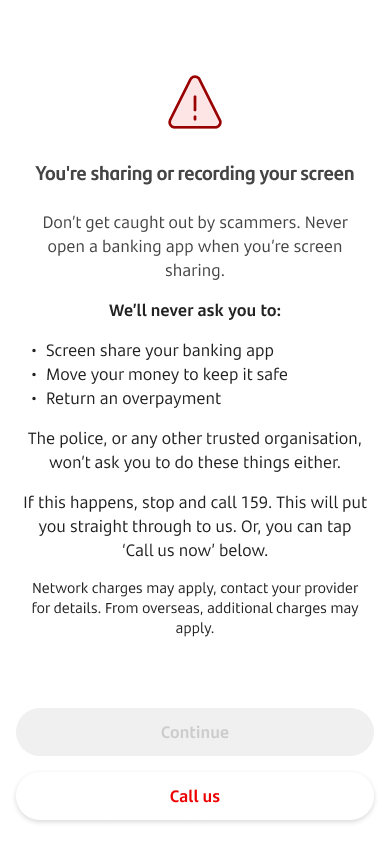

Santander has taken the fight to the fraudsters, with its latest update to its OneApp banking app, available to download today[1], now including screen sharing detection technology. „This technology will automatically blur a customer’s mobile screen and prevent them from carrying out any banking actions where screen sharing technology is being used on their device.” – according to the press release.

Data from Santander shows more than £1.8 million was stolen from customers in 2024, in scams which used screen sharing and remote access technology as a means to access money or personal information.

Often, customers are contacted out of the blue, by phone, email or text/Whatsapp with a range of messages either providing a new investment opportunity or warning of a technical problem with their phone. The scammer will persuade customers to download legitimate screen sharing software, such as AnyDesk or Teamviewer, giving scammers access to their mobile screen and personal information, including mobile banking credentials.

Chris Ainsley, Head of Fraud Strategy at Santander UK, said: “As technology advances, so do scammers. We have a range of specific warnings for customers, but these criminals are clever and will talk their way into accessing a customer’s personal information. Our latest development catches the social engineering in action, protecting customers who are often caught up in a moment of panic.”

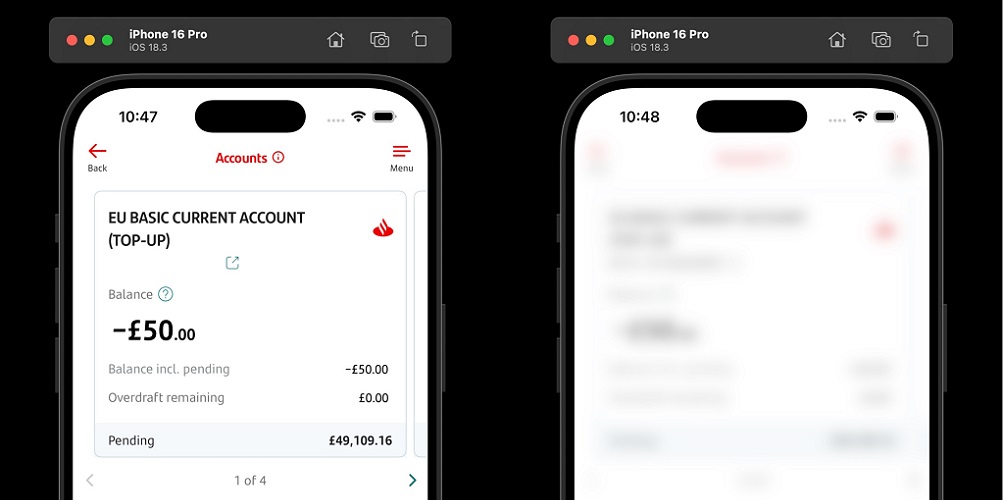

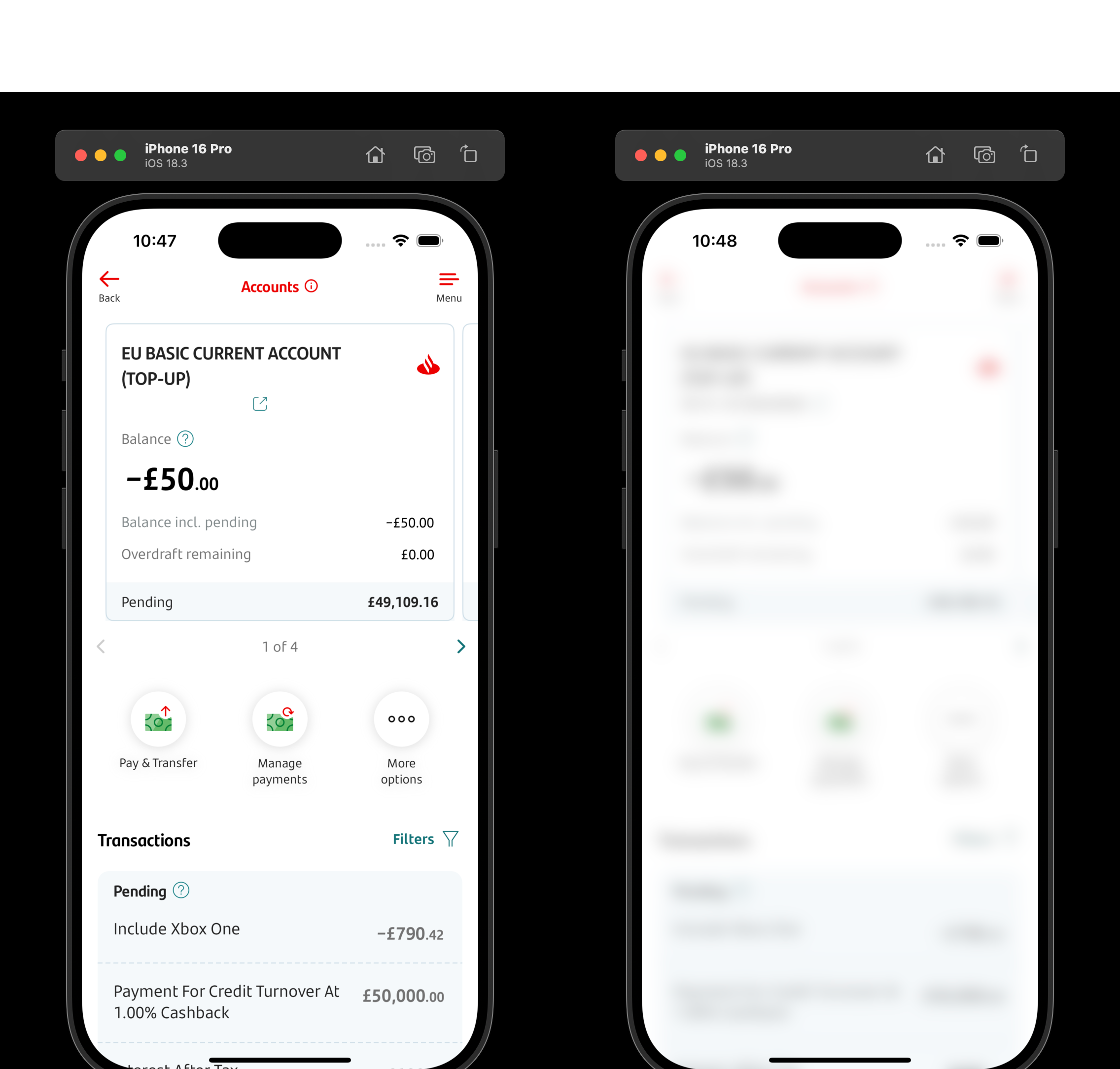

The bank previously introduced a specific warning that screen sharing technology had been detected on a customer’s device. The new technology will build on this making customers’ mobile banking app automatically blur, shielding their personal information as below.

Specific mobile warning

App blurring

______________

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: