EBA CLEARING announced that, together with eight multinational payment service providers (PSPs), has completed a pan-European proof of concept leveraging its R2P Service. As part of this initiative, the participating institutions successfully exchanged request to pay messages via R2P in milliseconds.

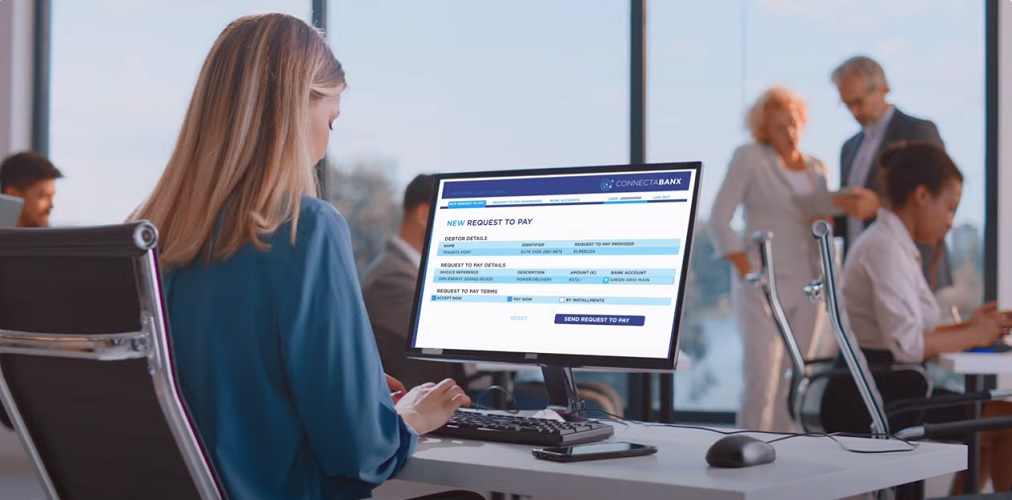

„The proof of concept thus confirmed the readiness of R2P to support commercial use cases. It also showcased how PSPs can roll out and create value around request to pay, putting a special focus on e-invoicing in the business-to-business space.” – according to the press release. A video showcasing key outcomes of the proof of concept and examples of request to pay exchanges for e-invoicing was released together with today’s announcement (details below).

Aimed at paving the way for live implementation of request to pay solutions, the initiative was started by frontrunners among the funding institutions of EBA CLEARING’s R2P Service. Participants in the proof of concept included BBVA, BNP Paribas, CaixaBank, Commerzbank, Crédit Agricole, Deutsche Bank, DZ BANK and Pine & Cone. R2P is a pan-European messaging infrastructure enabling payment service providers to deliver request to pay solutions for end users.

“With Project Breakthru, we have completed the first pan-European proof of concept for request to pay. By exchanging requests to pay and related responses across Europe, our eight participants demonstrated how easy it is to use and integrate R2P with their end-user solutions and gave a powerful outlook on the benefits that request to pay can generate for the invoicing processes of businesses across the continent,” said Fredrik Tallqvist, Project Manager for the R2P PoC at EBA CLEARING.

“Our participation in this proof of concept has been an important step for us in our efforts to provide our corporate and business customers with a request to pay service that relies on the best infrastructure solution for the exchange of requests to pay. Interaction with other PSPs has been a very useful experience and has made us realise how important it is for the success of any request to pay products that we are all well aligned on a uniform technical deployment. This challenge has strongly encouraged us to move ahead in the implementation of our RTP project, not only in the B2B environment, but in the B2C space too. We thank our fellow participants and EBA CLEARING for the opportunity to further explore the potential of request to pay,” said Raouf Soussi, Head of Strategy for Enterprise Payments at BBVA.

“At BNP Paribas, we’re excited about our contribution to this proof of concept, which aligns perfectly with our strategy on SEPA Request to Pay and e-invoicing. By engaging with the R2P Service and conducting exchanges with banks and PSPs across Europe, we’ve acquired invaluable insights that will guide our future implementation of end-to-end request to pay solutions,” said Lirka Bibezic, Global Head of Product Management for Receivables at BNP Paribas.

“This proof of concept confirmed the efficient functioning of the R2P Service. It also showcased the opportunities that the uniform pan-European rules and service levels established by R2P and the SEPA Request-to-Pay Scheme hold for delivering request to pay solutions to the market. We believe this pan-European approach has a great potential for tackling all key request to pay use cases, from e-invoicing to e-commerce or point of sale,” said Simone Loefgen, Global Head of Payment Platforms at Commerzbank.

“Request to pay enables corporations to leverage the benefits of instant payments and explore new use cases. Clients are increasingly requesting account-to-account payment methods. Corporations benefit from reduced payment risk through instant transactions, automated reconciliation, low transaction costs, improved liquidity and flexible API integration. For consumers, request to pay offers a convenient and safe way to use their bank accounts for invoice payments, e-commerce, subscriptions and other scenarios. The EPC Rulebook and the R2P Service provided by EBA CLEARING are enablers for more payment options and a high service quality. Overall, request to pay represents another significant milestone on the journey toward a more efficient payments ecosystem in Europe,” said Tino Meissner, Head of European Payments, Merchant Solutions at Deutsche Bank.

“Our participation in this proof of concept was an important step in our efforts to support our corporate customers in fully digitalising their invoicing journey. We were able to further explore how we can help corporates to reap key benefits of request to pay, such as automatic reconciliation of invoices, better cashflow predictions and cost reduction,” said Christian Intfeld, Head of PM Customer Applications at DZ BANK.

“At Pine & Cone, we have been very pleased to contribute to this proof of concept, which ties in well with our focus on and commitment to SEPA Request to Pay. By connecting to the R2P Service and exchanging messages with counterparties from different corners of Europe, we gained practical insight for the future end-to-end implementation of the request to pay solutions and the opportunity to work with funding banks inspired us to innovate a number of new use cases and monetising opportunities for banks,” said Sami Karhunen, Co-founder of Pine & Cone.

The pan-European request to pay (R2P) infrastructure service of EBA CLEARING was developed and implemented with the support of 27 PSPs from 11 European countries for the 2021 launch date of the SEPA Request-to-Pay Scheme created by the European Payments Council (EPC).

R2P provides a real-time messaging layer supporting a standardised and managed exchange of request to pay messages on a pan-European level. Separated from the end-user solutions and payment infrastructure layers, R2P is use case and payment channel agnostic.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: