The choice to split the payment in three or four instalments (from the first euro up to €1,000) is made directly on the app on the day of the purchase. Oney+ is already available in France and will soon be extended to other European countries.

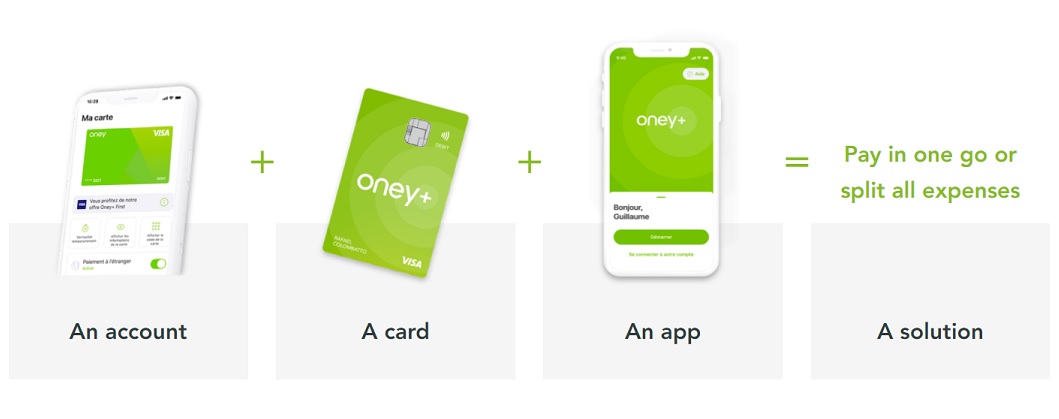

Oney, creator of the split payment offer in 2008 and current leader in France and three other European countries, announced the launch of Oney+. „This new offer includes a payment account, a Visa bank card and an app, giving consumers the power over their spending through universal split payment offer,” according to the press release.

„Oney+ couples the ability to have an overview of the entirety of one’s bank accounts, a real time tracker of one’s spending and the possibility to choose the account to be debited. Also, Oney + enables consumers to pay in 3 or 4 times everywhere in the world, across all channels, in all types of stores and for all services,” the company says.

While consumption and trade are major challenge for economic stimulus, split payment provides a flexible and innovative solution. It allows the French to consume while staying in control of their budget. In this perspective, 32% of French intend to use more split payment solutions for their purchases in 2021(1). Furthermore, 58% of the French believe that they could consume better if they could pay in instalments for second-hand or reconditioned products.** (2).

For Jean-Pierre Viboud, CEO of Oney :

„Fourteen years ago, Oney was the pioneer of split payment. It has become part of French people’s habits as a very simple, practical and secure budget management tool. This year, we are moving forward with the launch of Oney+, a payment account that makes split payments universal: available everywhere in the world, in all shops and on all channels.”

Oney+, a budget management solution, without having to change banks

Oney+ offers unique features in a single app like connecting all your bank accounts directly to the Oney+ app to have a complete overview of your budget or real-time monitoring of expenses and the possibility to be informed of upcoming monthly debits to better control your budget.

Also, the client has the possibility to choose the bank account from which to debit for each individual transaction (either a default choice or a choice for each transaction).

The split payment is available everywhere in the world, on all channels, for all types of stores and services, with the freedom to choose to pay in multiple instalments after the purchase (for example, for a shopping trip to New York or to pay a craftsman).

The user has the choice to select between two subscription formulas, combining a Visa bank card and insurance around the world of consumption:

Oney+ Original, for 2.50 € per month, includes a Visa Classic card and Online Buying Protection

Oney+ First, 5.90€ per month, which includes a Visa Premier card and Online Buying Protection, as well as Payment and Smartphone Protection (in addition to the standard Visa Premier Assistance & Insurance package)

The charges for split payments

The rates applied are 1.45% of the amount of the purchase, with a cap set at €15, for a payment in three instalments; and 2.2% of the amount of the purchase, with a cap set at €30, for a payment in four instalments. As an example, the purchase of a €300 washing machine in three instalments with Oney will cost the customer €1.45 per month.

_____________

(1) Source: Harris Interactive’s study for Oney en France – Avril 2021

(2) Source: Harris Interactive’s study for Oney en France – Avril 2021

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: