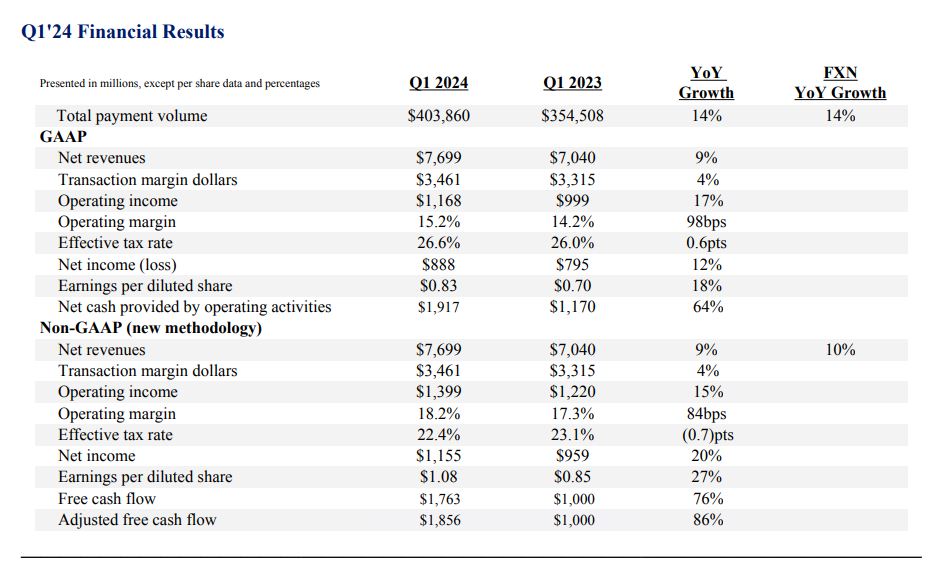

Q1’24 Operating Results: total payment volume increased 14% to $403.9 billion; Payment transactions increased 11% to 6.5 billion; Payment transactions per active account on a trailing 12-month basis increased 13% to 60.0.

Active accounts decreased 1% to 427 million. On a sequential basis, active accounts increased 0.4%, or by 2 million – the company said in a press release.

Cash Flow

Cash flow from operations of $1.9 billion and free cash flow of $1.8 billion.

On a trailing 12-month basis, cash flow from operations of $5.6 billion and free cash flow of $5.0 billion.

Adjusted free cash flow of $1.9 billion, which excludes the net timing impact between originating European buy now, pay later (BNPL) receivables as held for sale and the subsequent sale of these receivables.

On a trailing 12-month basis, adjusted free cash flow of $5.4 billion.

Balance Sheet and Liquidity

Cash, cash equivalents, and investments totaled $17.7 billion as of March 31, 2024.

Debt totaled $11.0 billion as of March 31, 2024.

“We delivered a solid set of results in Q1 and I’m encouraged by the progress the team is making against PayPal’s go-forward strategy and in strengthening our foundation. 2024 remains a transition year and we are focused on execution – driving our key strategic initiatives, realizing cost savings, and reinvesting appropriately to position the company for consistent, high-quality profitable growth in the future.” said Alex Chriss – President and CEO of Paypal.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: