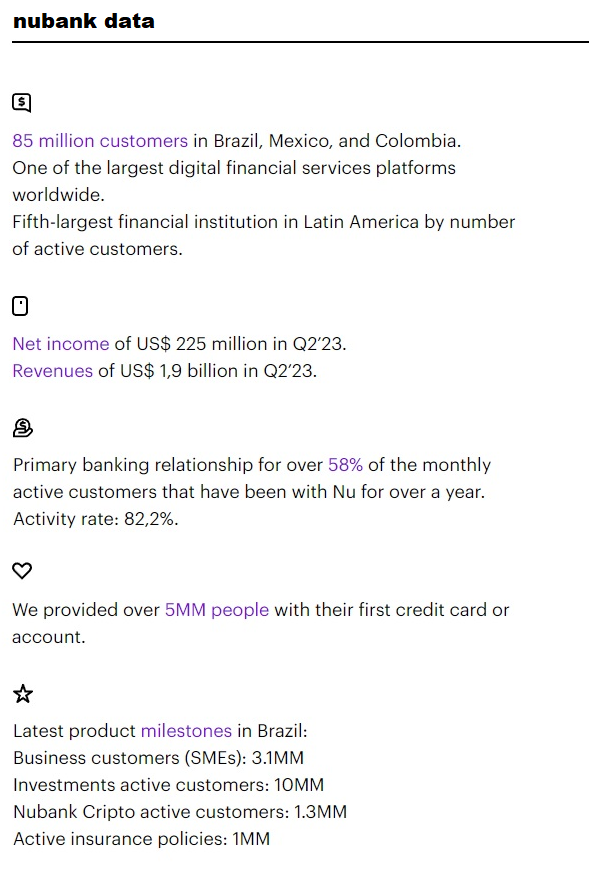

The Brazilian neobank reported Q2 2023 revenues of $1.9 billion and net income of $225 million, positioning the company as one of the most efficient and well-capitalized players in Latin America.

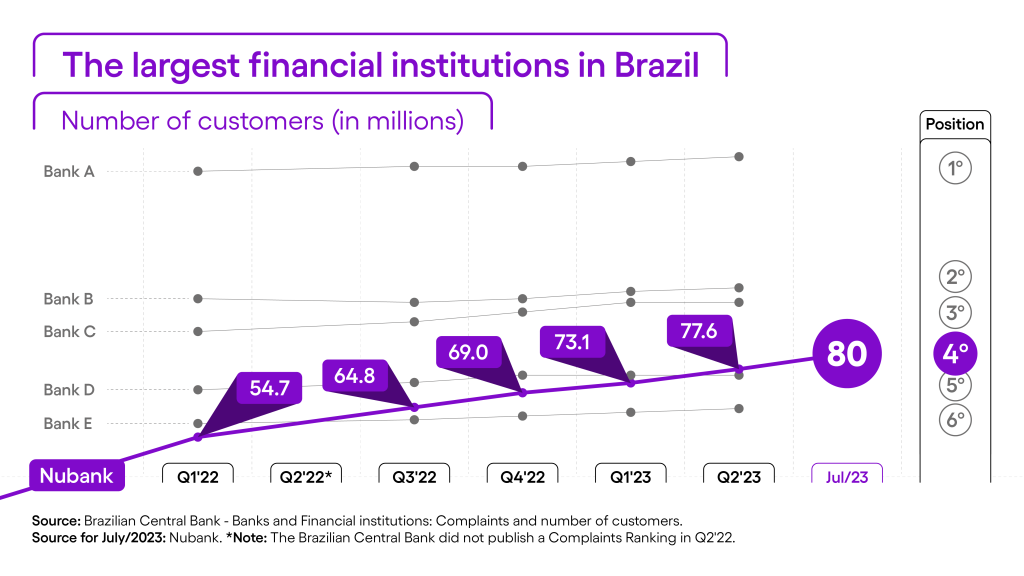

Nubank surpassed 80 million customers in Brazil, as of July 2023. Along with its operations in Mexico and Colombia, the company reached 85 million customers across Latin America. „This number has more than doubled in two years, since June 2021, when Nubank had a base of 41 million.” according to the press release.

Based on official data from the end of Q2’23, the Brazilian Central Bank also positioned Nubank as the fourth-largest financial institution in the country in number of customers.

„In October 2022, the company had reached the 5th position, quickly moving up the rank in comparison to long-established incumbent banks. Nubank also remains in the top three institutions with the lowest rate of complaints in the country, reinforcing the company’s focus on putting the customer first, through its awarded service and innovative products.” the company explains.

“The sustained growth in our customer base continues to reinforce the inherent efficiency and potential of our digital business model. This makes it possible to grow at scale while providing high-quality and low-cost financial services. We have robust activity levels above 82% and rising capabilities to cross-sell and upsell, which have been fueling the company’s revenues. We continue to invest in growth as we believe there is still a huge potential to increase market share in several products”, says David Vélez, Nubank’s founder and CEO.

Internationally, the company now serves 4.5 million customers in Mexico and Colombia, as of July 2023. Mexico was Nu’s first international operation, and now offers credit and debit cards, having recently launched a digital account. Cuenta Nu attracted over one million people just one month after its official release, offering 24/7 liquidity and one of the most competitive yield rates on the market, 9% per year. Nu’s digital account in Mexico allows access to local deposits and unlocks more growth opportunities by expanding the customer base at an even faster pace. This product will also allow Nu to better understand a larger customer base and thus improve its credit models, an important competitive advantage.

The launch of a digital account is also in the company’s 2023 roadmap for Colombia – Nubank’s most recent, but fastest-growing geography, which now offers La Moradita, our no-fee credit card.

Nubank’s market share in almost all verticals it operates still allows a lot of room for growth through cross-sell and up-sell. So far in 2023, the company has launched over 25 products and features in Brazil – from new insurance options (Nubank Auto, Nu Vidas Juntas, and Parcela Segura) to the company’s debut in payroll loans with NuConsignado.

“Almost half of the Brazilian adult population is already a Nubank customer. To keep growing our base in this scenario is a statement to the quality of our products and services”, says Livia Chanes – Country Manager of Nubank in Brazil. “We’re always carefully assessing our portfolio to offer the best options that eliminate complexity and empower people with the tools and the autonomy to make the best decisions about their money”, she adds.

The portfolio is also growing for business customers (PJs), which are now more than 3 million. Beyond an account, and credit and debit cards, individual microentrepreneurs (MEIs) can count on Nubank to simplify their business management, with new features that facilitate tax payment and organization, for example.

Almost 60% of active SME customers have Nubank as their primary account, according to research conducted in May. Among the company’s customer base, there are 10 million entrepreneurs, which represents great potential for even further growth in the PJ segment.

S&P Global Ratings has recently upgraded Nubank Brazil’s rating from brAA to brAA+ with a stable outlook. The decision was based on the company’s consistent improvement of operational trends, as reinforced by our most recent Q1’23 financial results.

S&P highlights Nubank’s strong capitalization (Basel Index in Brazil of 18.7%) and efficiency ratio (at 39% in Q1’23), which position the company as one of the most efficient and well-capitalized players in Latin America. Nu also registered a robust liquidity position in Q1’23, with a 33% loan-to-deposit ratio. S&P anticipates further improvement in financial results throughout 2023 and 2024 and expects the company to continue to outperform in the industry.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: