At Banking 4.0, the company will be represented by its regional partner, Transaction Systems, and its local partner, TxD IT Solutions.

PAX Global Technology Limited, one of the world’s leading providers of electronic payment terminal solutions and related services, published unaudited interim results for the six months ended 30 June 2025. PAX recorded USD 348 million in revenue, with net profit margin of 14.4%, yielding USD 50 million in profit.

PAX Android solutions play an increasing vital role in multiple verticals, powering payments in diverse market segments, including retail, hospitality, quick-service restaurant chains, transportation, vending, theme parks, tourist attractions and electric vehicle (EV) charging. During the period, Android products accounted for over 65% of the Group’s total revenue.

Strategic Expansion in Key Markets

EMEA: Achieved sales of USD 139 million, with flagship models A920Pro and A35 winning strong traction and considered best-in-class by leading acquirers.

In Europe, key markets like Italy, the United Kingdom and France achieved significant sales. Flagship Android models the A920Pro and A35 are highly preferred by leading acquiring banks and PSPs, with widespread adoption across sectors such as retail, hospitality and transportation. Strategic partnerships with EV charging providers also fueled sales growth for our unattended payment terminal model IM30.

In the Middle East, growth momentum in the UAE remained strong.

Across Africa, PAX strengthened partnership with local PSPs to drive digital payment adoption and financial inclusion. During the period, Egypt achieved strong double-digit growth while Sub-Saharan

shipments continued to rise steadily.

The Group continues to strengthen its payment security services in EMEA. During the period, PAX Remote Key Injection (“RKI”) service in Italy successfully renewed PCI PIN and PCI P2PE certifications, highlighting PAX’s commitment to upholding the highest industry standards. This achievement further solidifies our leadership in payment security across EMEA.

North America (US & Canada): Sales increased 39% year-over-year, driven by growing demand across cinemas, convenience retail, and the launch of advanced models like A920MAX and the IP67-rated A6650.

The Group’s flagship payment products such as the A920Pro, A3700, A35 and A800 are widely deployed across high-traffic sectors like cinemas, telecom operators, convenience retail and quick-service restaurant chains, driving stronger market penetration.

In the Android commercial POS (“EPOS”) field, the Group made notable inroads with Workstation orders rising steadily. During the period, we partnered with a nationally renowned quick-service restaurant chain, further driving large-scale adoption of its EPOS solutions across commercial environments.

Japan (APAC): Revenue doubled, supported by large-scale deployments of the A8700 in collaboration with a major retail chain. In thr first half of 2025, PAX remains the only Asian payment terminal supplier on the PCI SSC advisory board (among over 60 global members).

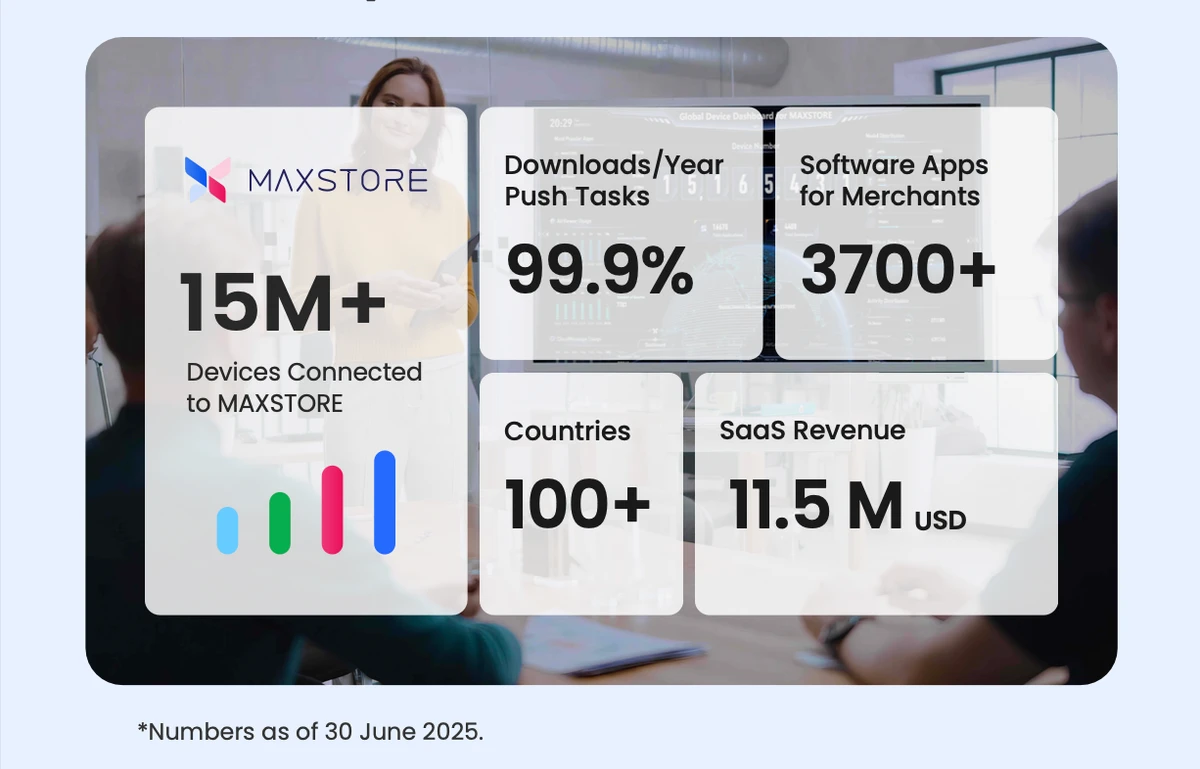

Expanded its SaaS ecosystem (AirViewer, GoInsight, Cyberlab, RKI key injection services) and reached a new milestone of 15 million terminals connected via the MAXSTORE platform supporting over 16,000 apps.

Embracing future payments, PAX terminals now support stablecoin and blockchain-enabled transactions, positioning the company at the forefront of emerging payment trends. (Discretion to enable Crypto – and indeed any other payment acceptance method – lies with the owners of the PAX terminals, typically acquiring banks and other payment service providers).

Mr. Tiger NIE, Chairman & CEO of PAX, said, “Looking ahead, riding the momentum of rapid global digital payment development, PAX is ready to seize the opportunities presented by stablecoins. We’re focused on streamlining our product portfolio and enhancing our SaaS services. Together with our global partners, we will explore new business opportunities and continue to reinforce our position as a leader in the payment terminal industry.”

Related news:

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: