PaySafe study: more than half of consumers in US, Canada and UK expect to abandon cash in next two years

More than half (54 per cent) of consumers expect to abandon using cash for shopping in the next two years, according to new research conducted by Paysafe, a leading global payments provider.

The report, called Lost in Transaction, uncovered the rapid move towards a cash-free economy with nearly half (49 per cent) of people only visiting an ATM once a month or less, and one in six saying they rarely carry cash at all, with that figure rising to one in five for under 34s. With the research showing two thirds (64 per cent) of people carrying less cash than a year ago, the move away from physical notes and coins only looks set to continue.

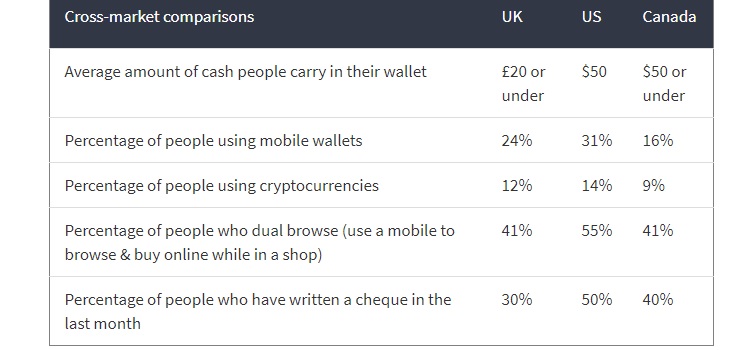

The comprehensive study, undertaken in the UK, US and Canada, looks at attitudes to money and consumer buying behaviour, and examines how cash is merging with digital formats. It reveals increased consumer confidence in mobile shopping, the start of a shift to new payment methods such as cryptocurrencies and the potential for retailers to lose relevance without the right payment mix for customers.

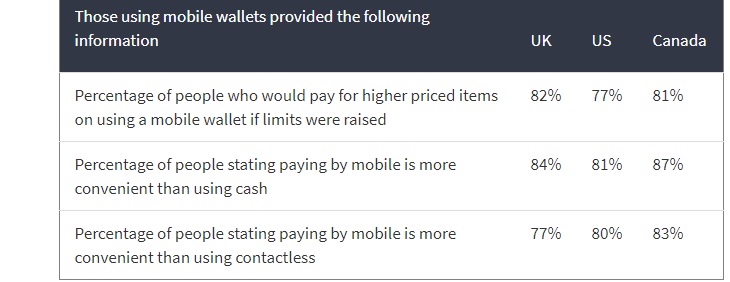

The evolution of cash into digital formats is enabling consumers to move away from carrying hard currency, with a quarter (23 percent) already adopting mobile wallets and 11 percent using cryptocurrencies for payments. The adoption of mobile wallets is linked to nearly two thirds (62 percent) being increasingly confident about using their mobile phone for shopping.

In Canada and the UK, contactless has paved the way for this new era of payments, with three out of five consumers regularly using it for purchases, 62 per cent citing it as more convenient than cash, and 44 per cent stating they preferred to shop in places that take contactless. The mass acceptance of contactless in the UK and Canada is facilitating more compatibility between retailers and emerging payment methods at point-of-sale, including digital wallets and smartphone apps.

However, it is America that is very much leading the way in new payment methods with nearly a third (31 percent) using mobile wallets and 1 in 7 using cryptocurrencies. The wider adoption of mobile wallets is likely being affected by concerns regarding people’s handsets. Across all markets, 31 percent of consumers said they worried about their phone being stolen, while a quarter (26 percent) did not even want to take their phone out to pay.

Commenting on the research, Oscar Nieboer, Chief Marketing Officer, Paysafe stated: “The world is a different place to the one where traditional hard currency was the only option. Today, people shop in new ways. Mobile is a preferred device and physical stores are showrooms as much as they are outlets. Contactless payments and mobile wallets are increasingly normalized with younger age groups leading this cash-free approach and driving adoption of cutting edge payment technologies such as cryptocurrencies.

“In a rapidly transforming landscape, the merchants who survive will have invested early in emerging technologies that enable them to meet a range of customer payments preferences and provide reassurance around security concerns.”

The research demonstrates it’s essential that businesses take a diversified approach to how they accept and process payments to accommodate both traditional and emerging payments technologies. That journey starts with merchants understanding how consumers use money, where they use it and which formats they prefer, as the proliferation of different payment methods means customers expect to be catered for when parting with their money. It will be those merchants who seize the opportunities provided by this new normal that will be best placed for the next big wave in omni-channel retail.

Lost in Transaction is an independent research project supported by the London-based agency Loudhouse. The research report was completed by surveying 3038 general consumers in the UK, US and Canada about their online shopping behaviours and payment habits. Respondents came from six different age groups and a variety of different professions.

To read the full report, which includes comparisons between consumer attitudes to cash and alternative payment methods in the US, UK and Canada, click here.

Source: PaySafe

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: