PayPal today „ushered in a new era for customers, making it easier and more rewarding than ever to shop and pay with PayPal anywhere, anytime – both in stores and online” – ccording to the press release.

„Now, customers have access to rich rewards, stackable cash back offers in the PayPal app, and more personalized ways to manage their spending – all with the safety and security PayPal is known for and the peace of mind they’re getting more money back in their pockets.” – the company said.

PayPal has been the go-to solution for online purchases, with the majority of U.S. adults having used PayPal in the last 5 years1. Now, with consumers looking for more ways to save money on every purchase, PayPal is expanding its reward program and its availability to deliver an omnichannel solution to give consumers a smart choice for every purchase, every time.

The company explained: „PayPal’s enhanced rewards include the ability to choose a monthly category of spending, such as groceries or clothing, to receive 5% cash back on up to $1,000 in selected category spend per month when using their PayPal Debit MasterCard ® 2.

Customers can also stack rewards on top of their monthly category by discovering and saving offers in the PayPal app from top brands including Sephora, Domino’s, DoorDash, Instacart, PetSmart, and hundreds more. For example, if a customer selects Restaurant as their monthly category, they’ll receive 5% cash back3 and another 10% cash back [for a total of 15%] if they save a deal from DoorDash in the PayPal app, which will be automatically applied when checking out with PayPal online.„

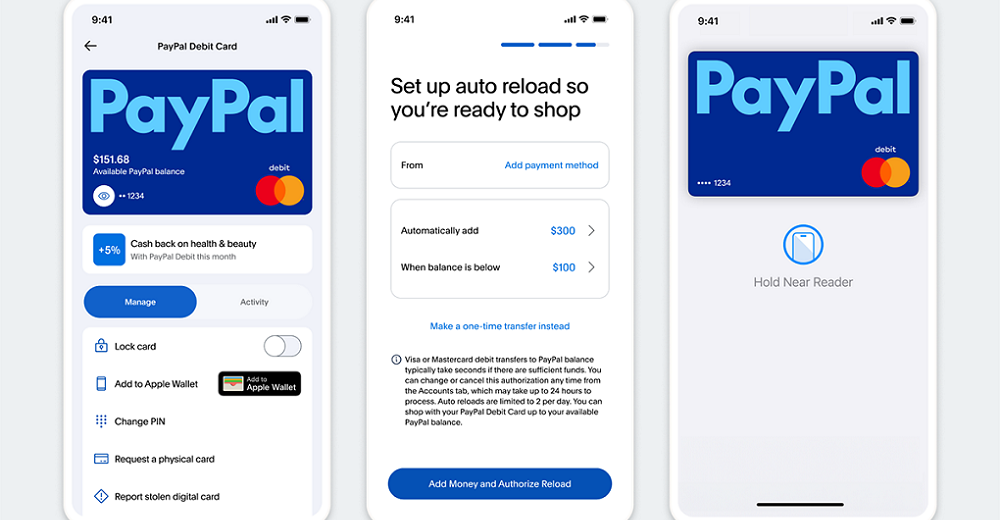

Every customer has unique needs and individual spending patterns. PayPal’s new auto-reload option empowers them to shop confidently by setting a PayPal balance threshold that automatically tops up if it dips below their chosen amount. Knowing how much is in their balance and customizing it for their shopping needs removes the guesswork and makes PayPal simpler for millions of Americans.

“We know that consumers are looking for smart, simple and safe ways to make their everyday purchases while also getting more value out of every transaction. That’s why millions of customers can now enjoy the trust and convenience they love about PayPal everywhere – both in-store and online, with access to rich rewards that put more money back in their pockets,” said Alex Chriss – President and CEO, PayPal. „It’s a pivotal moment for PayPal and its customers and a significant first step as we bring the power of PayPal to everywhere they shop.”

In addition, customers can now add their PayPal Debit Card to Apple Wallet in just a few steps and use it with Apple Pay, enabling even more ways to pay.

“We’re excited to work with PayPal to bring Apple Pay to PayPal Debit Card cardholders and help deliver a seamless shopping experience to even more users,” said Eddy Cue, Senior Vice President of Services at Apple. “Whether in-store, online or in-apps, PayPal debit card cardholders will be able to enjoy the convenience and security that Apple Pay brings to their everyday lives.”

Simple Sign-up: Streamlined sign up for a PayPal Balance Account, Digital Debit Card, and Account and Routing Numbers for PayPal Direct Deposit. A physical debit card can be requested at no cost.

Auto-reload: Customers will now have a personalized way to manage their spending, with the ability to automatically reload funds to keep their PayPal balance at a certain threshold.

Tap-to-Pay: Add the PayPal Debit Card to their mobile wallet with just a few clicks to earn cash back when they tap-to-pay with PayPal Debit in stores.

5% Cash Back In-Store and Online: Flexibility to choose a 5% PayPal Debit monthly cash back category from grocery, gas, restaurant, clothing, and health & beauty.

Stackable Cash Back Rewards: Earn 5% cash back with PayPal Debit and even more by stacking additional offers in their monthly category at the brands customers love like Sephora, Domino’s, DoorDash, Instacart, PetSmart, and many more when they check out with PayPal online.

Secure Transactions: As always expected, when they check out online with PayPal, all transactions are encrypted, and customers’ full financial information is not shared.

___________

1PayPal consumer penetration % calculation is based on number of unique PayPal consumers divided by total adult population (aged 18+), Source: UN World Population Prospects Report 2022 (2022 and 2023 adult population estimated using 2015-2021 CAGR).

2The PayPal Debit Card is issued by The Bancorp Bank, N.A. pursuant to a license by Mastercard International Incorporated and may be used everywhere Mastercard is accepted. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. The Bancorp is issuer of the Card only and not responsible for the associated accounts or other products, services, or offers from PayPal.

35% Cash back earned as points you can redeem for cash and other options on up to $1,000 category spend/month. Terms Apply. Merchant offers are subject to availability, merchant exclusions and PayPal Rewards terms.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: