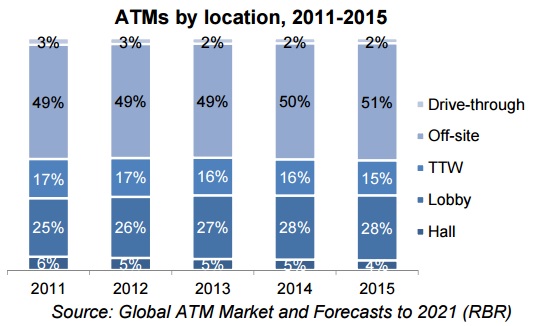

Globally, the share of ATMs located away from bank branches rose to 51% in 2015, according to RBR’s study Global ATM Market and Forecasts to 2021. RBR found that, faced with rising operating expenses and fewer customers visiting their branches, banks in developed markets are streamlining their branch networks and turning to off-site ATMs as a more cost-efficient customer service channel. In the Netherlands, for example, 900 branches were shut between 2011 and 2015, while the number of off-site ATMs grew by 800.

RBR’s study shows that in newer markets too, banks often see ATMs as a less costly alternative to branches. In countries with large rural populations, where it would not be feasible to open a branch in each small town or village, the ATM is often the first and only physical point of contact between banks and their customers. Off-site machines serve as an important tool in efforts to increase financial inclusion and compete for new customers. An example of this is Chile, where the state bank is the largest ATM deployer and has a mandate to reach out to unbanked and underbanked population segments.

Increasing activity by independent ATM deployers contributes to growth

As well as reducing costs for banks, off-site ATMs can be a lucrative revenue generator. A wellchosen location in a high-footfall area can attract high transaction volumes, bringing in surcharge and/or interchange fee income for the operator; and where ATMs can be made to run at a profit, banks will often find themselves competing with independent ATM deployers (IADs) for market share.

IAD terminals now account for 16% of ATMs globally, the majority of which are installed in non-branch locations. RBR forecast that, with the notable exception of China, most markets with non-bank deployers will see the IAD share grow over the next few years. In China, where IADs deploy on behalf of partner banks, their share will fall as banks increasingly take control of their own off-site ATMs.

Off-site ATMs will continue to become more common

Rowan Berridge, who led the RBR research, commented: “As IADs expand their fleets, more and more retail centres, transport hubs and other non-branch locations will host ATMs. Coupled with increasing off-site deployment by banks, in future it will be even easier for customers to find a convenient ATM away from branches”.

RBR is a strategic research and consulting firm with three decades of experience in banking and retail automation, cards and payments.

Source: RBR London

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: