PayPal today announced the launch of PayPal Pay in 4, an interest-free, no-fee, buy now, pay later (BNPL) solution for Canadians. .Consumers can now make their budget go further with PayPal Pay in 4 at their favourite brands.

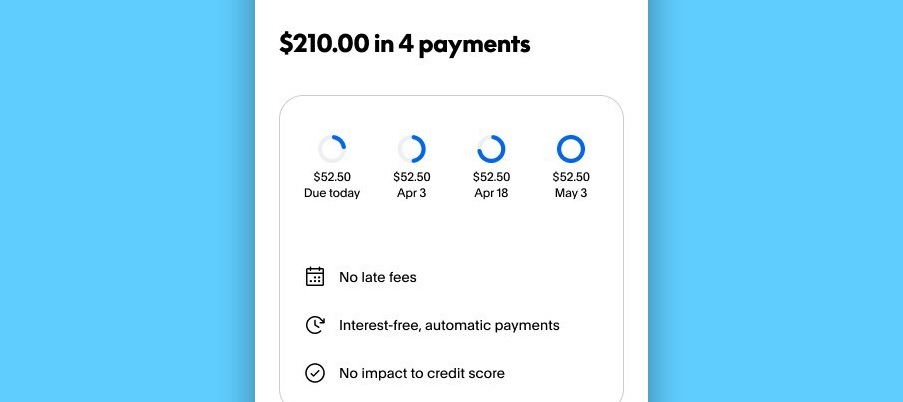

PayPal’s 2025 Festive Spending Survey reveals strong consumer interest: 60% of respondents who haven’t yet used BNPL say they’d be encouraged to try it if there were no fees. PayPal Pay in 4 gives Canadians more flexibility at checkout, letting shoppers split eligible purchases from $30 to $1,500 into four equal, interest-free payments over six weeks. Automatic payments keep everything on track with options to fund the payment including debit, credit, or bank account. If consumers want to pay early, they can do so using the PayPal app or online.

With PayPal Pay in 4, there are no late fees, sign-up fees, or hidden costs—just predictable installment payments that make holiday shopping less stressful and more manageable. Eligible PayPal Pay in 4 purchases are covered by PayPal’s Purchase Protection, bringing peace of mind to online shopping—whether purchases don’t show up, or aren’t quite as described.

„PayPal has served Canadians for over 15 years and is one of the most trusted brands across the country. To meet demand for transparent and trusted payment options, PayPal’s Pay in 4 helps Canadians manage cash flow without late fees or hidden costs,” said Michelle Gill, General Manager, Small Business and Financial Services, PayPal. „Businesses also benefit as those who offer PayPal BNPL offerings experience increased conversion and higher sales—both critical during peak holiday season.”

Better for shoppers, better for businesses

For businesses of every size, BNPL is no longer a nice-to-have—it’s what consumers expect. PayPal BNPL drives conversion with 90% global approval rate and boosts sales with 80% higher order value. By offering PayPal BNPL and showcasing it earlier in the shopping journey, businesses can help reduce cart abandonment and boost conversions, especially during peak shopping seasons.

PayPal’s 2025 Festive Spending Survey: Canadians are deliberate with how they manage their cashflow.

. 74% of Canadians set a budget while holiday shopping and try to stick to it, 72% plan their shopping in advance to help control their spending.

. 51% plan to spend the same as last year, while 14% say they’ll spend more.

. 31% of Canadians would consider using BNPL to shop for appliances, 30% for home décor/furniture, and 26% for electronics.

„We’re all feeling the pinch a little right now and Canadians are planning ahead,” said Pattie Lovett-Reid, financial commentator and former CTV Chief Financial Commentator. „They want to enjoy the holidays, but they’re also being smart about how they manage their finances. Having flexible payment options that give you some breathing room, without fees or interest, is a great way to manage cashflow.”

___________

Survey Methodology

PayPal’s 2025 Festive Spending Snapshot is an online survey of 1,500 Canadian adults (nationally representative) conducted by Leger in October 2025.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: