In recent years, Banking-as-a-Service (BaaS) adoption has surged, as non-financial brands have sought to offer innovative financial products directly to their customers and diversify their revenue streams, whilst banks and other financial entities have leveraged BaaS to accelerate the speed to market of new products and services.

According to McKinsey, the total addressable market (TAM) of BaaS providers in the UK and the European Economic Area is expected to increase significantly over the next five to ten years, reaching an approximate value of between $90 billion and $105 billion by 2030.

Despite funding downturns in the fintech arena at large, BaaS is growing, with some reports suggesting that the market is poised for mainstream adoption within the next two years.

To understand more about the course that BaaS is set to take in 2023 and beyond, Vodeno commissioned an independent body of research of over 1,000 European business decision-makers in the UK, Belgium and the Netherlands.

The research explores the wider market impact of BaaS, providing compelling insights as to what is important to businesses considering implementing BaaS, future embedded finance applications, as well as the trends that are set to disrupt the financial services sector in the coming years.

As embedded finance continues to gain wider adoption, BaaS providers are attracting greater regulatory scrutiny.

Our research uncovered that 64% of decision-makers believe that BaaS will achieve mainstream adoption in the next five years, with the cost-of-living crisis acting as a catalyst, according to an additional 56%.

With this in mind, businesses are recognising that finding the right BaaS provider can make all the difference when it comes to delivering compliant financial services.

To that end, Vodeno’s survey found that having the necessary licence and compliance expertise is set to play a more prominent role in the industry, as 58% of respondents said that BaaS providers offering a licence alongside their tech solution will shape the BaaS market in the years to come.

The results of our survey indicate that businesses are calling out for greater regulatory expertise alongside the delivery of BaaS products – 28% of businesses that have already implemented BaaS products said they would like to see their provider moving to offer access to a banking licence.

Of the respondents who have not implemented BaaS to date, 32% said they don’t know enough about BaaS, while 29% said there was a lack of understanding about the products available, and 27% cited compliance and security concerns as key barriers to adoption.

For many brands and retailers, innovating the checkout experience is the end-goal, with BaaS products seamlessly integrated into their existing ecosystems to ensure an optimal customer journey.

Our survey uncovered that nearly a quarter (24%) of respondents are calling for their BaaS provider to show a better understanding of their customer journey.

This strengthens findings from our previous research, which highlighted that businesses which implemented embedded financial products were motivated by new revenue streams (41%), growth in customer basket (40%) and enhanced customer loyalty (40%).

To that end, Vodeno’s survey found that having the necessary licence and compliance expertise is set to play a more prominent role in the industry, as 58% of respondents said that BaaS providers offering a licence alongside their tech solution will shape the BaaS market in the years to come.

The results of our survey indicate that businesses are calling out for greater regulatory expertise alongside the delivery of BaaS products – 28% of businesses that have already implemented BaaS products said they would like to see their provider moving to offer access to a banking licence.

Of the respondents who have not implemented BaaS to date, 32% said they don’t know enough about BaaS, while 29% said there was a lack of understanding about the products available, and 27% cited compliance and security concerns as key barriers to adoption.

For many brands and retailers, innovating the checkout experience is the end-goal, with BaaS products seamlessly integrated into their existing ecosystems to ensure an optimal customer journey.

Our survey uncovered that nearly a quarter (24%) of respondents are calling for their BaaS provider to show a better understanding of their customer journey.

This strengthens findings from our previous research, which highlighted that businesses which implemented embedded financial products were motivated by new revenue streams (41%), growth in customer basket (40%) and enhanced customer loyalty (40%).

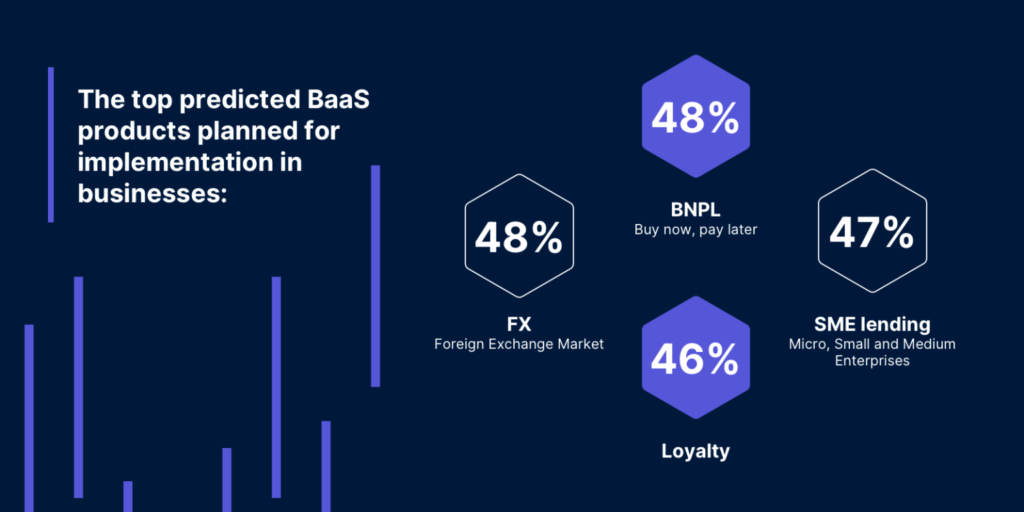

At present, 39% of respondents have already implemented BaaS products, with an additional 38% considering using it in the new year. When surveyed about which BaaS products were planned for implementation, FX (48%), BNPL (48%), SME lending (47%), and loyalty (46%) were amongst the most popular products that businesses were weighing up.

68% of European SMEs to implement real-time payment this year, read the research.

With BaaS adoption in the retail sector steadily growing, 59% of those surveyed predicted the rise of ‘platform banking’, expecting the lines between the way consumers use eCommerce platforms enabled by BaaS and traditional banking to blur.

60% went further still, predicting a decline in traditional branch-based banking – a sentiment that adds weight to recent bank closures in the UK, as people begin to interact more with their favourite brands when handling their finances, rather than legacy financial institutions.

Looking to the future, almost two-thirds (65%) of those surveyed predict that more Big Tech firms will move to deliver financial services, and a further 59% believe that augmented and virtual reality (AR and VR) will become a large part of their immersive retail experiences, powered by BaaS.

Meaning that we could see consumers stepping into the metaverse to visit and shop at their favourite brands.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: