Nuvei, a global leader in payments, and Advent, a significant player in fintech private equity investing, join forces via all-cash transaction. In its recent 2023 annual financial statements Nuvei announced that it had processed more than US$200 billion in Total volume, and US$1.2 billion in revenue.

Key highlights:

. Shareholders will receive US$34.00 per share in cash, which represents a premium of approximately 56% over Nuvei’s unaffected closing share price of US$21.76 on the Nasdaq Global Select Market on March 15, 2024, and a premium of approximately 48% over Nuvei’s 90-day volume weighted average trading price as of such date, valuing Nuvei at an enterprise value of approximately US$6.3 billion

. Canadian shareholders Philip Fayer, Novacap and CDPQ will indirectly own or control approximately 24%, 18% and 12%, respectively, of the equity in the resulting private company as part of the agreement

. Philip Fayer will continue to lead Nuvei as Chair and Chief Executive Officer, alongside his broader leadership team, with Montreal continuing to serve as Nuvei’s headquarters

Nuvei Corporation announced that it has entered into a definitive arrangement agreement to be taken private by Advent International, one of the world’s largest and most experienced global private equity investors, with the support of each of the Company’s holders of multiple voting shares, being Philip Fayer, certain investment funds managed by Novacap Management Inc. and CDPQ, via an all-cash transaction which values Nuvei at an enterprise value of approximately US$6.3 billion. The Company will continue to be based in Montreal.

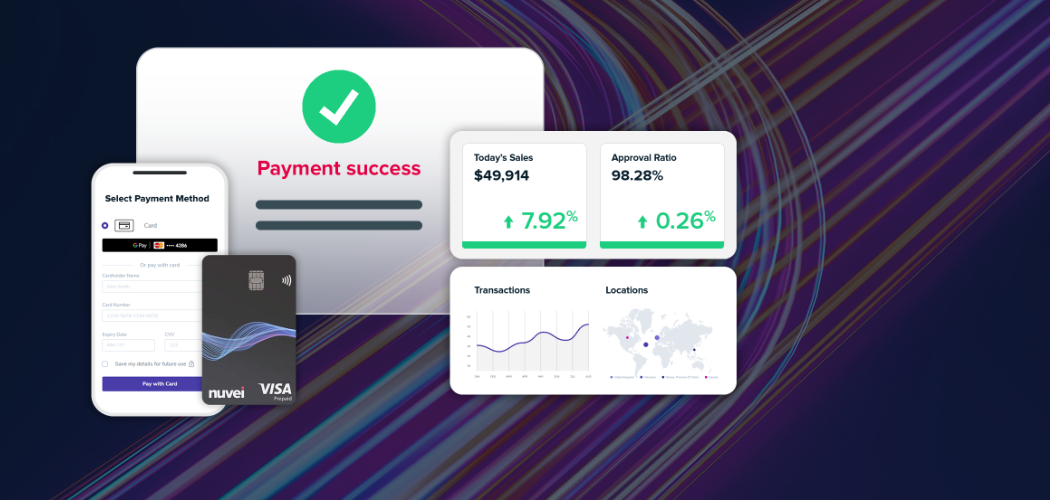

One of the most advanced technology providers in the global payments industry, Nuvei accelerates the growth of its customers and partners around the world through a modular, flexible and scalable solution that enables leading companies across all verticals to accept next-gen payments, offer all payout options, and benefit from card issuing, banking, risk and fraud management services. Nuvei’s global reach extends to more than 200 markets across the globe, with local acquiring in 50 markets and connectivity to 680 local and alternative payment methods.

Advent is a longstanding investor in the payments space. Nuvei will benefit from the significant resources, operational, and sector expertise, as well as the capacity for investment provided by Advent.

Philip Fayer will remain Nuvei’s Chair and Chief Executive Officer and will lead the business in all aspects of its operations. Nuvei’s current leadership team will also continue following the conclusion of the transaction.

Fayer commented on the announcement: „This transaction marks the beginning of an exciting new chapter for Nuvei, and we are glad to partner with Advent to continue to deliver for our customers and employees and capitalize on the significant opportunities that this investment provides.”

Fayer continued: „Our strategic initiatives have always focused on accelerating our customers revenue, driving innovation across our technology, and developing our people. Bringing in a partner with such extensive experience in the payments sector will continue to support our development.”

„Nuvei has created a differentiated global payments platform with an innovative product offering that serves attractive payments end markets like global eCommerce, B2B and embedded payments,” said Bo Huang, a Managing Director at Advent. „Our deep expertise and experience in payments give us conviction in the opportunity to support Nuvei as it continues to scale from its base in Canada as a global player in the space. We look forward to collaborating closely with Nuvei to capitalize on emerging opportunities to help shape the future of the payments industry.„

Transaction Highlights

Advent will acquire all the issued and outstanding subordinate voting shares of Nuvei (the „Subordinate Voting Shares”) and any Multiple Voting Shares that are not Rollover Shares (as defined below). These Subordinate Voting Shares and Multiple Voting Shares (collectively, the „Shares”) will each be acquired for a price of US$34.00 per Share, in cash.

This price represents a premium of approximately 56% to the closing price of the Subordinate Voting Shares on the Nasdaq Global Select Market („Nasdaq”) on March 15, 2024, the last trading day prior to media reports concerning a potential transaction involving the Company and a premium of approximately 48% to the 90-day volume weighted average trading price per Subordinate Voting Share as of such date.

Philip Fayer, Novacap and CDPQ (together with entities they control directly or indirectly, collectively, the „Rollover Shareholders”) have agreed to roll approximately 95%, 65% and 75%, respectively, of their Shares (the „Rollover Shares”) and are expected to receive in aggregate approximately US$560 million in cash for the Shares sold on closing. Philip Fayer, Novacap and CDPQ are expected to indirectly own or control approximately 24%, 18% and 12%, respectively, of the equity in the resulting private company.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: