(P) The Forrester Wave™: DIGITAL BANKING ENGAGEMENT HUBS, Q3 2021. Infosys Finacle recognized a #LEADER.

Here’s what Forrester had to say about Infosys Finacle (EdgeVerve). „EdgeVerve excels with engagement infrastructure on a well-designed architecture”. Download the report here.

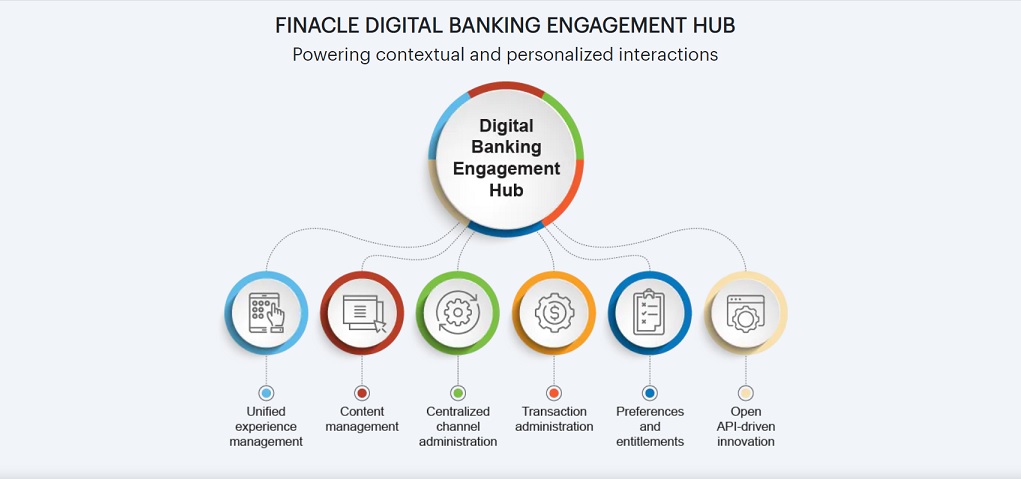

Finacle received the highest scores in the criteria for ‘API and API Management’, ‘Delivery and Operations’, ‘Solution Architecture’ (among highest scores), and ‘Breadth of Offering’ (tied).

The solution received a score of 5/5 in 20 of the 30 evaluation criteria, including API Support, API. Management, Off-the-shelf retail banking services, Analytics, Artificial Intelligence, Engagement.

Referring to Finacle, the report mentions that: „In addition to a host of rich functional, technology, and architecture enhancements, the solution’s

well-defined roadmap also features many differentiators such as hyperscalable APIs and machine learning and deep learning for security purposes. Also the reports said that: „The solution comes with strong API management, offers broad and rich retail, business, and corporate

banking services, and excels with its top-tier engagement infrastructure.”

Infrastructure, Application Architecture, Security, Planned technology and architecture enhancements, SaaS strategy, Breadth of offering, among others.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: