Micro-deposits have long been used as the main method for bank account ownership verification and customer identification. The process works by transferring small amounts of money to or from a bank account to verify that a person owns this account. Even though the process is simple, it’s far from ideal, especially considering the alternatives currently available.

Micro-deposits can work in two ways: when a company makes a transfer to a user’s account or when a user makes a transfer to the company’s account. An example of the former is Paypal’s bank account verification process (called “random deposits”). An example of the latter is Mintos’ bank account verification process (called “one-cent transfer”).

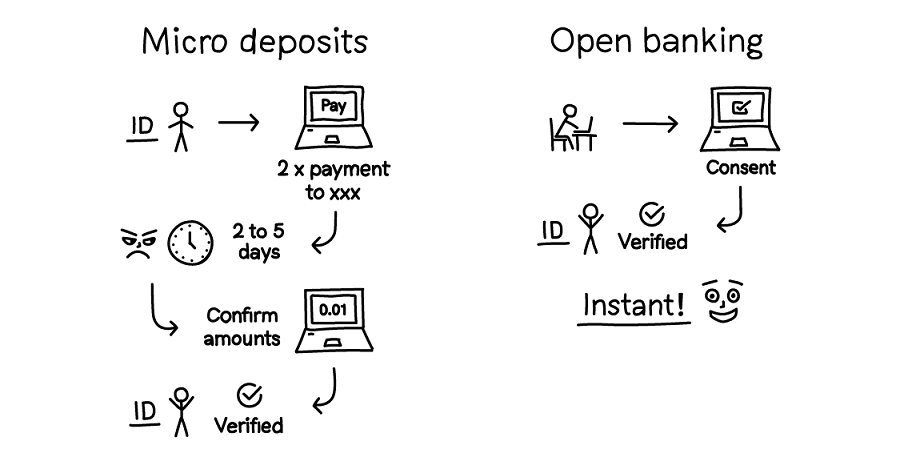

The micro-deposits used to verify bank account ownership and are usually processed in 3 steps: 1) User provides bank account details for verification, 2) User waits for one or two micro-deposits to be received and 3) User then indicates the amounts or a code in the transaction received to verify account ownership.

Usually the deposit amounts range from 1 cent to 50 cents, never exceeding 1 euro.

Another common use-case for micro-deposits as identity verification is called “know your customer” (KYC). In this case the customer would be asked to perform two micro-deposits to the business account to verify their identity. This is far from being the most user-friendly method, since it requires several steps and is prone to user mistakes, such as an incorrectly entered account number.

After decades of use, it’s now clear that using micro-deposits as account ownership and identity verification processes should no longer be the gold standard.

The process of performing a couple of micro-deposit transactions is not only time-consuming, but also prone to errors. The steps include a user accessing their online bank account, starting a money transfer transaction, and inputting the bank details manually. With all of these little steps, there’s plenty of room for mistakes that can lead to a breakdown in the verification process.

Another major problem related to micro-deposits as verification is waiting time. Today’s customers place extreme value on the ability to start and finish any financial process almost immediately. With that in mind, micro-deposits are nothing more than traditional bank transfers, which can come with a waiting period that can range from two to five working days.

Open banking is the perfect alternative to micro-deposits and is used as the preferred method for account verification by many top financial companies, including Paypal. Open banking allows people to verify their identity or bank account ownership in a fast and secure way. Registered European AISPs can use PSD2-compliant application programming interfaces (APIs) and current consent gathering platforms as an alternative to micro-deposits. Customers can now go through the verification process in a few clicks and with virtually no waiting time.

The use of open banking for account and identity verification benefits not only customers, but also businesses. These benefits include that open banking:

. Is user-friendly — open banking offers customers a platform that result in a much smoother user experience

. Eliminates mistakes in the process — consent gathering platforms are built to maximise efficiency and security, while eliminating all human error

. Eliminates fees — open banking is free in Europe (thanks to PSD2) and this means that businesses and their customers do not have to pay to verify accounts

Source: Link

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: