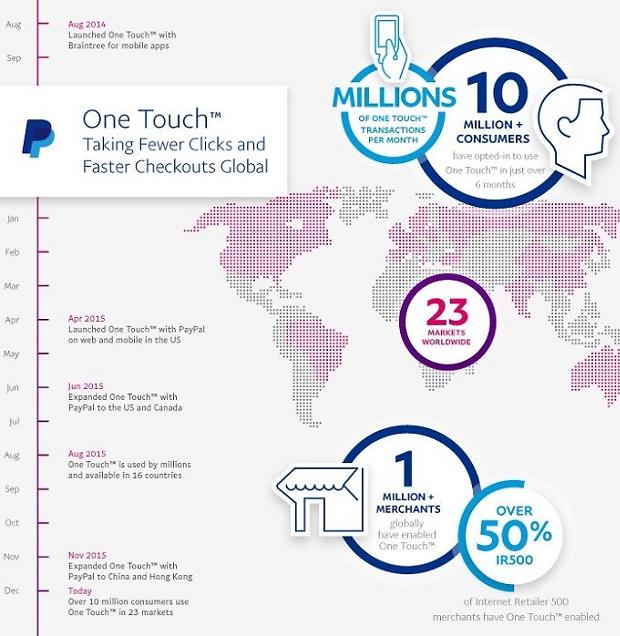

PayPal: 10M+ people use One Touch™ payments just six months after launch

PayPal claims that 10 million people worldwide have opted-in to use One Touch payments, enabling consumers to pay for purchases online with a single click after their first login.

„We launched One Touch™ with PayPal just eight months ago and have since seen tremendous growth and adoption of the checkout experience. In just over six months, more than 10 million consumers had opted-in to use One Touch. Today, people across 23 countries are using the checkout experienceto quickly and securely check out across merchants online and on mobile without having to type in any payment information, usernames or passwords once they’ve opted in. As One Touch gains momentum globally, PayPal is processing millions of One Touch transactions each month, showing true innovation at scale.”, company says.

According to PayPal, today, more than 50 percent of the Internet Retailer 500 and more than 1 million merchants around the world have One Touch enabled to make it easier for their customers to quickly and securely check out. For eligible merchants, One Touch is automatically enabled and has also been proven to decrease shopping cart abandonment and increase conversion and engagement rates.

„One Touch is one of the biggest changes to online shopping since PayPal pioneered digital payments more than a decade ago. Unlike new checkout tools that require a login and password, once a customer opts in, One Touch authenticates customer credentials for up to six months so that people don’t need to even log in to check out.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: