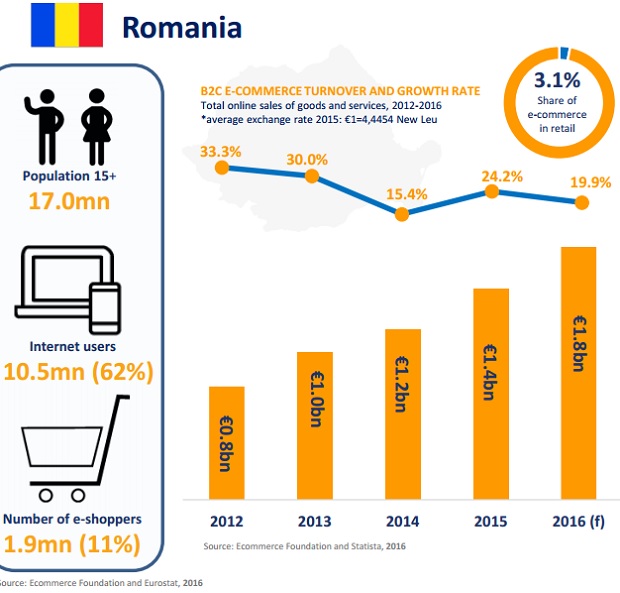

Number of e-shoppers in Romania reached 1.9 mil in 2015 – 11% increase in annual rate

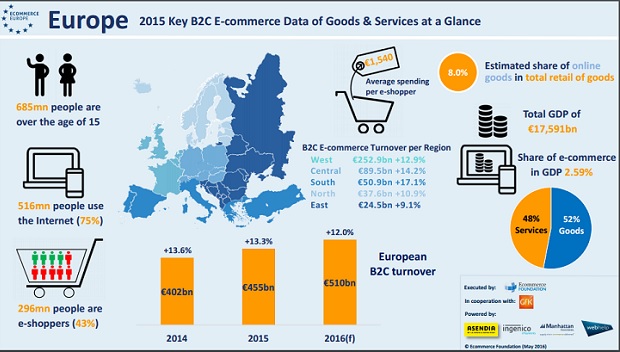

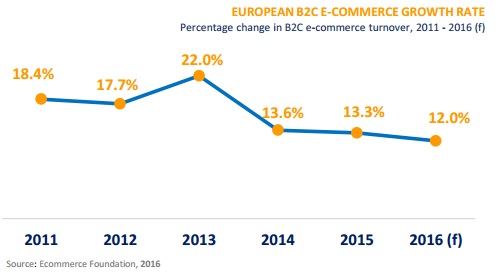

The European B2C e-commerce sales have been growing steadily since 2011. Still, the growth rate has decreased the last few years, from 18.4% in 2011 to 13.3% in 2015. This trend is expected to continue in 2016, as a growth rate of 12.0% is forecast, resulting in a European B2C ecommerce turnover of €509.9bn.

Cross-border e-commerce is driving global growth and is expected to grow 27% each year, reaching more than €1 trillion by 2020, according to estimates. Ecommerce Europe estimates the share of the European Internet economy in the GDP at 2.59%, a percentage that is set to nearly double by 2020.

According to the latest figures of Eurostat (December 2015), the growing share of cross-border online purchases is an important indicator to judge how smoothly the Single European Market (SEM) for e-commerce functions. In 2015, 16% of all individuals in the EU28 purchased goods and/or services through the Internet from sellers outside their country of residence, but within the EU28. This is an increase of 33% compared to 2013. Popular reasons for shopping abroad were a more competitive price and a wider offer of goods and services available.

The full potential of the European e-commerce market has not yet been reached. Today, 57% of European Internet users shop online, but only 16% of SMEs sell online – and less than half of those sell online across borders (7.5%). Also, only 16% of consumers shop online from another EU country. Ecommerce Europe believes that a pan-European Trustmark scheme is a powerful tool to stimulate trust in online crossborder transactions.

The full potential of the European e-commerce market has not yet been reached. Today, 57% of European Internet users shop online, but only 16% of SMEs sell online – and less than half of those sell online across borders (7.5%). Also, only 16% of consumers shop online from another EU country. Ecommerce Europe believes that a pan-European Trustmark scheme is a powerful tool to stimulate trust in online crossborder transactions.

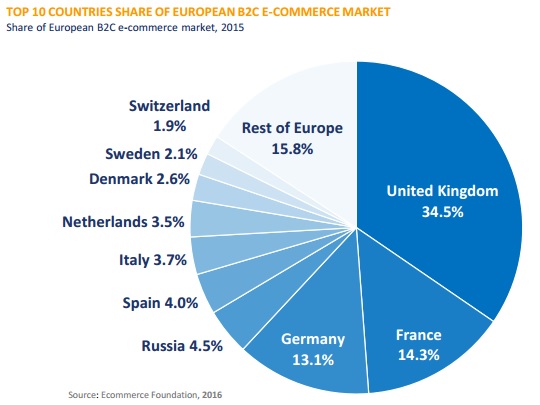

In the category of B2C e-commerce sales, the UK is the clear leader in Europe. In 2015, the British in total spent €157.1bn online, which is more than France (€64.9bn), Germany (€59.7bn) and Russia (€20.5bn) combined . The graph of the European B2C e-commerce market immediately shows the importance of the UK. After all, its market has a share of more than one third of the entire European e-commerce market. In addition, the share of the UK is more than twice as much as all the other countries outside the top 10 combined. The share of the top 10 countries in the total European B2C ecommerce (€383.0bn) markets is almost 85%. However, within the top 10 the difference between the United Kingdom, France and Germany and the rest is also significant. Together, the UK, France and Germany account for 61.9%, while the other seven countries combine for 22.3%.

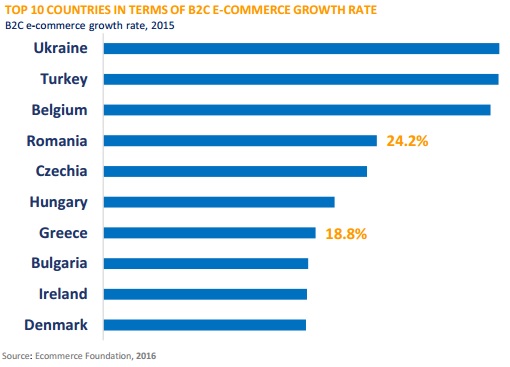

An interesting trend at the moment is that the growth rate of the mature markets is leveling off. However, the overall European growth rate is maintained due to the rapid increase of several Southern and Eastern European e-commerce markets. Romania is one example.

For more details folow the link: European B2C e-commerce report 2016.pdf

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: