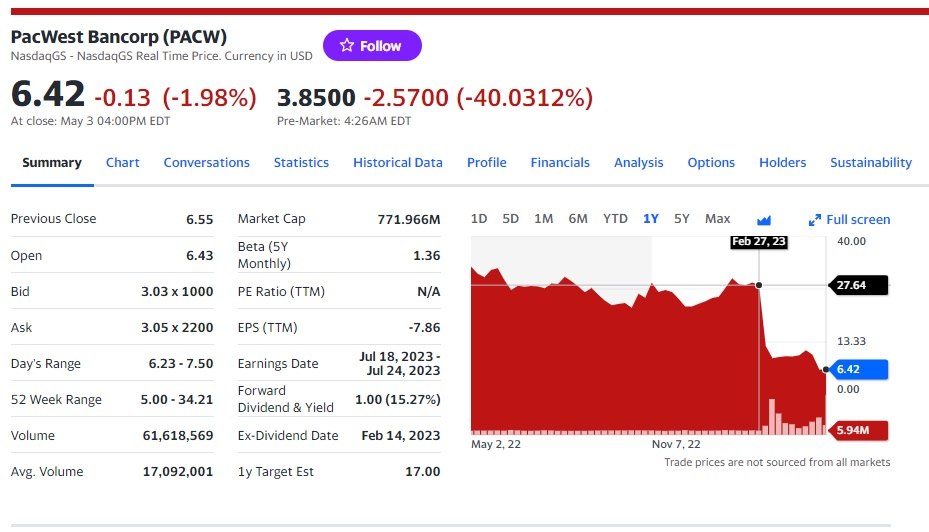

PacWest Bancorp is the latest US bank to explore strategic asset sales to avoid liquidity problems. The bank’s shares fell 40% after hours on NYSE.

PacWest falls more than 40% after hours on report bank is considering strategic options, according to CNBC. The regional bank is assessing options, including a possible sale, and bringing in advisors to evaluate longer-term plans for the business.

In light of recent reporting regarding strategic actions, PacWest Bancorp provides the following statement:

„Our message remains consistent with what was conveyed last week with earnings. As previously announced, the Company has explored strategic asset sales, including moving the $2.7 billion Lender Finance loan portfolio to held for sale in 1Q23. This planned sale remains on track and upon completion will accelerate our CET1 capital ratio to 10%+ (from 9.21% at 1Q23).

Additionally, in accordance with normal practices the Company and its Board of Directors continuously review strategic options. Recently, the Company has been approached by several potential partners and investors – discussions are ongoing. The company will continue to evaluate all options to maximize shareholder value.

The bank has not experienced out-of-the-ordinary deposit flows following the sale of First Republic Bank and other news. Core customer deposits have increased since March 31, 2023, with total deposits totaling $28 billion as of May 2, 2023 with insured deposits totaling 75% vs. 71% at quarter end and 73% as of April 24, 2023. In addition, the company recently paid down $1 billion of borrowings with our excess liquidity. Our cash and available liquidity remains solid and exceeded our uninsured deposits, representing 188% as of May 2, 2023.”

The shares of many West Coast regional banks have been hit particularly hard since the collapse of Silicon Valley Bank in March, in part because of concerns that their customer bases are similar. This week, First Republic Bank was seized by regulators and sold to JPMorgan Chase.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: