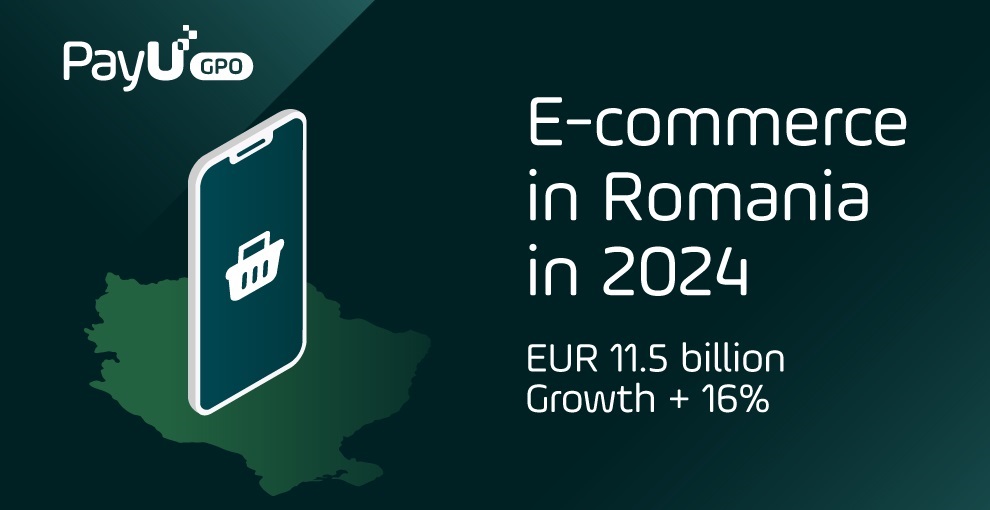

PayU GPO Romania estimates that the value of the e-commerce market will be around 11.5 billion euros in 2024. With 16% yearly growth, the local market can become the second in CEE.

PayU GPO Romania, the leader of the local online payment market, estimates that the value of the e-Commerce market (products and services ordered online) will be around 11.5 billion euros in 2024. The estimated growth for 2024 both from its own calculations, as well as from the data reported by McKinsey and Statista, stands at ~16% compared to the recently ended year, with an advance of about 30% in the services segment.

„The growth forecast for 2024 can be supported by merchats by optimizing aspects such as offering

an omnichannel experience through their own mobile applications, but also by integrating

technologies such as RPA and AI both to ensure a personalized experience for consumers and to

make good and fast business decisions. Moreover, these solutions will help them achieve operational

efficiency, i.e. scalable processes with built-in automated solutions for fast delivery, customer support,

etc.„, stated Elena Gheorghe, PayU GPO Romania Country Manager.

According to PayU forecasts, in 2024 the payment process will continue to represent one of the

important pillars in terms of revenue growth for online merchants. Although card payment – and

especially payments with a saved card (Google Pay, Apple Pay and other digital wallets) – will

maintain its steady growth of 15%-20%, this year we will definitely see in e-Commerce industry the

use of Account-to-Account payment methods, such as Open Banking or Instant Payments.

At the same time, payment in installment such as BNPL and Slice will have an increasing degree of online penetration due to the concept of online installments, directly to the debit card, with subsequent installments being held, as they are perceived by consumers as simple and easy both as payment methods and as financial resource management process.

„We recommend merchants to have a simple check-out process, clear terms and conditions regarding

delivery, return, refund and the payment methods listed on the front page. Obviously, they should

offer payment methods that help them increase their conversion rate, such as pre-saved card

payment and installment payment, as the latter can generate up to 30% more revenue and has an

average value 3 times higher than instant payment„, emphasized the PayU GPO Romania Country

Manager.

2023 retrospective in local e-Commerce

Last year, the local e-Commerce market was valued at 9.8 billion euros according to McKinsey, of

which ~65% represented products/goods and ~35% services.

In the area of goods, the most searched in online were IT&home (65% of the total), clothing (23%),

food products (6%), but the verticals with the biggest increases in transactions were fashion and

beauty, food&delivery and groceries. In the services area, most online purchases were made in

transportation, including delivery services (80%) and travel packages (14%), but the biggest increases were registered in the entertainment and travel packages verticals.

In 2023, Romania ranked third in e-Commerce in Central and Eastern Europe, after Poland (with a

market estimated at USD 27.8 billion in 2023) and the Czech Republic (USD 13 billion in 2023), but

well ahead Hungary and Bulgaria, which totaled USD 6 billion. The local e-commerce market

represents 11% of total retail, while in Poland it is 7%, in the Czech Republic 14%, in Hungary 10%

and in Bulgaria 7%. Thus, considering the economic growth pace of Romania, it has the chance to

become the second operator in the region in the e-Commerce industry, in a very near future.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: