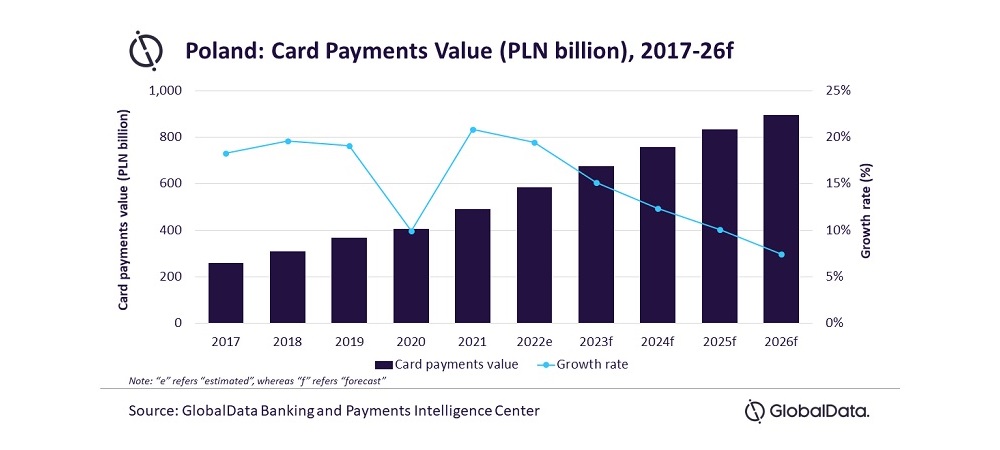

Driven by consumers’ increasing preference for electronic payments, a surge in contactless payments, and the government’s push for a cashless society, Poland’s card payments market is expected to grow by 19.5% in 2022 to reach PLN585.7 billion ($145.2 billion) in 2022, forecasts GlobalData, a leading data and analytics company.

GlobalData’s report, ‘Poland Cards and Payments: Opportunities and Risks to 2026’ notes that the country’s card payment value registered a growth of 20.9% in 2021. This was driven by improving economic conditions and a rise in consumer spending, with growth expected to continue this year.

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, comments: “While cash has traditionally been the most preferred payment method in Poland, consumers are now gradually embracing electronic payments. Government financial inclusion initiatives (such as mandatory availability of basic banking services along with a debit card with zero or minimal costs), improving payment infrastructure and a gradual rise in consumer preference for non-cash payments have driven the growth of card transactions during the last few years. Additionally, the fast adoption of contactless payments, and growth in ecommerce are also supporting the rise in card usage.”

During the COVID-19 pandemic, Polish consumers were increasingly using contactless cards, so all major banks started providing this option as well as increasing the contactless payment limit. According to the Polish central bank, out of the total card transactions, contactless payments accounted for 95.8% in H1 2021. This high usage is supported by a large acceptance network as from the beginning of 2019, 100% of all POS terminals were adapted to support payment cards with a contactless function.

The government also aims to reduce the country’s dependency on cash by promoting electronic payments and has already introduced a law where all businesses using a cash register are obliged to provide cashless payment options. Additionally, effective from January 1, 2023, a cash transaction limit of PLN20,000 ($4,958.14) between businesses and customers will be introduced further driving the growth of electronic payments.

Sharma concludes: “The gradual economic recovery, improving payment infrastructure and rising contactless adoption are expected to further drive the Polish card payments market. The card payments value is expected to grow at a strong compound annual growth rate (CAGR) of 11.2% between 2022 and 2026 to reach PLN895.4 billion ($222.0 billion) in 2026.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: