People in Sweden now at risk of losing access to notes – Central Bank calls for new laws to address fallout of cashlessness

People living in the world’s most cashless society may soon lose their access to notes and coins. To avoid that extreme scenario, Swedish cash-handling provider Loomis AB wants authorities to force banks and retailers to continue accepting cash.

The warning follows similar calls from the Swedish central bank, which is worried that the rapid disappearance of cash will ultimately lead to the disintegration of the infrastructure needed to use notes and coins and undermine its task to promote a safe and efficient payment system.

“We have to have cars, vaults and all that, and in order to maintain the infrastructure we also need a base volume,” Loomis Chief Executive Officer Patrik Andersson said in an interview.

He says Sweden’s more remotely populated areas in the north are most at risk of losing access to cash. Such a scenario would be worrying in the event of natural disaster or a technological breakdown, with Swedes potentially unable to buy the basics needed to survive.

“Cash is important in a crisis situation,” Andersson said. „Swedes don’t maybe have the insight to understand the effects of such a crisis, that it pervades the whole community.”

A parliament committee reviewing the broader framework for the Riksbank plans to publish a special report this summer looking at the challenges posed by declines in cash usage. Riksbank Governor Stefan Ingves this week called for legal changes to safeguard the central bank’s governance of the payment system amid the rapid decrease in the use of cash.

Sweden is moving toward a situation where „the public’s means of payments is controlled by commercial parties,” Ingves said in an op-ed in Dagens Nyheter. „That could become problematic, especially in a crisis situation.”

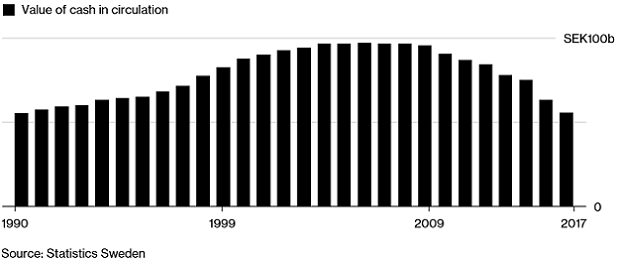

The amount of cash in circulation in Sweden last year dropped to the lowest level since 1990 and is now more than 40 percent below its 2007 peak. The declines in 2016 and 2017 were the biggest on record.

Disappearing Cash

Amount of Swedish notes and coins in circulation has dropped to lowest level since 1990

As the usage of cash continues to decline, the cost for shops, eateries and banks to provide notes and coins increases. That further exacerbates the problem by reducing the incentives to do so.

Nina Wenning, the CEO of Bankomat (which is jointly owned by Sweden’s biggest banks and handles most of the cash that passes through Sweden’s automatic tellers) says the cost banks pay for each ATM transaction „has been increasing quite dramatically in recent years.”

Source: Bloomberg

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: