Pizza Hut & Visa Inc. are the first to test the beacon technology in cars – after e-commerce and m-commerce now is launching a new concept: car-commerce

Visa Inc., Pizza Hut and Accenture announced they are working together to develop a proof-of-concept connected car to test mobile and online purchases on the go. The connected car is expected to feature Visa Checkout, Visa’s online payment service, cellular connectivity, Bluetooth Low Energy (BLE), as well as Beacon technology deployed at Pizza Hut restaurants to alert staff when the customer has arrived and is ready to pick up the order. The integration of these technologies is being managed by Accenture.

“By 2020 it is estimated that more than 250 million vehicles worldwide will include some form of embedded connectivity,” says Bill Gajda, senior vice president of Innovation and Strategic Partnerships, Visa Inc. “As the number of connected cars on the road increases, so does our ability to bring secure online commerce to consumers everywhere. We initially focused on a specific use case – ordering a meal on your way home – but we envision a world where consumers can seamlessly make many of their everyday purchases from the car.”

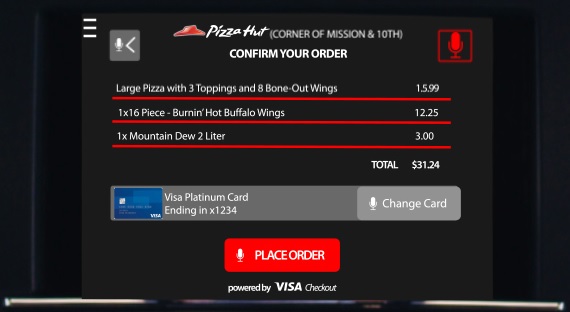

Look how does it look the car’s board when you order

Building next-generation commerce experiences

With busy, on-the-go consumers in mind, the connected car concept led by Visa, combines leading edge payment security, cellular and wireless technologies to test connected car consumer payment experiences. The demonstration of connected car commerce is a first of its kind in the industry. While the initial focus is on ordering food at a quick service restaurant, the technology can also be applied to other, everyday consumer purchases including gasoline, transit and parking and drive-through retail opportunities.

. Visa Checkout, the online payment service that lets consumers make purchases with just a few clicks, integrated into the dash of a connected car, will allow consumers to easily order food from the car. Interactive Voice Control (IVR) will be used to enable consumers to easily and securely make in-car purchases. IVR enables the driver to order and authenticate the purchase while keeping both hands on the steering wheel and maintaining focus on the road.

. Pizza Hut, the world’s largest pizza company and biggest digital pizza brand by order volume, has already integrated Visa Checkout as an easy checkout option on pizzahut.com. As part of the connected car trial, the company now will provide in-car access to menus, delivery and pick-up options as well as test in-restaurant “beacon technology” to notify team members when the customer’s car has arrived.

“We’re committed to offering speed and convenience to our customers when ordering online and this new connected car technology is the latest way for us to do that,” said Baron Concors, Chief Digital Officer, Pizza Hut. “We have the largest suite of mobile apps and are proud to be the exclusive pizza company to offer Visa Checkout, so with our history of innovation, it only made sense for us to be the first to test the beacon technology in cars.”

. Accenture plays a pivotal role developing the applications and integrating several technologies to build the technical foundation for secure and seamless in-car purchases. This includes the car’s head unit, cellular network, Visa’s payment technology, the restaurant’s eCommerce platform, beacon and Bluetooth technologies.

“We are pleased to team with Visa to explore the future of Internet of Things-based commerce by building the connected car commerce prototype,” said Anand Swaminathan, Global Growth and Strategy lead for Accenture Digital. “Visa has great vision in this space and continues to innovate and explore new ways to make purchases more convenient for consumers, setting the bar even higher in terms of friction-less payment transactions.”

Visa will demonstrate connected car commerce at Mobile World Congress,March 2-5 in Barcelona, Spain (Hall 6, Exhibit Booth 6D40). The partners expect to test the connected car commerce experience in Northern California, over a three-month period, starting this spring.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: