There are now over 69,000 ATMs in the UK of which over 50,000 (72%) are free-to-use. Both these totals are record highs for the UK market.

LINK, the UK’s ATM network, announced that Christmas 2014 was a record time for cash machine withdrawals. Britons flocked to ATMs on Christmas Eve for a last-minute dash for cash, making it the busiest day of the year for cash machines across the UK. £662 million was dispensed by ATMs on 24 December 2014, with an average withdrawal of £82. The total amount withdrawn was a 22% increase on the £544 million dispensed on the same day in 2013.

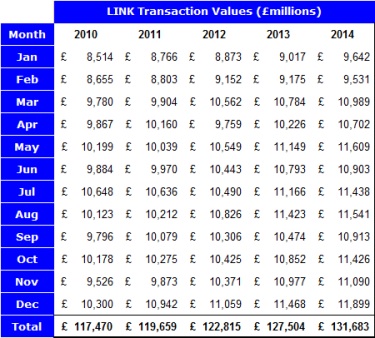

Overall, we withdrew £11,899 million in December 2014, an increase of 4% on December 2013 (£11,468mn). There was also an increase on New Year’s Day, with 14% more cash withdrawn this year than last (£164 million on 1 January 2015, compared with £144 million on 1 January 2014).

LINK ATM Numbers (thousands) – effectively every ATM in the UK is connected to the LINK network.

Number of transactions processed by LINK*

Value of transactions processed by LINK*

*These figures do not include withdrawals made by customers at their own banks’ or building societies’ ATMs.

Source: LINK statistics

John Howells, CEO of the LINK ATM Scheme commented: “ATMs are going from strength to strength as cash remains a vital part of so many people’s lives. The industry continues to invest in cash as a payment method, with more ATMs and continued innovation, for example, the new polymer bank notes announced by the Bank of England. It’s reassuring to see this time-tested payment method stand its ground, and I’m excited to see what the future will hold as we move into 2015.”

LINK was formed in the mid 1980s to allow the smaller banks and building societies to compete against the cash machine networks of the larger banks. Using the concept of a central switch the LINK network was able to grow quickly and rival the banks’ sharing arrangements in size. By 1998, all the major UK banks and building societies had become LINK members, enabling their ATMs to be shared by the other members of the network. In 2006 the LINK ATM Scheme became separate from the LINK Interchange Network Ltd, a commercial entity offering ATM switching among other services. In July 2007 LINK Interchange Network Ltd merged with Voca to create VocaLink. VocaLink provides the technical, commercial and settlement services which make ATM sharing possible on the scale seen today.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: