An ongoing look at how the attitudes of financial decision makers in Romania are evolving during the COVID-19 pandemic.

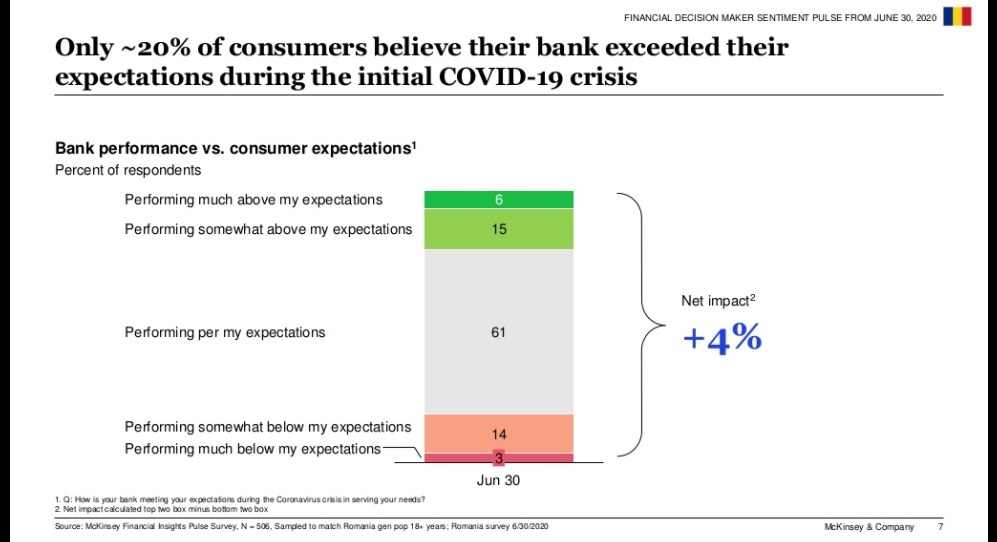

Only 21% of consumers believe their bank exceeded their expectations during the COVID-19 crisis, as they seek more support from banks in terms of convenient credit terms (e.g., waiving late fees) but also improved service model via digital channels (e.g., website functionality for seamless online transactions across all banking activities).

However, Romanian has the highest percentage of the seven European countries included in the “Financial Pulse Survey” conducted by McKinsey.

Another 61% said the interactions with the bank were in line with their expectations. This could indicate, to some extent, lower expectations of local customers given that banks in Western European countries are more advanced in terms of services offered through digital channels.

Digital channels (both online and via mobile) are already widely used: over 70% of respondents are connected, during this period, to the web platforms or mobile applications of banks.

Digital channels also generate a significantly higher level of customer satisfaction than traditional ones (over 50% said they are very satisfied with digital channels vs. about 30% on non-digital channels), pointing out that a rate Greater adoption of digital channels could help banks increase customer satisfaction.

Digital channels that allow complete („E2E”) and fast online transactions for all banking activities would be a strong point for banks, according to 44% of local users. Also, 31% of Romanians, most likely less digitally experienced, would feel more comfortable if the bank would help them become more familiar with as many of the services available via mobile phone or online for transactions or other interactions with the bank.

McKinsey study also shows that Romanians need immediate support from banks for more convenient lending. 52% of customers in Romania would like their bank to support them during this period by waiving fees for late payment for a credit card or other loan.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: