Orange launches an online solution for topping-up mobile credit from abroad

To send mobile credit to a contact, users simply have to enter the mobile number to be credited, select an amount and pay by credit card. A SMS is sent to the user to confirm the transaction and a personal message can be sent to the recipient to let them know their account has been topped-up.

The solution called Orange Top-Up is available online in five languages (English, French, Spanish, Italian and Portuguese) and three currencies (euros, US dollars and South-African rand). The service is designed for those who live far from their families or friends, and provides them with a simple way to send mobile credit from almost anywhere in the world.

This top-up service is aimed in particular at migrant populations or those living abroad who are looking for a simple way to send mobile credit to their friends and families as means to stay in contact or simply as a gift. The site enables users to top-up credit for customers of over 350 operators based in over 100 countries, including 18 countries in which Orange is present. From launch, Orange Top-Up accepts credit cards from 39 different countries.

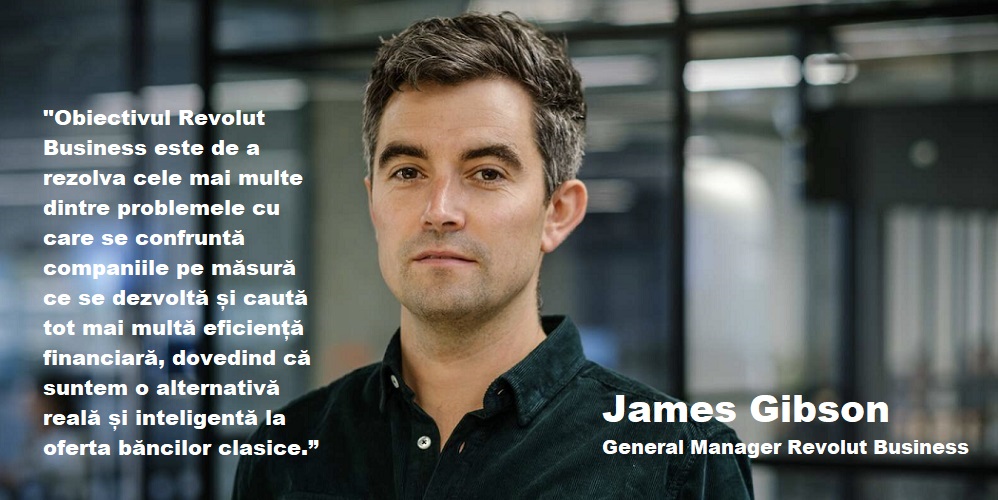

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: