Konsentus’ Q1 2024 Open Banking Tracker reveals growth in cross-border and an increase in TPPs authorised to make payments on an account holder’s behalf.

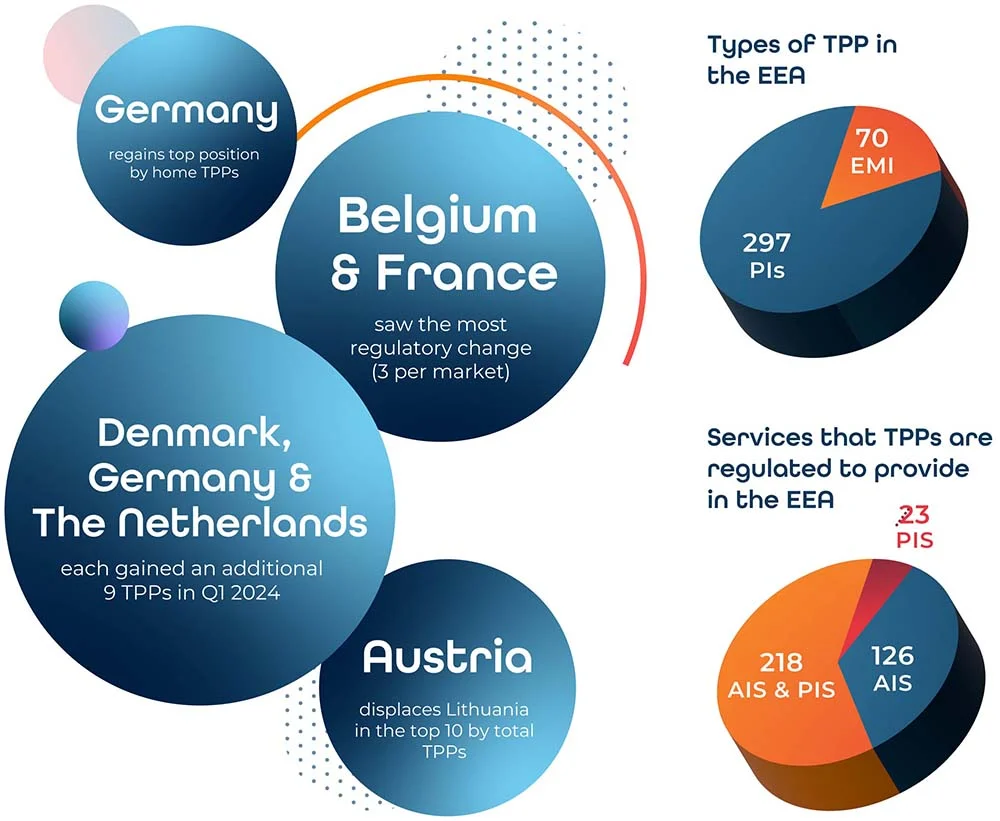

Q1 2024 shows strong growth in new third parties authorised to provide open banking services, with 11 new TPPs approved in the European Economic Area (EEA). Over the same period, 8 TPPs in the EEA had their open banking permissions removed. The EEA’s total is now 367.

In the UK, 3 TPPs gained regulatory approval and 5 TPPs had their permissions removed from the register, resulting in a total figure of 206 for the UK1.

The overall total for the EEA and the UK now stands at 573. While this may only be a small net gain in overall numbers, the 27 permission changes over the last quarter are well above the quarterly average for the previous twelve months.

The data reveals that the market remains dynamic emphasising the importance of properly verifying any TPPs attempting to access payment accounts.

„For the first time since we launched our tracker in 2019, the number of EEA TPPs passporting their open banking services into other markets has surpassed the 50% mark. This is a significant milestone and corroborates the interest we are seeing globally around cross-border initiatives and alliances between different trade corridors and regions.

This confirms the future and emphatically reinforces the need for having technology systems and processes in place that can identify authorised entities conducting business outside of their home regulated market.” – said Mike Woods – CEO Konsentus.

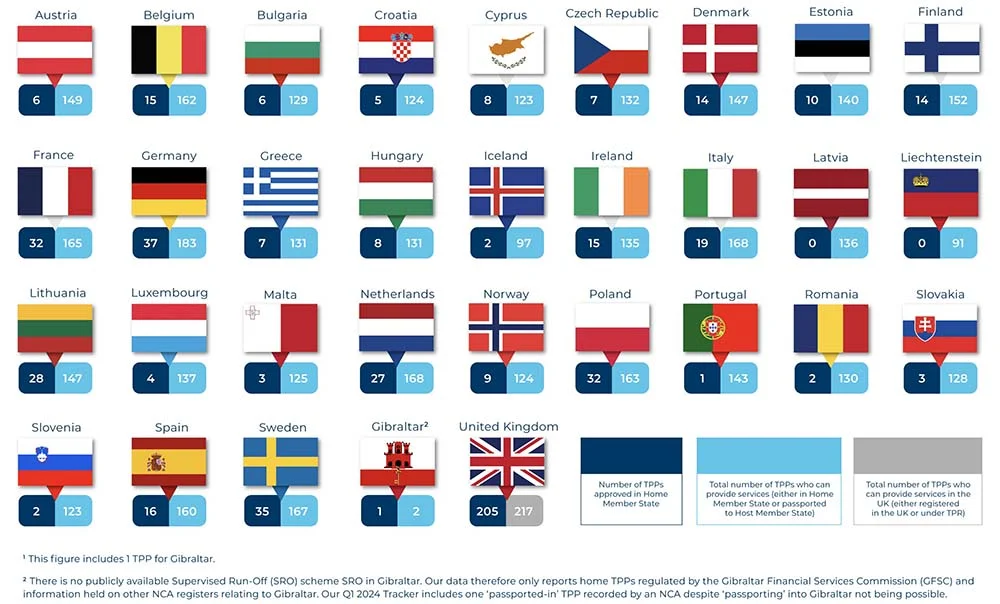

TPP Tracker Country Breakdown

Q4 Highlights (EEA)

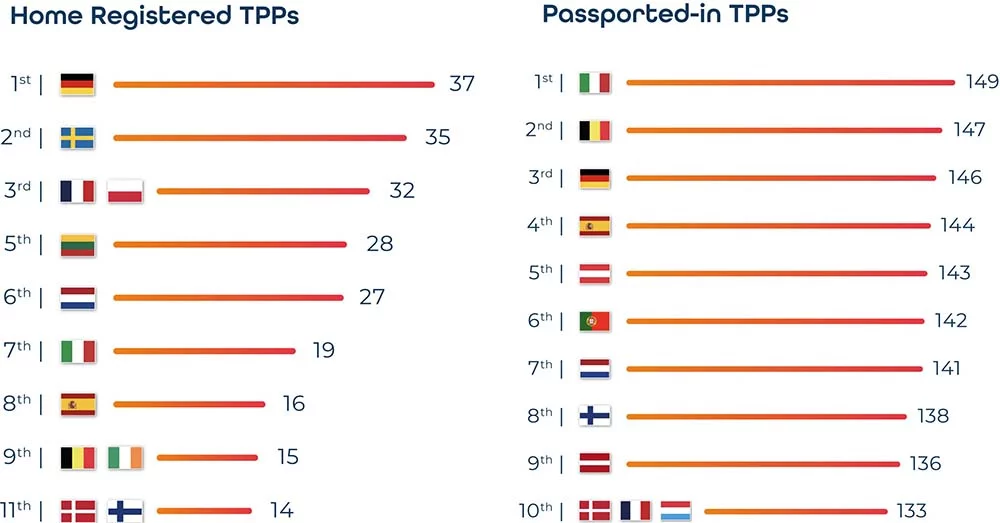

Germany regains top position by highest number of home-regulated TPPs, at 37, due to 2 new entities being granted regulatory approval in the last three months.

Italy still has the highest number of passported-in TPPs (149), but Belgium (147) extends its lead on Germany (146) and Spain (144).

TPPs from 8 different EEA markets gained regulatory approval during the first quarter of 2024: Belgium (1), Cyprus (2), France (2), Germany (2), Iceland (1), Lithuania (1), Netherlands (1), Spain (1).

TPPs from 5 different EEA countries had their permissions removed: Belgium (2), France (1), Malta (2), Spain (1), Sweden (2).

Latvia and Liechtenstein once again remain the only two markets with no home TPPs.

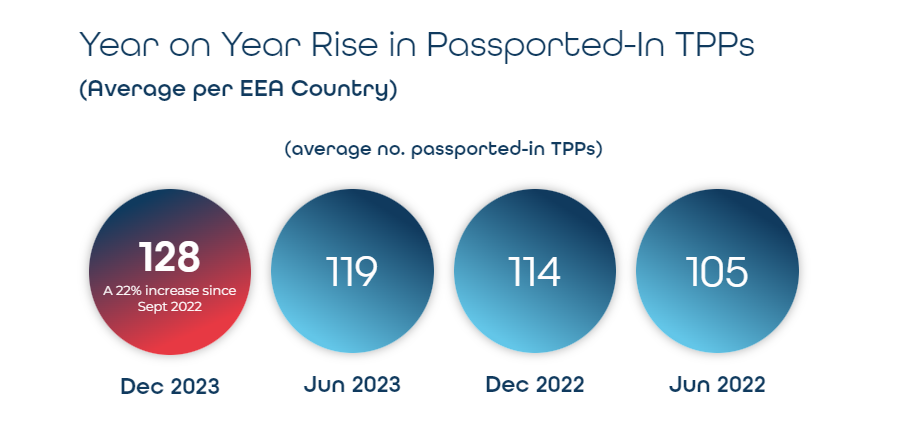

Between September 2023 and March 2024, each country gained on average 9 additional passported-in TPPs, mirroring the increase over the previous six months.

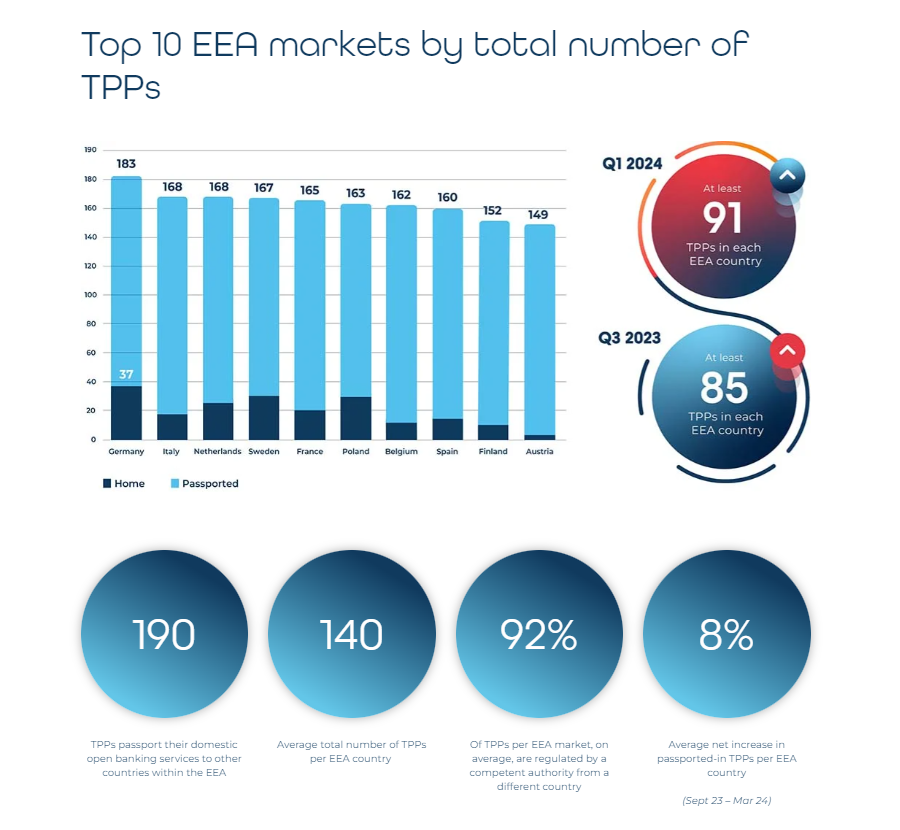

Passported-in TPPs make up, on average, 92% of the total number of TPPs per EEA market. This clearly shows the value TPPs place on growing their businesses by extending their geographical reach.

Passporting and cross-border transactions are clearly a trend that’s here to stay. For the first time since we launched our tracker in 2019, over 50% of all EEA TPPs now passport their open banking services outside their home-regulated market. „This is a significant milestone.” – according to the report.

Download report: Q1 2024 Konsentus Third Party Provider Open Banking Tracker

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: