PayThink PSD2 and open banking innovation is getting away from banks

An article written by Lars Sandtorv, the CEO of WeaWallet

The payments industry is on the move. As new regulations come into force a flow of new digitized payment technologies, business models and stakeholders are gaining serious traction in the market.

This new school of payments is threatening to beat conventional banks at their own game. Few anticipate a wholesale demise of the banking industry as we know it, but huge customer volumes shield most banks from serious threat. Nonetheless, it’s fair to say that banks’ grip on the market, and on their previously uncontested relationships with customers, is loosening fast.

Central to the problem is that, compared to their fintech counterparts, banks lack the required agility to keep pace with digitalization, something that is now demonstrably impacting their customer retention.

Blaming what it dubs the „friction endemic in almost every legacy payment system,” a recent report from Deloitte reveals quite how quickly users are moving away from traditional payment rails. PayPal already has 250 million users. The rising popularity of the OEM Pays (including Android Pay, Apple Pay, and Samsung Pay) provides yet further evidence. Apple Pay alone is on track to reach 200 million users by 2020. And by then, the global transaction value of mobile payment apps is expected to reach $14 trillion.

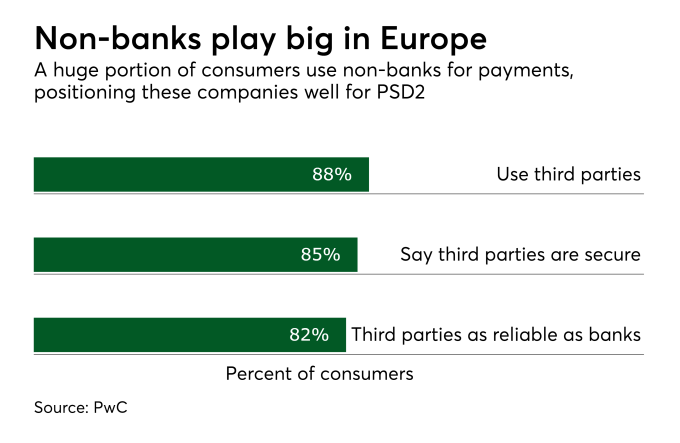

The challenges facing banks are particularly acute in Europe where the fintech scene is flourishing, following a boost from supportive regulations like the second Payments Services Directive (PSD2).

In a recent keynote speech, European Central Bank vice-president Luis de Guindos suggested that in parallel with meeting structural challenges, Europe’s banks must also face down increased competition from the fintech sector: “Increased competition in lending, investments and payments is bound to increase pressure on retail banking revenues.”

With open banking and „bank direct” payments arriving courtesy of PSD2, the ways that banks generate income is set for yet more disruption. All of this signals that banks need to find quick wins; enhancements that make the most of their current strengths by maximizing revenues and offsetting rising customer attrition. This is particularly apparent for smaller banks which lack the resources to develop their own proprietary digital payment systems.

Overhauling their payment card infrastructure is one such opportunity. By collaborating with a specialist card payment platform provider, banks can make dramatic enhancements to their customer’s card payment experience, making their services and their brand more attractive as a result.

By combining support for the OEM Pays with additional services like EMV Secure Remote Commerce (SRC), tokenization and token management facilities, banks can provide customers with greater flexibility and convenience, encouraging greater usage.

So, what individual benefits do these capabilities bring to the table?

Payment-enabled bank apps. By enabling a mobile banking app with wallet functionalities, customers can make in-store payments. This provides the flexibility to not only manage finances in the app, but also to make payments from the same environment.

Issued card to OEM Pays. Connecting a banking app to the OEM Pays gives banks the potential to grow the customer base by providing a broader, more flexible solution, allowing consumers to select which wallet they’d prefer to use.

SRC-enabled payments. SRC is the next step in e-commerce that will enhance both security and user experience in online shopping. Customer benefits include a frictionless shopping experience via a reduced need for entering card and shipping information.

Greater customer control with a tokenized app.Tokenization has become the new and modern standard to secure, provision and store card data to mobile, IoT devices and online merchants. With it, customers have the ability to enable push provisioning and manage tokens across multiple card schemes directly from the app.

By improving functionality and increasing app usage, banks additionally stand to benefit from improved customer loyalty. This can lead to improved cross-selling opportunities improved usability keeps the bank’s brand front and center in the mind of its customers leading to additional, more profitable revenue streams.

About the author

With other 20 years experience in the field of technological innovation, Lars Sandtorv is the founder and CEO of MeaWallet. After setting up the company in 2013, Lars has been a driving force behind establishing MeaWallet as one of Europe’s leading companies within mobile payments.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: