Plaid, a world leading open banking platform, has acquired Cognito, an identity verification and compliance (KYC, AML) platform

Plaid has acquired Cognito, an identity verification and compliance (KYC, AML) platform that makes it faster, easier and safer for people to verify their identity when signing up for financial services online. Its products are used by hundreds of digital finance companies today, including many Plaid customers such as Affirm, Brex, Current, Republic and Wyre.

Verifying someone’s identity is critical across almost all financial services, yet remains a major challenge for many companies that stitch together different solutions to get the tools and data needed. This patchwork approach often delivers poor user experiences that result in people abandoning the signup process because it takes too long or it is too difficult to provide the required documents and information.

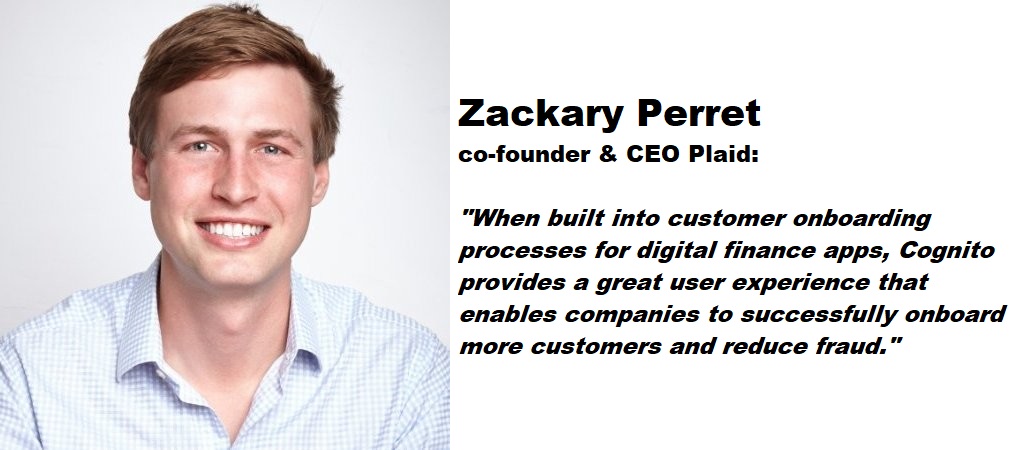

The Cognito team has built a platform that combines all of the tools and data sources a company needs for automating identity verification, KYC and AML screening. When built into customer onboarding processes for digital finance apps, Cognito provides a great user experience that enables companies to successfully onboard more customers and reduce fraud.

Identity verification is one of three critical parts of a complete onboarding experience, along with account connection (connecting your bank/financial data to an app) and account funding (moving money into an app), which Plaid provides today.

„With Cognito, the next major step in our journey is to help developers build the best and most seamless onboarding experiences across all of these areas. This means simplifying every step of the consumer journey from their first interaction during signup, to the first magical moment delivered by that product – the first time sending money to a friend, or the first time trading a stock or cryptocurrency,” said Zachary Perret, Co-Founder / CEO at Plaid.

„Together, we can combine our experience in safely connecting millions of people to financial apps with Cognito’s expertise in identity and compliance to help make the onramps to digital finance easier, safer and more accessible for everyone,” Zack added.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: