By integrating with the secure payment authentication service from Google Pay, Checkout.com will offer device biometric checks like a PIN, password and facial recognition to speed up the checkout process for merchants, increase acceptance and authentication performance, and drive higher conversion rates at the checkout.

Checkout.com, a leading global digital payments provider, announced it is the first payment provider to partner with Google Pay to bring its biometric-based secure payment authentication service to merchants.

Checkout.com, which offers authentication to merchants such as Remitly, will offer Google Pay’s biometric authentication to brands that seek to increase their digital payments performance and speed up their authentication for customers. This offers a streamlined alternative to other authentication methods, where a customer verifies their identity with a one-time passcode and, in the process, is often redirected to multiple different pages.

In its initial roll-out, the technology has already proved successful. eSky, the leading travel platform in CEE on Checkout.com’s platform, reported a 14- second reduction in checkout time, as well as a 5 percentage point uplift in authentication rate and a 3 percentage point uplift in the authorization success rate, compared to the 3DS alternative.

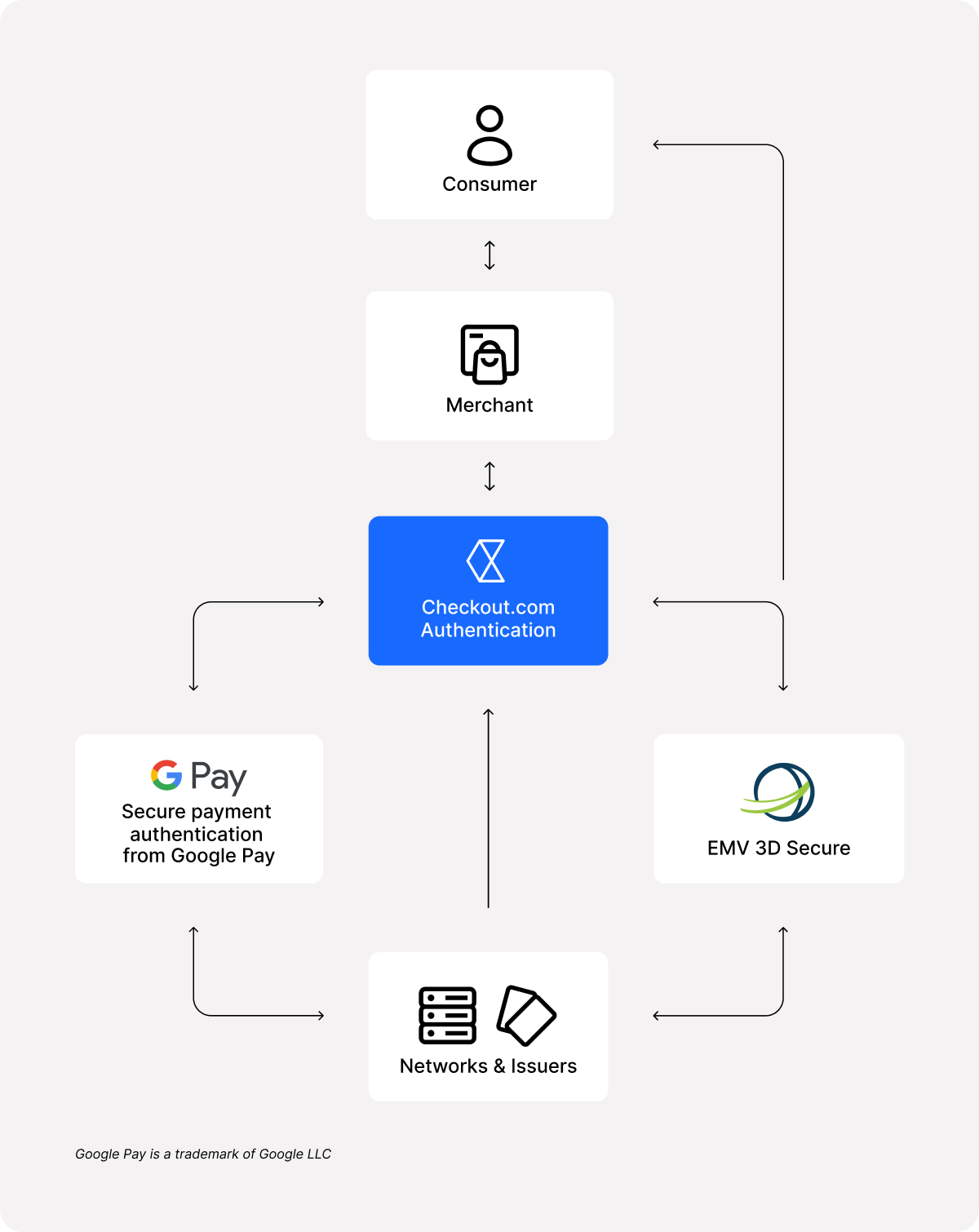

Difference between 3DS and secure payment authentication from Google Pay

The primary distinction between 3DS and secure payment authentication from Google Pay lies in their verification methods. 3DS depends on bank verification through SMS OTP, bank login, or security questions, introducing friction and making the checkout process longer. In contrast, secure payment authentication from Google Pay meets two-factor authentication (2FA) requirements using a device-bound token (possession) and device biometric or device PIN (inherence). This streamlines the checkout flow, making it faster and more convenient without disrupting the user experience.

„However, offering both authentication experiences is at the core of our ambition to be a one-stop shop for all our merchants’ payments and security needs. What does this mean for you? Checkout.com’s authentication offering has evolved into a comprehensive solution. Beyond connecting to various schemes and access control servers (ACS) to support 3D Secure for one-time-password (OTP) and out-of-band (OOB) experiences, we have now enhanced our solution by integrating device biometric-driven authentication with Google.” – the company explained.

„Implementing Google SPA has significantly boosted our conversion rate by streamlining the transaction process. The speed of transactions and seamless payment flow is crucial in the travel industry because airline ticket prices change in real-time. Faster checkout with frictionless authentication means customers can secure their tickets at the best available prices – adds Grzegorz Kwiecień, Head of Payments & Fraud Prevention at eSky Group.

To complement this new service, merchants can also incorporate Checkout.com’s AI-based dynamic routing (‘Intelligent Acceptance’), a system built on billions of transactions that selects the optimal authentication option for each merchant and transaction. This means that shoppers can complete transactions in three simple steps, enjoying a faster checkout experience.

Guillaume Pousaz, Founder and CEO at Checkout.com said: „This marks a significant leap forward in authentication, directly tackling the primary performance challenges faced by merchants with the existing 3DS solutions. Through this innovation, we’re the first PSP to pioneer a digital wallet-like experience driven by biometric authentication.”

Ben Volk, Vice President and General Manager, Google Pay, said: „We’re always looking for ways to improve the checkout experience for shoppers while reducing cart abandonment rates for merchants. With our secure payment authentication service, we are able to reduce friction at checkout by speeding up the process, all-the-while ensuring a secure payment experience and further reducing fraud.”

__________

eSky Group is the owner of a leading travel platform in Central and Eastern Europe, operating globally in more than 50 countries. eSky offers a diverse array of travel products including flights, accommodations, city breaks & holidays packages, supplemented by ancillary offerings such as insurance, car rentals, airport transfers, sports and concert tickets, and various attractions. This comprehensive suite of services positions eSky as a one-stop shop in the travel and leisure industry. Closing out 2023 with an impressive EBITDA of over EUR 18.7 million, eSky earned recognition as the most valuable Polish travel e-commerce company by Forbes. Additionally, in the UK eSky holds an ATOL offering financial protection for travel bookings and has been a long-standing member of the International Air Transport Association (IATA) group of agents, maintaining a solid footing within the travel industry.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: