Open banking adoption in UK: 2 billion API calls and 15 million users

Open banking is no longer a concept reserved for early adopters or fintech insiders. „It’s now a part of everyday life for millions of people in the UK – whether they realise it or not.” – says Open Banking Limited.

In July 2025, the UK’s open banking ecosystem hit two major milestones: over 2 billion API calls and more than 15 million users* in a single month. These figures mark a turning point – not just in scale, but in the maturity and mainstream adoption of open banking.

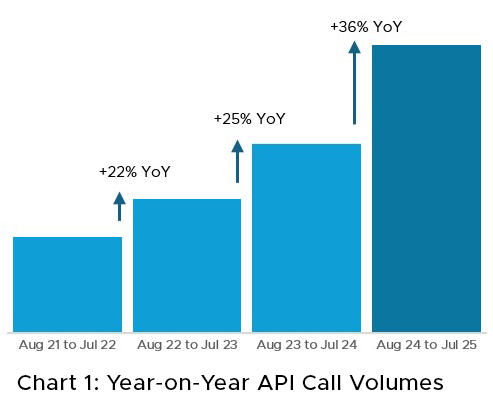

API Call Volumes Are Accelerating

In the 12 months leading up to July 2025, the number of API** calls made across the open banking ecosystem exceeded 22 billion—a clear sign of growing momentum. This represents a 36% increase compared to the previous year, up from 22% growth two years earlier.

About 80% of API traffic is related to Account Information Services (AIS)—such as viewing balances or transaction histories. However, Payment Initiation Services (PIS) are growing faster, with a 66% year-on-year increase.

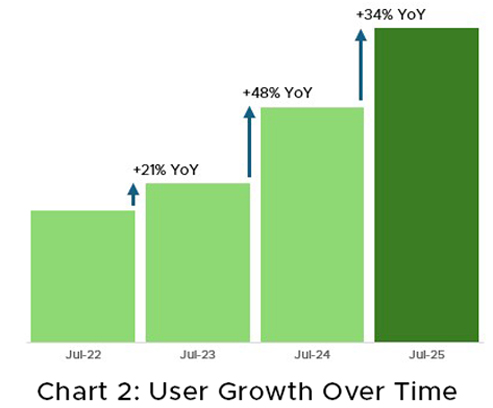

User Adoption Is Surging

Open banking now serves 15.1 million users* – nearly 1 in 3 UK adults. That’s a 34% increase in just one year.

The composition of users is also shifting. In 2021, AIS users made up 75% of the total. Today, PIS users account for 55%, reflecting growing comfort with open banking-enabled payments.

Payments remain the biggest driver of adoption, with July’s data revealing that the total value of payments has reached 29.89 million – an 8.7% growth (from 27.5 million to 29.9 million). This rapid growth demonstrates the UK’s global lead in data-enabled technology supported by strong infrastructure and rising consumer demand.

Variable Recurring Payments (VRPs) are emerging as a key open banking enabled innovation, giving consumers and businesses greater control and flexibility over regular payments. In July alone, VRPs accounted for over 4% of all open banking transactions – a sharp 8.6% increase, to 4.26 million. From HMRC tax payments (£4.7 billion in January) to retail giants like Just Eat and Tesco, and travel brands such as Ryanair, growing consumer and business trust is driving momentum and uptake across different sectors.

What’s next?

Expanded use cases: From affordability checks to personalised financial advice.

Smart data integration: Enabling cross-sector services in energy, telecoms, and beyond.

Continued focus on security and user empowerment: Keeping consumers in control of their data and choices.

___________

*Open Banking are unable to identify individuals consuming services through more than one brand. Reporting therefore represents the number of user connections with the brands providing reporting, rather than individual users.

**An API (Application Programming Interface) is a set of rules that allows different software systems to communicate securely and efficiently. Think of it as a digital translator that enables apps, websites, and services to exchange information without manual input.

In open banking, APIs are the invisible infrastructure that powers everything; from viewing your bank accounts in one app, to verifying your identity, to making payments directly from your bank account.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: