Paym, the service which enables money transfer using just mobile number, signs up 1.8 million consumers in only 8 months

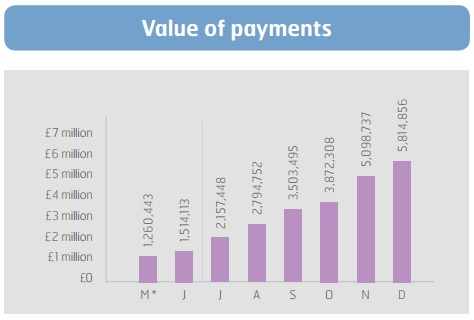

Since the launch of Paym on 29th April 2014, £26 million has already been sent by consumers using the new way to pay back friends and family using just a mobile number. Nearly two million people have now registered with their participating bank or building society to receive payments into their bank account using just their mobile number.

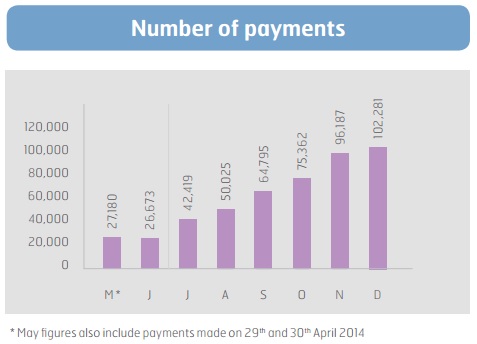

Customers of 16 banks and building societies are now able to register to receive Paym payments, with seven of these institutions joined in October and November last year. This has extended the reach of Paym to more than nine out of ten current accounts and contributed to a notable increase in the volume and value of payments in the last two months of the year. The average value of a Paym payment across the whole of 2014 was £53.65 and this remained fairly consistent.

„We expect to see strong growth in terms of the number of people who register for the service, as well as the volume and value of payments sent using Paym.Sixteen bank and building society brands covering more than 40 million customers now offer the service and it will expand further during 2015.”, according to the press release.

Use of Paym peaks over the weekend. A snapshot of data from November 2014 reveals Friday, Saturday and Sunday account for 49% of Paym payments, with the three hours between 6-9pm being the most popular time for using the service.

The figures are revealed in the first Paym statistical update, which includes a survey of consumer attitudes to mobile payments. Two thirds (66%) of the UK population are aware of mobile payments, with more than half (52%) of those with knowledge of mobile payments aware of Paym.

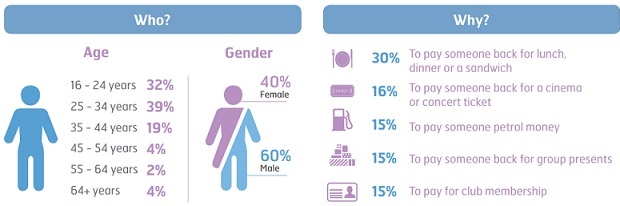

People aged between 16 and 34 account for well over half of Paym users (71%). Registrations are evenly split between genders, though 60% of males and 40% of females have used Paym since launch. So far, Paym is most commonly used to pay back a close friend (21%), followed by a partner (19%), parents (19%), or child (13%). The consumer attitudes survey also found that the main reason for using Paym is to pay someone backfor lunch, dinner or a sadwich. Approximately one in six people have used Paym to pay someone back for a cinema or concert ticket; to pay a contribution for petrol money; as a contribution to a group present; or to pay for a club membership.

Source: TNS online survey conducted amongst 2,499 GB adults aged 16+ between 18th December 2014 and 8th January 2015. The sample has been weighted to represent the adult population of Great Britain 16+

Craig Tillotson, Managing Director of Paym, said: “More people are using Paym every day – nine out of ten current account holders can now register to receive payments using just their mobile number. ‘It’s still early days for the service, but people seem to find Paym most useful at the weekend – almost half of payments are made between Friday and Sunday. Paym means securely settling up with friends and family for weekend fun has never been easier – no sort codes, no account numbers and no cash needed.”

What is Paym?

It’s a simple, secure way to send and receive payments directly to a current account using just a mobile number. Paym means there is no need to ask for other people’s sort code or account numbers, or to tell them yours. Anyone using Paym to send money is able to check the name of the recipient before confirming the payment, so they can be sure they’re sending it to the right place.

Paym for business is an area of growth for the service, with several participants actively offering the service to their small business customers. In recognition of this, Paym has developed an acceptance mark for small businesses to download, so they can let their customers know that they accept payment through Paym.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: