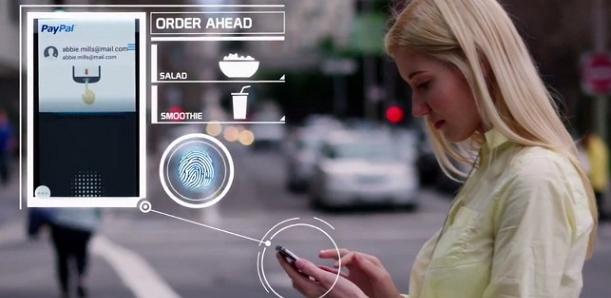

PayPal will be the first global payments company to support Samsung’s mobile fingerprint authentication technology. Users will no longer need to remember passwords or login details when they shop. Customers can use their finger to authorize PayPal payments directly from their new Samsung Galaxy S5.

PayPal, and Samsung, have announced a collaboration that enables Samsung Galaxy S5 users to login and shop with the swipe of a finger in online, mobile and in-store payments wherever PayPal is accepted. With FIDO Ready™ software on the device and the new Samsung Galaxy S5 fingerprint sensor, which Samsung announced at MWC, users will securely and privately communicate between their device and PayPal’s service in the cloud.

Combining FIDO authentication with the new secure biometric feature means users will no longer need to remember passwords or login details when they shop. Samsung is one of the world’s most trusted handset makers, with a strong presence in more than 150 countries. PayPal enables global commerce and processes more than 9 million payments every day. Samsung Galaxy S5 users immediately benefit from a uniquely secure and seamless online, mobile and in-store shopping experience across the millions of merchants that accept PayPal.

“We congratulate PayPal and Samsung on their partnership, and their graphic demonstration of the value proposition that FIDO technologies bring – a login experience that is radically easier for consumers than passwords; and one that is simultaneously much stronger for Internet services,” said Michael Barrett, president of the FIDO Alliance.

“While this first deployment of FIDO Ready technology leverages a biometric – a simple swipe of a finger – we anticipate FIDO authentication to emerge in many forms and applications, through many providers and as a result of many more innovative partnerships dedicated to moving beyond passwords with more secure, private, easier-to-use authentication.”

The PayPal/Samsung deployment of FIDO authentication relies on a PayPal secure wallet in the cloud, which does not store personal information on the device. Customers can use their finger to authorize PayPal payments directly from their new Samsung Galaxy S5, because the FIDO Ready™ software on the device securely communicates between the fingerprint sensor on their device and PayPal’s service in the cloud. Per FIDO specifications, the only information a user’s device shares with PayPal is a unique encrypted key that allows PayPal to verify the identity of the customer without having to store any biometric information on PayPal servers.

FIDO standards will support a full range of authentication technologies, including biometrics such as fingerprint and iris scanners, voice and facial recognition, as well as further enabling existing solutions and communications standards, such as Trusted Platform Modules (TPM), USB Security Tokens, embedded Secure Elements (eSE), Smart Cards, Bluetooth Low Energy (BLE), and Near Field Communication (NFC).

The open specifications are being designed to be extensible and to accommodate future innovation, as well as protect existing investments. FIDO specifications allow the interaction of technologies within an interoperable infrastructure, enabling authentication choice to meet the distinct needs of users and organizations.

Starting in April, FIDO authentication from PayPal and Samsung will be available in 26 markets globally, including Australia, Brazil, Hong Kong, Russia, United Kingdom and United States.

The FIDO (Fast IDentity Online) Alliance, was formed in July 2012 to address the lack of interoperability among strong authenticationtechnologies, and remedy the problems users face with creating and remembering multiple usernames and passwords. The Alliance plans to change the nature of authentication by developing standards-based specifications for simpler, stronger authentication that define an open, scalable, interoperable set of mechanisms that reduce reliance on passwords. FIDO authentication is stronger, private, and easier to use when authenticating to online services.

The FIDO Alliance Board of Directors includes leading global organizations:Blackberry®; CrucialTec; Discover Financial Services, Google, Lenovo, MasterCard, Microsoft, Nok Nok Labs, Inc., NXP Semiconductors N.V., Oberthur Technologies OT, PayPal, RSA®, Synaptics, Yubico.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: