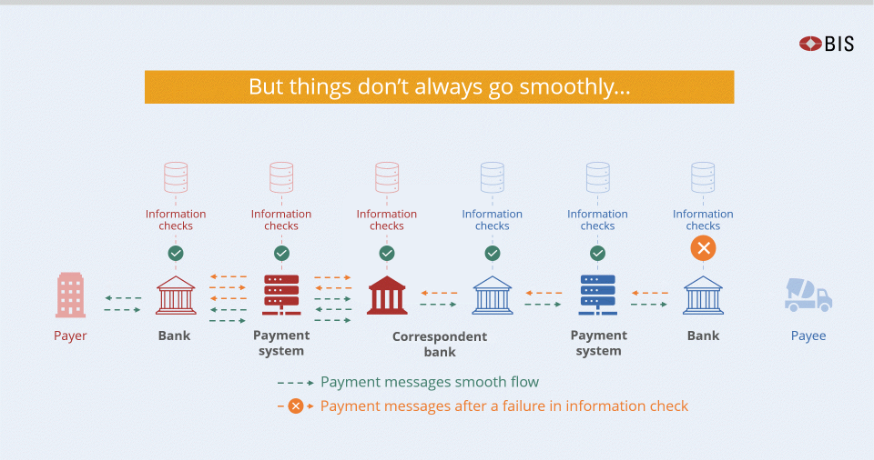

This major public-private partnership will seek to overcome several structural inefficiencies in how payments happen today, especially across borders, which add a layer of challenges: different legal, regulatory and technical requirements, operating hours and time zones. Plus the increased complexity of carrying out financial integrity controls (eg against money laundering and customer verification), which today are often repeated several times for the same transaction, depending on the number of intermediaries involved.

BIS Innovation Hub projects are generally experimental in nature and aim to explore and deliver public goods to the global central banking community.

Next steps

The BIS will issue a call for expressions of interest to private financial institutions to join Project Agorá. The IIF will act as the intermediary and convener of private sector participants. It is envisaged that several regulated financial institutions will participate representing each of the seven currencies. Specific instructions and requirements will be issued in due course. Being a member of the IIF is not a requirement to participate.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: