Opening a business bank account in the Nordic countries is still challenging, especially if the company’s business model is based on digital assets

a blog post written by Sarah Palurovic, strategic advisor at Digital Euro Association

The other week, I started the process of setting up a business bank account at one of Sweden’s largest commercial banks, filling out basic information about the intended business model and other standard information.

Of course, I intentionally avoided the word crypto currency in my description and kept it quite general, saying that I provide consulting and educational services on digital forms of money such as CBDCs and specifically excluding investment advice from the scope of services offered.

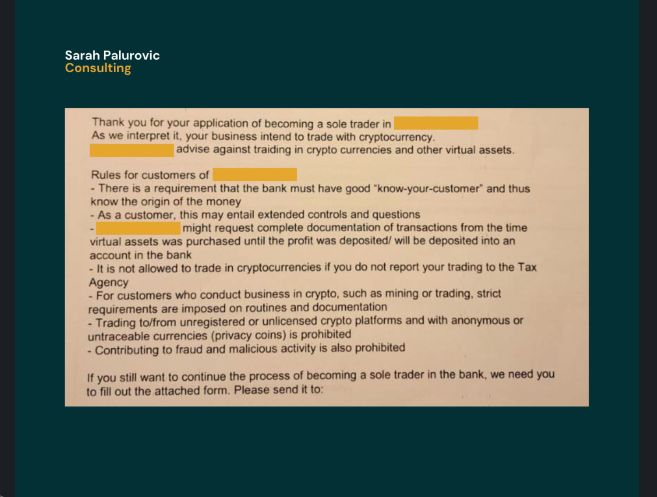

Their response? See the letter below. In a nutshell: A discouragement to trade crypto currencies and virtual assets, which they interpreted to be my business model, and an invitation to undergo more extensive KYC processes if I’d like to open a bank account with them.

Naturally, my jaw dropped to the floor as a first response, then turned into disbelieve. Though their response was predictable, since it is a standard KYC process once you enter the realm of digital currencies as required by national and European law, it was Kafkaesque to experience in 2024.

In the specification of how I „will trade crypto currencies and virtual assets in my business?”, I let them know the following:

– Not at all.

– There seems to be a misunderstanding of the basic terms digital money and the concept of CBDCs.

– Reference to (supra)national regulation in place today and those to come.

– Reference to TradFi involvement in digital money, with examples from Sweden.

– How CBDCs compare to commercial bank money, especially in their liability and deposit structures.

The bank clerk’s reaction when he checked my filled out papers? Priceless.

My favorite part about it is that the technology partner used for the Swedish E-Krona CBDC is the very commercial bank I applied to open an account with.

Also interesting: The non-cohesive way of writing „cryptocurrency” or „crypto currency” within the one pager and the use of the biased word „virtual currency” referring to largely unregulated digital currencies, usually issued and controlled by developers.

In any case, I think I convinced the bank clerk of my intended business model right then and there 🙂

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: