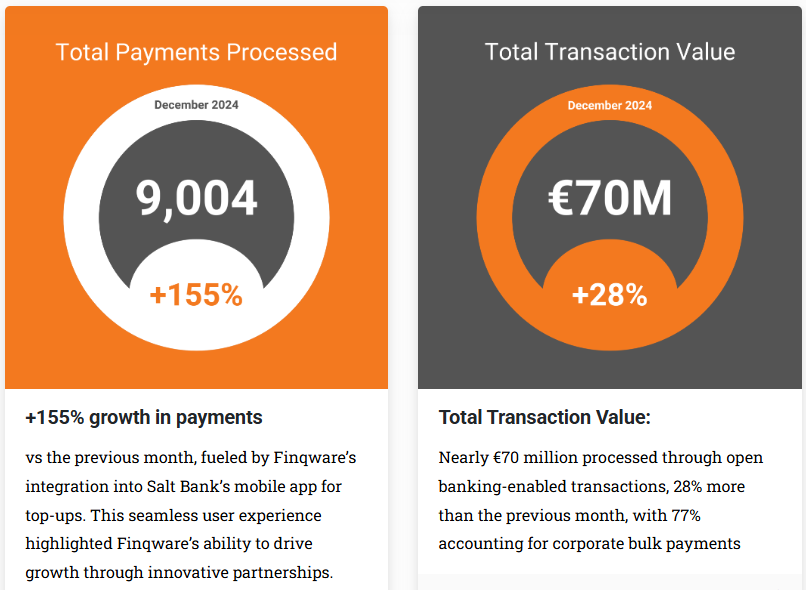

For 2024, Finqware’s platform supported unprecedented growth in account-to-account payments from 200 payments/month in January to 9,000/month in December. Bulk payments accounted for 77% of the total payment value. PSD2 API error rates dropped to 0.8%, compared to 15% in 2022. Only in December 2024, nearly 90 mil. euros were processed by Finqware through open banking-enabled transactions.

Romania’s open banking journey reached new heights in 2024, and „Finqware was at the forefront of this transformation” – according to a company’s blog. „Thanks to improved API reliability, progressive regulations, and Finqware’s innovative solutions, the country solidified its position as a key player in the European open banking landscape. With exponential growth in account-to-account payments and the successful implementation of bulk payment APIs, open banking in Romania has moved beyond theory and into real-world impact.” the company said.

Here’s a closer look at how 2024 unfolded for open banking in Romania, supported by Finqware’s contributions and the milestones that highlight its success.

Regulatory Progress Paves the Way

A game-changing moment came when the National Bank of Romania enforced the implementation of bulk payment APIs for all banks. This regulation, and Finqware’s role as a leading aggregator, enabled seamless corporate transactions and addressed the growing demand for reliable payment solutions.

What this means for Romania:

A standardized and scalable infrastructure for corporate payments.

Increased confidence in open banking as a mainstream financial tool, with Finqware’s solutions playing a critical role in adoption.

2024 in Numbers: Payments and Performance

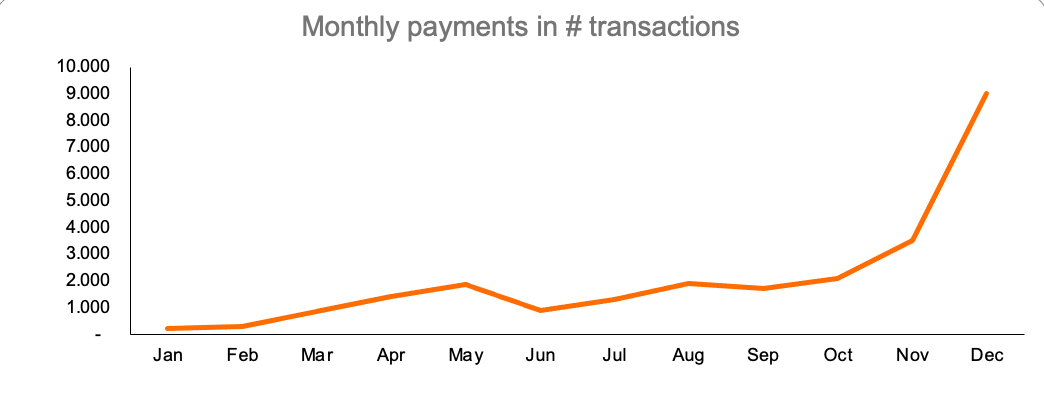

Finqware’s platform supported unprecedented growth in account-to-account payments, driving adoption across corporate and individual users:

Payment Growth: From 200 payments/month in January to 9,000/month in December

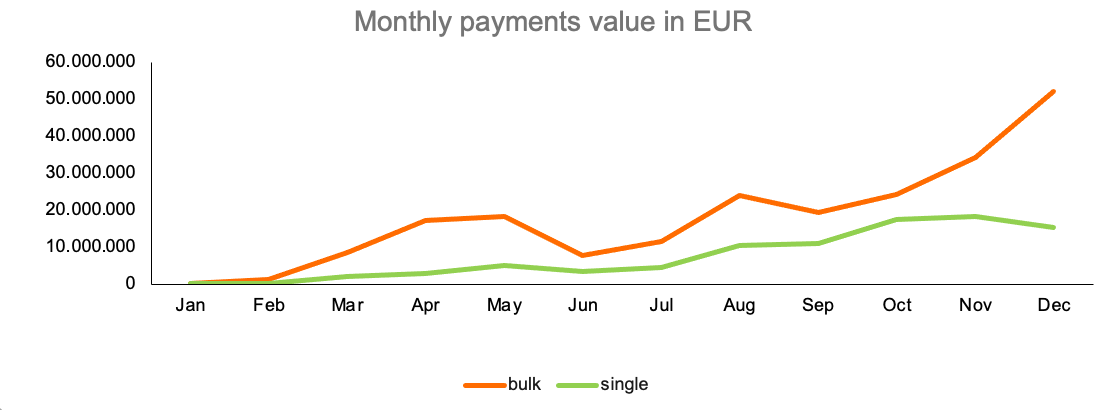

Corporate Dominance: Bulk payments accounted for 77% of the total payment value, emphasizing the strong uptake by businesses using Finqware’s technology to streamline high-value transactions.

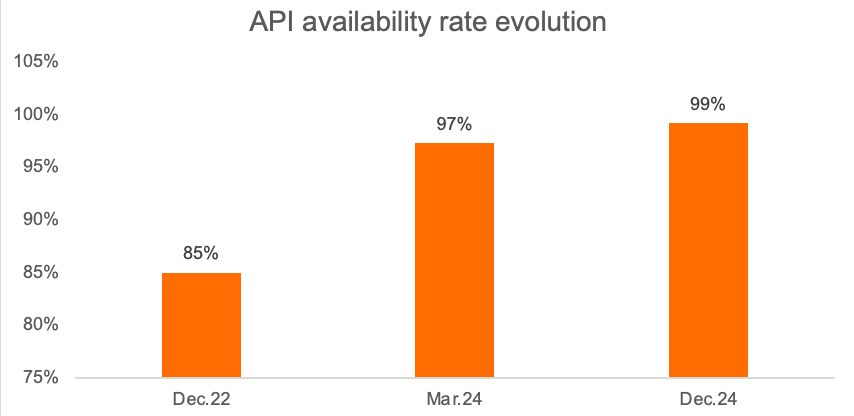

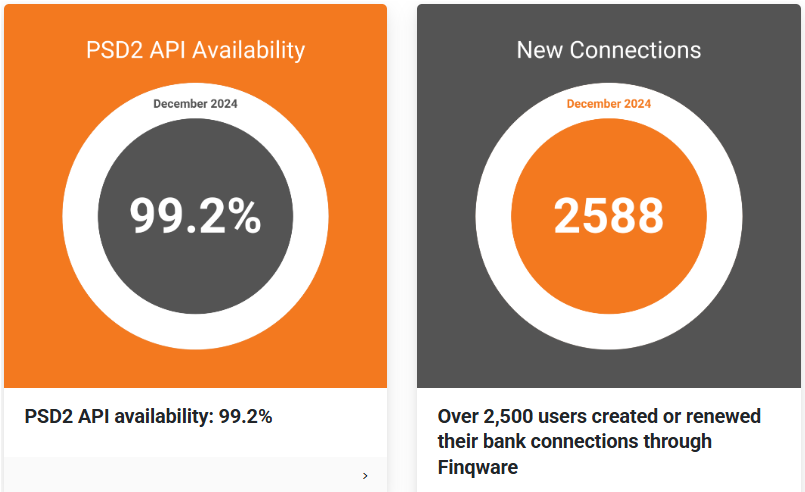

API performance: PSD2 API error rates dropped to 0.8%, compared to 15% in 2022, making APIs a dependable channel for transactions and data retrieval.

December: A Record Month for Growth

December 2024 marked a high point for both open banking adoption and Finqware’s performance:

Corporate bulk payments continued their steady rise, enabled by the reliability and scalability of Finqware’s solutions.

Reliability also reached new levels, thanks to improvements in PSD2 APIs, which Finqware utilizes to deliver consistent results:

Major Romanian banks like BT, CEC, and Salt Bank relied on Finqware’s solutions to deliver value to their customers, further solidifying its position as a leader in the ecosystem.

Finqware’s influence extended beyond Romania, driving open banking adoption across 12 countries. By managing over 8 million monthly API calls, Finqware enabled businesses to access seamless financial data and transactions, supporting about 2,000 companies.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: