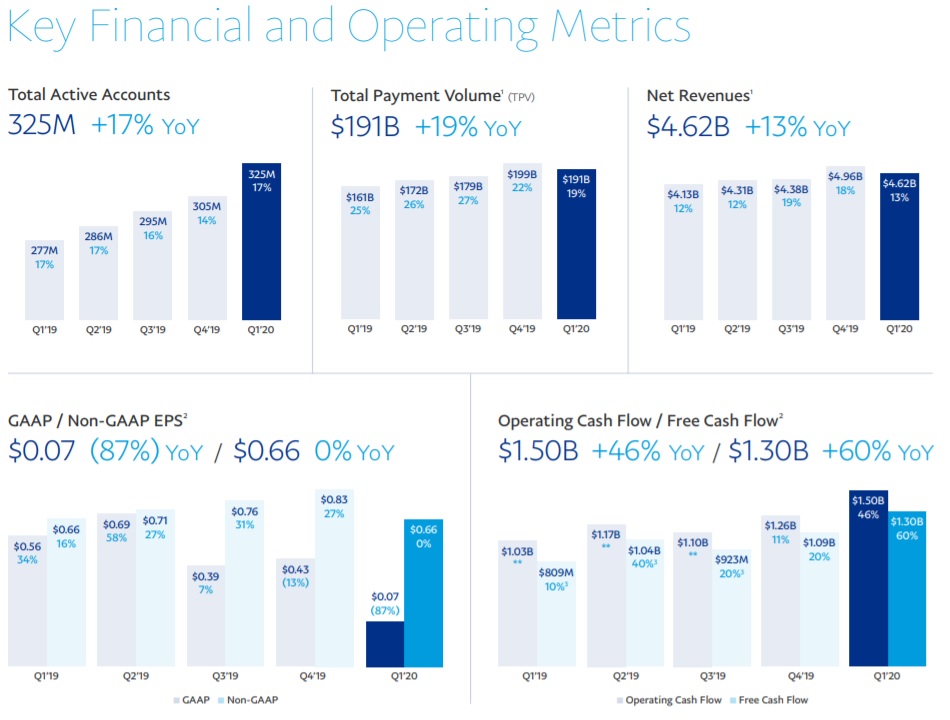

In the first quarter of 2020, PayPal’s profit plunged 87.4% as it boosted credit loss reserves, but it still beat market expectations. PayPal processed $191 billion in payments in the first quarter, up 18% from a year earlier, but missed analysts’ estimates of $194.23 billion.

“In March, the deteriorating environment resulting from COVID-19 further impacted PayPal’s business, affecting both volumes and revenue generated from travel and events verticals as well as impacting credit income,” the company said.

PayPal Holdings Inc said it expects a strong recovery in payments volumes in the second quarter as social distancing drives more people to shop online, even as lockdowns start to ease, sending its shares up 8% in extended trading, according to Reuters.

Online retailers are seeing demand rise, boosting digital payments. PayPal said on Wednesday it added a record 7.4 million net new customers in April.

„As our platform sees record increases in both new customer accounts and transactions, it is clear that PayPal’s products are more important and relevant than ever before. The strength of our customer value proposition combined with the acceleration of digital payments adoption significantly accelerated in April, with increased demand and engagement.”, said President and CEO Dan Schulman.

Net income fell to $84 million, or 7 cents per share, in the quarter ended March 31, from $667 million, or 56 cents per share, a year earlier.

Operating income was reduced by a $237 million increase in credit loss reserves, the company said.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: