Open banking platform Tink closes €90 mil. investment round to further support European expansion

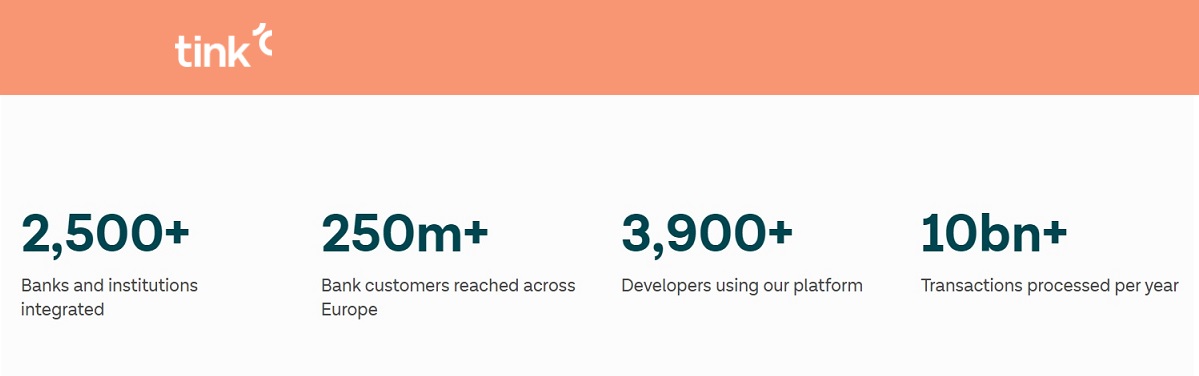

Investment round will allow Tink — Europe’s leading open banking platform that connects to more than 2,500 banks that reach over 250 million bank customers across Europe — to accelerate growth plans towards pan-European coverage and further expand its product offering.

Tink today announces it has completed a €90 million investment round. This investment round follows Tink’s €56 million investment round in February 2019, which makes today’s funding Tink’s largest to date.

This new funding will fuel Tink’s continued expansion across Europe and support further development of its open banking platform that enables banks, fintechs and startups to develop data-driven financial services. Through one API, Tink allows customers to access aggregated financial data, initiate payments, enrich transactions and build personal finance management tools.

Tink’s technology and connectivity power some of the world’s leading banks and fintechs, including PayPal, Klarna, NatWest, ABN AMRO, BNP Paribas Fortis, Nordea and SEB. The open banking platform is also used by more than 4,000 developers.

Tink is currently live in the UK, Germany, Spain, Italy, Portugal, Sweden, Denmark, Finland, Norway, Belgium, Austria and the Netherlands. Founded in 2012 and headquartered in Stockholm, Tink has more than 270 employees and is currently serving its clients out of local offices in London, Paris, Helsinki, Amsterdam, Warsaw, Madrid, Copenhagen, Milan, Oslo and Lisbon.

The investment round was co-led by two new investors — London-based B2B software venture capital firm Dawn Capital and San Francisco-based investment management firm HMI Capital — together with existing investor Insight Partners, the New York-based venture capital firm. The round also includes the incumbent postal operator and Italy’s largest financial services network Poste Italiane as a new investor, as well as existing investors Heartcore Capital, ABN AMRO Ventures and BNP Paribas’ venture arm, Opera Tech Ventures.

Daniel Kjellén, co-founder and CEO, Tink, said: “The investment round will facilitate our ambitious growth plans over the next year and beyond. During 2020 we are committed to building out our platform with more bank connections and, on top of that, expanding our product offering. Our aim is to become the preferred pan-European provider of digital banking services and to offer the technology needed for banks, fintechs and startups to leverage the opportunities of open banking and enable them to successfully develop financial services of the future. Two key factors for succeeding with that are that we strengthen our European coverage and continue to deliver new data-products on top of this infrastructure to our customers.”

Josh Bell, General Partner, Dawn Capital, added: “As the world of banking undergoes a fundamental shift, from analog to digital and from closed to open, banks and financial services require a new set of technical foundations on which to build a winning product strategy for the coming decades. Tink has become a trusted partner amidst growing demand from Europe’s leading banks and fintechs seeking to build better and more creative financial products and services. Our investment underlines the confidence that the industry has in Tink’s categoryleading technology, and we look forward to supporting them on their continued journey.”

About Tink

Tink is Europe’s leading open banking platform that enables banks, fintechs and startups to develop data-driven financial services. Through one API, Tink allows customers to access aggregated financial data, initiate payments, enrich transactions and build personal finance management tools. Tink connects to more than 2,500 banks that reach over 250 million bank customers across Europe. Founded in 2012 in Stockholm, Tink’s 270 employees serve 14 European markets out of 12 offices.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: