PayPal moves to online lending by buying a stake in a company which targets clients considered too risky by banks

PayPal has made a strategic investment in LendUp, an online lender targeting Americans that are generally considered too risky by traditional banks. The online loans are are up to $250 for up to 30 days and good credit history isn’t required. So far, the company provided more than $1 billion in credit.

LendUp, a socially responsible financial services firm for the emerging middle class, announced that PayPal has made a strategic investment in the company, for an undisclosed sum.

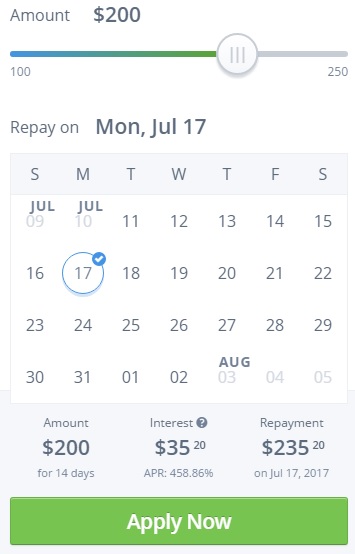

Example of the lending costs for a 14 days loan

„PayPal has long been considered at the forefront of fintech innovation, reinventing payments for the modern world. They’ve since built one of the most successful fintech companies of all time,” said Sasha Orloff, LendUp co-founder and CEO. „We share a common vision of how technology can democratize industries, and that’s exactly what LendUp is doing. We’re building our own technology to create new financial products and experiences for the 56 percent of Americans shut out of mainstream banking due to poor credit or income volatility—right on a mobile phone. We’re thrilled to count PayPal among our esteemed investors, and look forward to leveraging their insights as we continue to build a multi-product company.”

„LendUp loans are offered entirely online, so you can apply 24/7 — whenever it’s most convenient for you. Applying takes only minutes. Our online loan decisions are instant, and if approved, you could have money in your account in as soon as 15 minutes (where available). The loans are up to $250 for up to 30 days. Good credit isn’t required.”, the company say.

LendUp offers also online installment loans „up to $1,000 for qualified customers, giving you access to more money and more time to repay”. LendUp’s installment loans report to all 3 major credit bureaus in the Unitesd States, „which could help you build or improve your credit over time”, according to the company.

About LendUp

LendUp is a socially responsible online lender on a mission to redefine financial services for the emerging middle class—the 56% of Americans shut out of mainstream banking due to poor credit or income volatility. It builds technology, credit products and educational experiences that haven’t existed before for this consumer segment, which includes more than 131 million Americans.

Source: prnewswire.com

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: