One in two aged 18-34 feel comfortable trusting AI to make decisions on savings and investments. One in four feel they could benefit from financial apps which use AI. However, only 18% think AI benefits them day to day.

Trust in artificial intelligence (AI) to improve financial knowledge and management is growing among young people, according to new data from smart money app Plum.

Its research of 2,000 UK adults found 61% of those aged 18-34 year olds are comfortable with AI making financial predictions for them*. Young people are also the most confident in using data to save money, with 45% happy to share their data for this purpose compared to just 15% of those aged 55+.

Meanwhile, half (50%) of 18-34 year olds said they felt comfortable trusting AI to make decisions on savings and investments for them. This could indicate that this generation may make the boldest move yet away from traditional financial advice and towards AI, such as robo advisers or money management apps.

The research also explored young people’s opinions about other forms of AI, finding that:

. 60% of 18-34 year olds felt happy with AI predicting what they should read or listen to, vs 43% of all ages;

. 58% felt comfortable with AI being used to prevent fraud or for facial recognition, vs 52% of all ages;

. 56% would use AI for personalised shopping, vs 40% of all ages.

These results show that young people see many uses for AI beyond financial services, and are substantially more open-minded to novel uses than respondents from older age groups.

However, scepticism about the benefits of AI still remains across age groups. Only 1 in 5 (18%) felt that they could benefit from financial apps that use AI, although for young people, this rises to 1 in 4 (24%).

Furthermore, nearly half (46%) across all age groups felt that they didn’t understand how AI could impact their life for the better. This indicates that while people recognise the benefits of AI within specific contexts, they do not necessarily see it as a benefit more generally.

Plum’s CEO and co-founder, Victor Trokoudes, comments: “Your first thought when you hear the words ‘artificial intelligence’ might be the Hollywood-inspired futuristic robot that can think like a human and take over the world. But what we’re actually starting to see are real-world, useful applications of AI that benefit your everyday life. They might not be taking over the world, but this type of AI is having a democratising effect on financial services, which is really exciting. Smart technology means everyone can cheaply access services that previously would have been gate-kept by those with enough money to afford expensive services or advisers.

“That said, our data still shows that more education is required so that people understand better the technology they are using, even among younger people. While they might be comfortable using AI in a specific context, they still struggle to understand wider benefits of adopting technology like AI in general. This speaks to a wider issue we face in the fintech sector. As an industry we need to make sure we are educating our customers and not alienating them with complexity and jargon, so as many people as possible can benefit from the opportunities that AI brings.”

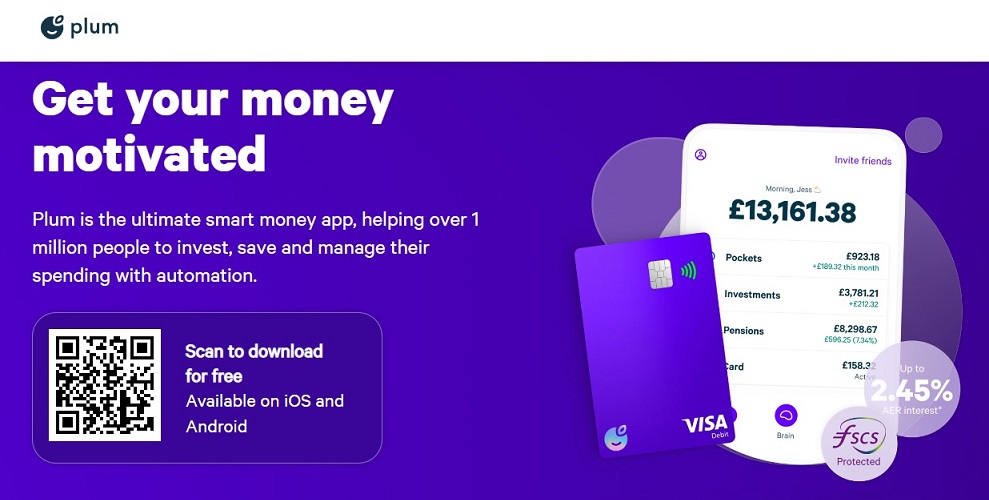

The Plum app helps more than 1.5m people across Europe with their finances by using a smart AI-powered algorithm to save, invest and manage their spend for them.

___________

*The national representative study of 2,000 UK adults was carried out by Opinium on behalf of Plum between 9 and 13 September, 2022.

Plum is a smart money app, with the mission to make wealth building automatic. Founded in 2016 by Victor Trokoudes (ex-Wise), Plum automates parts of personal finance that people find difficult or don’t have time for, helping them save, invest, budget and manage their spending. Plum has over 1.5 million customers across the UK and EU, helping them set aside more than £1.5 billion. The app ranked no.1 among fintechs and no.5 overall in the 2022 Deloitte UK Technology Fast 50, a ranking of the 50 fastest-growing technology companies in the UK. Plum is headquartered in London, UK, and has offices in Athens, Greece and Nicosia, Cyprus.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: