Moreover, the bank’s mobile app ratings reached historic values of 4.5 and 4.9 for App Store and Google Play, respectively.

„OTP Bank Romania reports sustained growth in digital banking services in 2023, showcasing record performances in online sales and significant improvements in the digital experience for individual clients. Consequently, it has been a milestone year, highlighting a crucial chapter in the bank’s evolution within an ever-evolving banking industry.” according to the press release.

„The foundations of this year’s progress lie in promoting a digital culture throughout the entire organization, enabling a shift from an individual approach by teams to an integrated and collaborative one. This strategy facilitated the broader adoption of digital services within the organization. A key element in achieving this outcome was the work of the digital ambassadors’ team, which expanded the online sales process to 40% of branches across the national network.” the bank explains.

Campaigns dedicated to online account openings further supported this digital advancement, with over 35% of total accounts opened during these campaigns being done online.

Furthermore, OTP Bank recorded a 56% increase in digital activation and usage rates of internet and mobile solutions compared to two years ago. The SmartBank application was updated with an innovative, more user-friendly, and customizable interface, significantly enhancing the customer experience in using mobile banking services.

As digital solutions become increasingly accessible, over 63% of OTP Bank customers have signed contracts for Internet & Mobile Banking services, driving an 81% increase in transactions in RON and a 93% increase in transactions in EUR through Internet & Mobile Banking services. Moreover, the bank’s mobile app ratings reached historic values of 4.5 and 4.9 for App Store and Google Play, respectively.

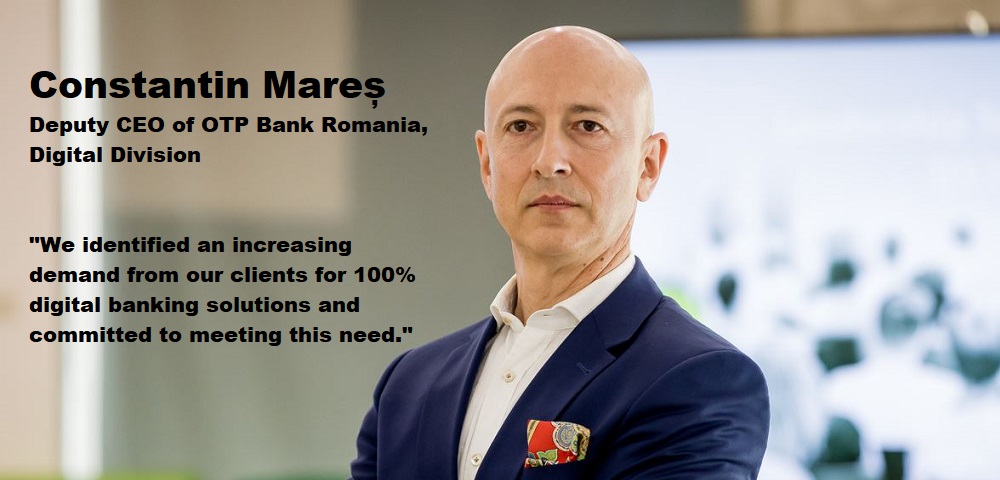

„We identified an increasing demand from our clients for 100% digital banking solutions and committed to meeting this need. The excellent results recorded in 2023 are a result of the Digital team’s efforts to enhance the online account opening process and the online services offering. Moving forward, customer orientation remains essential for the development of these services, along with finding the necessary balance between innovation and ethical considerations related to online security and safety,” said Constantin Mareș – Deputy CEO of OTP Bank Romania, Digital Division.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: