The Norwegian central bank is in no rush to introduce a digital Krone, despite conducting recent research which shows that cash is used for just four percent of transactions in Norway, according to finextra.com.

Declining cash usage is often cited as a primary reason for the development of central bank backed digital currencies.

In a speech at a payments conference in Oslo, Ida Wolden Bache, deputy governor of Norges Bank, says the plummeting use of cash in Norway was uncovered in a study conducted just three weeks ago.

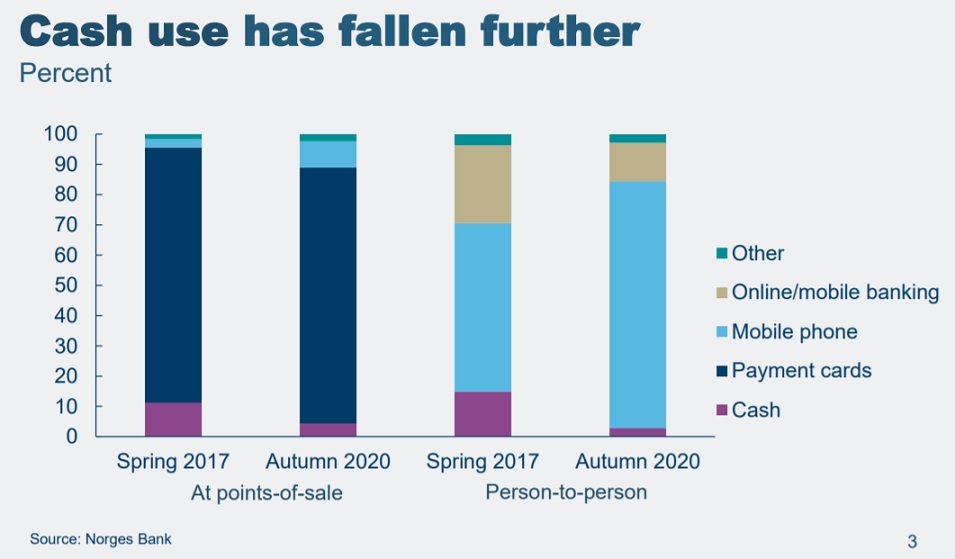

„Only four percent of payments are now made using cash,” she says. „This share is approximately the same as in spring, and considerably lower than before the pandemic. To our knowledge, the share of cash payments is lower in Norway than in any other country.”

Norway, like other jurisdictions, has been exploring the options for creating a CBDC over the past four years. The Bank expects to publish results in 2021 from a third phase of research which specifies the features a CBDC should have and a range of technical solutions.

„The prospective introduction of a CBDC is still some way off,” Wolden Bache cautions. „The lack of urgency reflects our view so far that there is no acute need to introduce a CBDC. The introduction of a CBDC could have considerable consequences in a number of areas. Our decision must be well-informed. Introducing a CBDC will involve such a substantial change in the monetary system that it will require a political decision. It could also involve the question of whether the Central Bank Act would have to be amended.”

A more pressing issue for Norges Bank is the push to realise the benefits of real-time payments in businesses and the public sector. While instant payments are commonplace in the retail consumer segment thanks to the overarching reach of the bank-backed mobile payments app Vipps, they have yet to take hold in the business-to-business marketplace. To this end, the bank is considering expanding its role as a payment system operator to directly settle payments in Norges Bank.

„Two alternatives for real-time settlement in Norges Bank are being considered,” states Wolden Bache. „The first alternative is to establish a system whereby Norges Bank is itself responsible for management, development and operation. The second is to join the Eurosystem’s TIPS solution. Payments would then be settled in TIPS in NOK on behalf of Norges Bank. Sveriges Riksbank decided to join TIPS earlier this year.”

She says a decision on the bank’s musings will be delivered early next year.

Meanwhile, Deputy Governor of Norges Bank acknowledges that there is a more important issue to be addressed. „Banks’ credit losses have risen so far in 2020 (…) the outlook for losses is more uncertain than normally,” says Wolden Bache.

###

More details:

Speech by Ms Ida Wolden Bache, Deputy Governor of Norges Bank (Central Bank of Norway), at Finance Norway’s Payments Conference, 5 November 2020: „Central bank digital currency and real-time payments”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: