Prepare for an m-commerce explosion: users will surpass 2 billion in 2019

The total global user base for mobile payments will increase from an estimated 689.99 million users in 2014 to 4.77 billion users in 2019, according to global analyst firm Ovum. Of the three segments covered in the new forecast* – m-commerce, person-to-person (P2P) mobile money transfers, and mobile proximity payments – m-commerce is the biggest in terms of users and transaction value.

Ovum forecasts 452.78 million global m-commerce users in 2014, rising to 2.07 billion users in 2019.

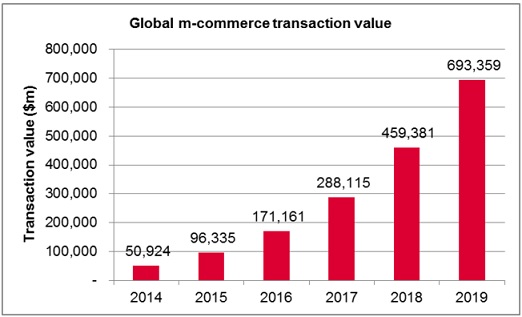

The global transaction value of m-commerce will grow from $50.92bn in 2014 to $693.36bn by 2019, as shown below:

The rise of m-commerce is being driven by the widespread adoption of increasingly powerful smartphones with larger screens. Meanwhile, more and more retailers are optimizing their sites for mobile shopping. “Smartphones have become a platform that can support the whole shopping journey, from product search and discovery, through comparisons and recommendations, to payments,” notes Eden Zoller, Principal Analyst, Consumer Services and Payments, at Ovum.

China is the rising star of m-commerce and by 2019 will have 370.29 million m-commerce users, making it the largest m-commerce user base in the world. China is also on track to be second only to the US in terms of m-commerce transaction value, which will reach $79.36bn in China in 2019.

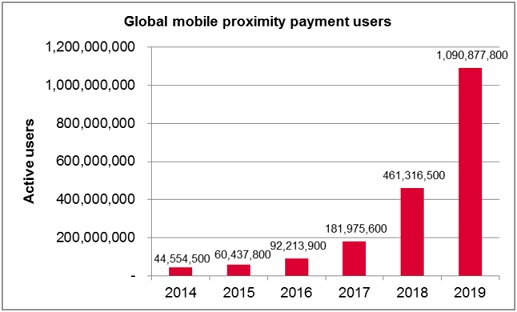

Also, Ovum’s new m-payments forecast* shows that mobile proximity payments are the smallest, but fastest growing segment for mobile payments. The global user base for mobile proximity payments (both NFC and non-NFC) stood at 44.55 million in 2014, as shown below.

Traction for NFC mobile proximity payments is, with a few notable exceptions, particularly low across the vast majority of mature markets and almost non-existent in emerging markets. But by 2019 there will be a total of 1.09 billion global mobile proximity payment users, of which 939.10 million will be NFC. The total transaction value of mobile proximity payments (both NFC and non-NFC) will grow from $4.77bn in 2014 to $141.21bn in 2019.

“Factors driving growth include wider merchant support for NFC across point-of-sale (POS) acceptance infrastructure, which in the US is being helped by the upgrades to EMV. The adoption of host card emulation (HCE) is also helping, providing a more flexible way of implementing NFC. At the same time, NFC is being championed more widely across the ecosystem by players such as Apple, Google, PayPal, and Samsung,” said Eden Zoller, Principal Analyst, Consumer Services and Payments, at Ovum.

Ovum defines mobile proximity payments as purchases made using a connected mobile when the user is physically present at or near the point of sale, using NFC or alternative enabling technologies such as QR codes.

Disruption and innovation ahead for P2P mobile money transfers

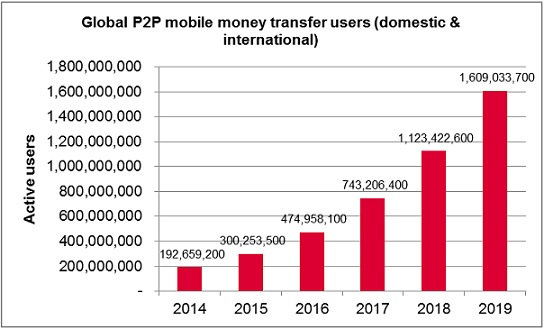

The global user base for person-to-person (P2P) mobile money transfers will increase from 192.66 million users in 2014 (domestic and international) to 1.61 billion in 2019, according to global analyst firm Ovum.

Ovum’s new m-payments forecast* shows that the total global user base for mobile payment segments will increase from an estimated 689.99 million users in 2014 to 4.77 billion users in 2019. This forecast also covers m-commerce and mobile proximity payments.

P2P domestic transfers drive users, international drives value

The total global transaction value generated by P2P mobile money transfers will increase from $15.22bn in 2014 to $270.93bn in 2019. P2P domestic transfers eclipse international remittances in terms of the number of users, but the inverse is true when it comes to transaction value, with international remittances being the bigger value generator. P2P domestic transfers are characterized by high-volume, smaller-value transactions, particularly in emerging markets where they continue to be the most widely used type of mobile money service.

New competition could shake up the market

Ovum expects the P2P mobile money transfer market to transform over the next five years. “The market for P2P mobile money transfers will be shaped by a new wave of players that will drive innovation and disruption going forward,” said Eden Zoller, Principal Analyst, Consumer Services and Payments, at Ovum. Key players include popular OTT messaging applications adding money transfer capabilities such as Facebook Messenger, KakaoTalk, and Line.

Although mobile adds new levels of convenience to international remittances and can potentially lower costs, mobile is still a small part of the overall remittance market. “The traditional remittance market is highly entrenched and has been characterized by lack of innovation. Mobile has the potential to really shake things up and introduce new levels of competition,” added Zoller

Person to Person(P2P) transfers – domestic refers to the transfer of money from one individual to another both in the same country via a connected mobile device. This includes transactions between m-wallets, other online wallets, and dedicated P2P payment services.

P2P transfers – international refers to the transfer of money from one individual to another in different countries, via a connected mobile device. Includes all transmission methods initiated using a mobile device.

Ovum is part of Informa Group, the world’s leading provider of business intelligence. Informa has over 6,000 employees and delivers specialised information to companies operating in sectors including agriculture, consumer, commodities, energy & utilities, financial services, healthcare & pharmaceuticals, maritime, telecoms, media, and IT.

Source: ovum.com

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: