OpenAI CEO Sam Altman says it „terrifies” him that banks still use voice-based authentication methods in an era when the AI that he has helped bring into the mainstream can trick such technology. He thinks it’s insane that banks still use voice or face to authenticate.

Speaking in an interview at the Federal Reserve, Altman said: “I am very nervous that we have an impending, significant, impending fraud crisis. Right now, it’s a voice call; soon it’s going be a video or FaceTime that’s indistinguishable from reality.”

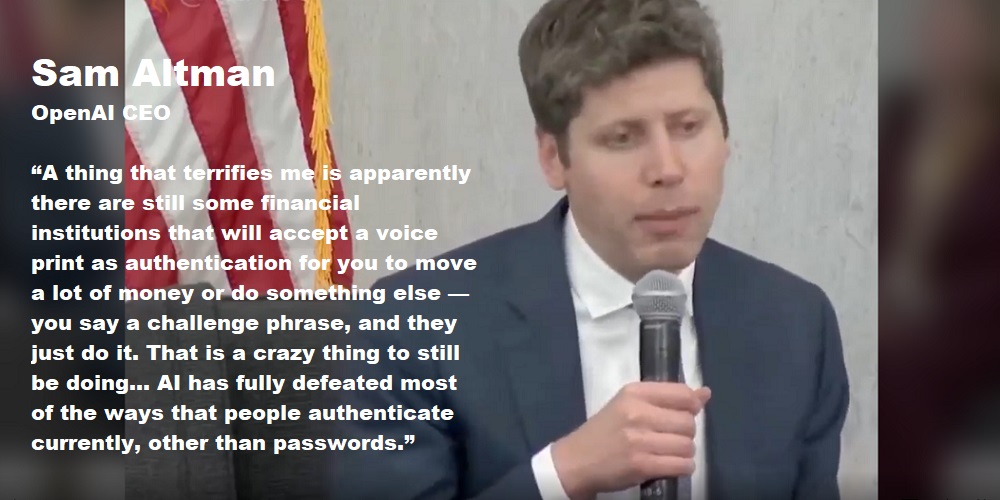

Already, the technology has caught up with how some banks authenticate users, he warned: “A thing that terrifies me is apparently there are still some financial institutions that will accept a voice print as authentication for you to move a lot of money or do something else — you say a challenge phrase, and they just do it. That is a crazy thing to still be doing…AI has fully defeated most of the ways that people authenticate currently, other than passwords.”

According to Simon Taylor, Head of Strategy at Sardine, here’s the KYC nightmare no one’s talking about.

„The core problem: KYC exists to verify WHO is making the transaction. If AI can perfectly mimic voice and face, you’re not authenticating the customer. You’re authenticating anyone with the right software.„

This creates a compliance crisis:

. Every voice-authenticated transaction is potentially non-compliant

. When regulators ask „How do you KNOW your customer made this trade?”

. The answer becomes „Well, it sounded like them…”

„That’s not KYC. That’s wishful thinking.” – said Taylor.

The control framework breakdown:

– Identity verification fails (can be spoofed)

– Transaction authorization fails (wrong person approved it)

– Audit trail fails (no proof WHO actually authorized)

Altman’s exact warning: „Some bad actor is going to release it. This is coming very very soon.”

Taylor concludes: „Banks using voice auth for high-value transactions are at risk. The regulatory implications are massive. When examiners catch this gap, the conversation won’t be about fraud losses. It’ll be about systematic failure to identify customers.

The solve? KYC needs to be always on.

The industry has talked about „perpetual KYC for a decade” but very few do it in practice.

Every signal, every tap, swipe, or interaction needs to feed a real time risk score and set of models to understand is this a human. And as an industry we need to get much better at detecting bad software and malware. Does your bank’s KYC policy account for AI voice cloning?„

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: