Over one-fifth of institutions have already partnered with fintechs to get access to open banking technology – Tink study

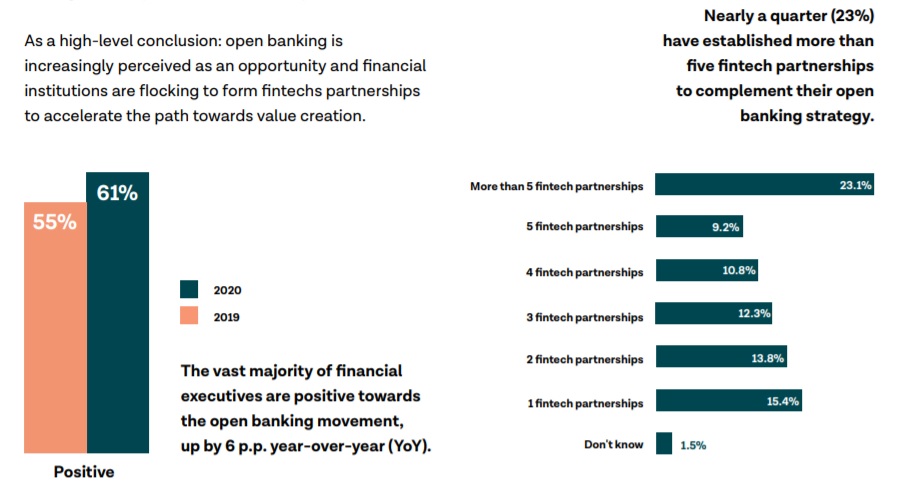

If 2019 was the year of open banking, the widespread adoption of proven open banking use cases will make 2020 the year of value creation, says Tink in its latest report related to open banking attitudes and fintech partnerships. „Financial executives are more positive and optimistic towards open banking than ever before.”

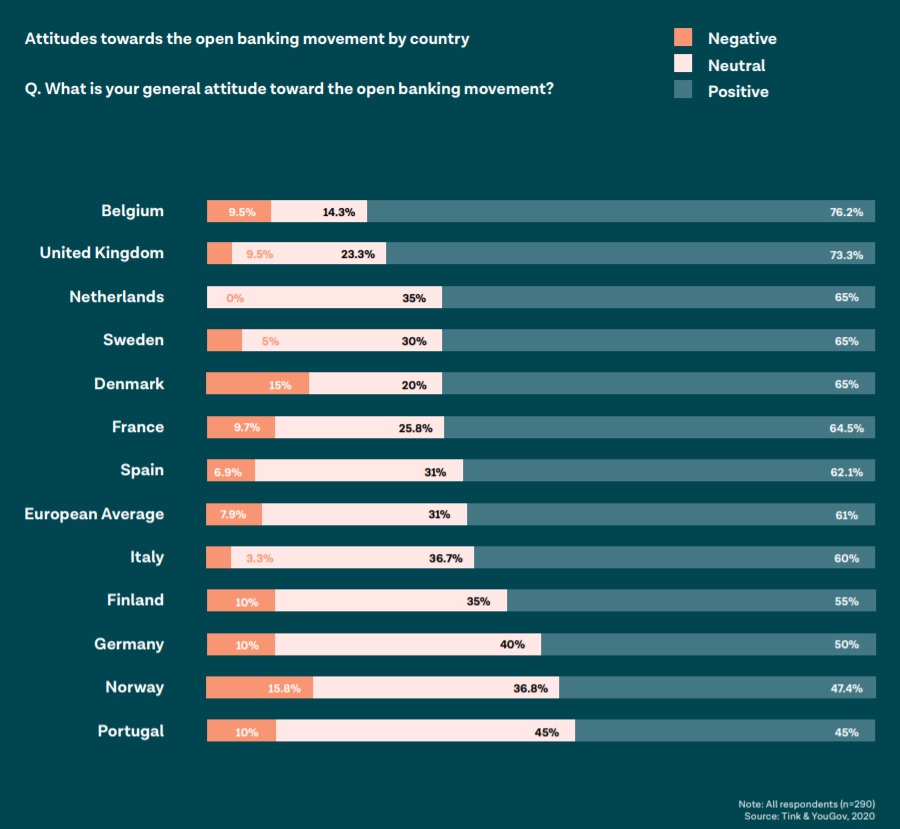

To better understand how the market has shifted since last year, Tink teamed up with market research firm YouGov for the second year in a row. This time, the company wanted to learn more about open banking attitudes, investment budgets, and investment priorities across Europe – so they surveyed 290 senior executives and decision makers working at regulated financial institutions from 12 European countries to hear what they had to say.

Although a large number of financial institutions recognise the open banking opportunity, there are still some question marks when it comes to translating it into a concrete strategy.

Most open banking executives are approaching open banking from a long-term strategic perspective, but short-term, they’re looking to use cases that can impact their current business model by enhancing existing products and services. Over one-fifth of institutions have already partnered with fintechs to get access to open banking technology. But looking to the future, the journey of value creation is just getting started.

In this first survey report, you’ll get a glimpse into:

. How the attitude towards open banking has changed since last year (Attitudes are shifting as the industry starts accepting there is money to be made on open banking. But the focus on the production of APIs and compliance has steered investments towards a long-term strategy — even though there is short-term value for the taking.)

. Which countries are more optimistic – and which have a clear strategy to reap the benefits (Belgium and the United Kingdom (UK) come out as the most positive, with 76.2% and 73.3% respectively. The only countries where more than 10% of executives are negative towards the open banking movement are Norway and Denmark.)

. Why bankers are looking to fintech partnerships to accelerate the path towards value creation.

( Instead of making significant investments towards exposing data and developer services, a number of financial institutions have embraced the role of a TPP. They’re consuming APIs to enhance their current products and operations – and leveraging the available data to improve customer acquisition, accelerate onboarding, increase conversion, lower risk, and improve customer satisfaction rates.)

Top findings

For more details download the report: „2020 – the year of value creation”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: