Open Banking: Is Data The New Currency?

Bank APIs Challenge or Opportunity?

Bank APIs Challenge or Opportunity?

Banks across the globe are anxiously looking at the slow but seemingly inexorable progress of banking APIs. Regulation and market demands will require banks and other financial services firms to make it easy for another firm to gain access to their customers’ data and to engage with their platforms to transact. Most realise that the world of financial services is going to be shaken to its foundations by their arrival. Financial data will soon become a new commodity owned and managed by customers — not the banks.

Banking APIs are generally good news for all parties involved, but for the incumbent banks and institutions business as usual is no longer an option. In Europe, because of the imminent implementation of PSD2 (the European Commission’s of Second Payment Services Directive supported by the European Banking Association), Banking APIs are an even more urgent challenge. PSD2 sets out a series of guidelines that will define how banks will have to enable bank customers to authorise accredited third parties to securely link their bank accounts to access data or initiate payments. This is going to be game-changing.

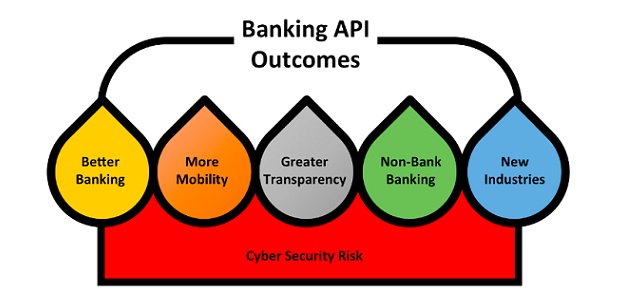

Projecting the impact of a broad rollout of banking APIs is not easy. That said, we can comfortably predict a range of likely outcomes:

1. Better Banking

Banks will improve the offering to their existing customers

By being able to complement their customer transactional data with those from other institutions, banks will be able to offer their existing customers products and services that are better tailored to their needs. By better understanding their customers they will be able to offer:

. More competitive pricing,

. Higher level product customisation,

. Targeted advice,

. More appropriate product suitability.

Banks will soon realise that APIs can become a source of new income. The analysis of customer data is a service useful to businesses beyond financial services. As an outcome of creating new infrastructure to manage the new banking API requirements, we could see both banks and API services providers create completely new revenues opportunities. These could include the provision customer authentication, risk scoring and eligibility verification just to name a few.

There is a possible downside to this. Once a provider is able to gain a holistic view of their customers, they may realise that some provide a higher risk than initially thought. This could result in higher prices and a more restricted product offering to some customers. Customers will need to be selective on who they allow to leverage their data.

2. More Mobility

It will be easier for customer to change banks

Thanks to APIs, challengers and competitors are able offer customers products and services that are a much better fit to their needs by combining data sources. By understanding new prospects better, they can “poach” their competitors’ best customers. By having lower cost bases, more up-to-date technology and often more customer-centric mind-sets, challenger banks or comparison sites should be able to offer a real challenge to the established players.

Historically large banks make poor use of the customer information they collect. Few banks offer their own customers better deals than those available to all. Some of this was dictated by regulation — or the banks’ interpretation of it — but some was the result of trying get the maximum profit from a customer that is inherently reluctant to change bank.

With banking APIs we should see a sharp increase in customer mobility for three fundamental reasons:

Firstly customers will see competitors to their bank provide them propositions that are better tailored to their needs and expectations.

Secondly, APIs will make it very easy to change banks as authentication will be simpler

Thirdly, moving will no longer mean leaving your history behind as a customer’s account history can travel with them as they move.

As with existing customers, lower quality customers could see price and range of the products offered to them deteriorate.

3. Greater Transparency

The Market Will Become More Transparent

Today aggregators have become a powerful force in increasing competition and reducing costs — the effect on the UK auto insurance market is a good example of things to come.

Banking APIs will further strengthen this trend. With the new APIs, customers will be able to see exactly how they are being treated by their existing banking providers. New businesses (or even competitors) will be able to extract a prospective customer’s transaction history and model how they would be served if they switched bank.

Today’s shopping comparison providers will be able to provide consumers much more accurate data on who would be the best provider for them. The less competitive providers will be easily and accurately singled out making it much harder for them to use clever marketing or pushy sales practices to sell their wares.

4. Non-Bank Banking

Disintermediation of the banking customer

One emerging trend is that you do not need to be a bank to offer banking services. Social networks, hardware manufacturers and even search engines are entering the financial services space. What is interesting about these eCommunities is that often they do not aim to become a regulated financial services provider but merely want to provide services to them to increase their own customers’ engagement and extract some of the margin.

A good example is how Wechat (with Wechat Pay) or Apple (with ApplePay) have woven financial services — in both cases payments — into a proposition that is not meant to be just financial. These players often see income from financial services as marginal, what they really care about is retention — making sure that their offering become so inter-woven to their customers’ lives that they minimise the likelihood of changing social network or hardware provider.

For example Apple could expand their ApplePay offering to provide real-time balances but also enable bank-to-bank transfers directly from their app with no need for the customer to login to their bank. They could eventually offer a whole-of-market comparison service, letting ApplePay customers see where their custom would be best served. They could then extend their services to enabling customers to close their account on one bank and to move to it another one. Customers will know that by buying an Apple product, they will also always get the financial product that best suit their needs.

The effect of this would not be to eliminate the existing banks, but to make them less relevant to their customers. Banks would then become utilities to these providers de-facto dis-intermediated from their own customers.

5. New Industries

New types of businesses will appear

The availability of the new banking APIs will create new industries. As every bank will by and large have their own API, talking to all of them will be complicated. Some banks may decide to link up to the different banks APIs on their own but most other will use intermediaries. There will be an abundance of data suddenly generated by theses APIs. This will not only need to be extracted it will also need to be stored, analysed and kept safe.

So we will see a proliferation of new business types:

These API aggregators (AISPs and PISPs in PSD2 talk) will act as hubs to provide one-stop-shops to entities wishing to link with all the banks’ APIs.

Data management providers that will enable the creation of efficient and scalable data silos.

Big Data analysis providers that will tap into the already scarce data analytics talent pools to help companies make sense of the data.

But not everything is sweetness and light…

Regulators will have to realise that data is now a new commodity that needs to be regulated and protected. The upcoming GDPR (General Data Protection Regulation) regulation provides an initial framework for this from the data privacy perspective. More regulation will be necessary to protect data from a financial perspective.

Another big risk with APIs is that they create new entry points to the armies of hackers worldwide. Even though APIs are going to be overwhelmingly good for customers, their wide adoption can generate its fare share of cybersecurity issues. With banks creating backdoor access to their data it will be almost inevitable that some banks as well as some of the API aggregators will eventually be breached. The banks, the API services firms, technology providers and regulators will have to up their games considerably to address these risks.

The Cybersecurity industry will receive an even greater boost than it did with Digital Banking. New specialist firms will emerge to make sure that customer data is safe throughout its lifecycle. They will manage and monitor the security of the myriads of access points to secure data stores created by these new API

…

Banking APIs will usher a completely new era for banking. Financial services firms will have to accept a reality where their most valuable asset – their customers’ data – is now controlled by customers themselves. This may not be the end for the big banks and financial institutions but it’s definitely very different world from what they are used to.

Source: Alessandro Hatami

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: